Gig economy or not, it looks like part-time or flexible jobs are becoming a more structural part of the labor market. But software hasn’t necessarily improved to help contractor-based businesses manage their payments.

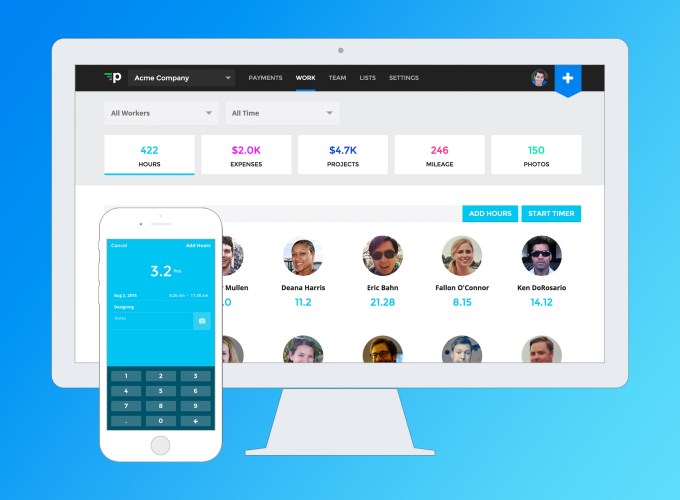

So a team of Intuit veterans went through Y Combinator to build a platform called Payable that will easily let contractors measure and bill their hours and help businesses manage their invoices in a single dashboard. The company, formerly known as Tiempo, has just raised $2.1 million from Freestyle Capital, Redpoint Ventures and Sherpa Ventures, Lerer Hippeau Ventures, Rothenberg Ventures, Haystack, Moment Ventures and other angel investors.

“We want to be the easiest way to manage and pay contractors,” said co-founder Tad Milbourn. “We want to help companies streamline their invoicing, onboard their contractors and make it easy to pay them in a tap.”

Normally, this type of work can become a mess of invoices. Some contractors might have one type of invoice that they e-mail over. Then there’s a waiting period to get cash.

“It’s a hodgepodge,” Milbourn said. “There’s no real clear solution. Some people use invoicing services like FreshBooks or QuickBooks. But you’re dealing with a world of 30- to 60-day delays in payments as a freelancer.”

Now with Payable, there’s an app for contractors where they can count and bill their hours and also manage multiple employers. Their software will also help contractors do their tax filings for this year, pending some final features they need to add after getting the IRS approvals.

The seven-person, San Francisco-based startup isn’t targeting only the big 1099-based, on-demand startups that have emerged over the past few years. They are designed for plenty of other small to medium-sized businesses that need to regularly pay contractors. They’ve worked with Serious Eats, NEAT Method and Pretty Instant.

The company uses a SaaS-based model where they charge $8 per contractor per month. If you have over five users, then there’s also a base $25 per month fee.

Milbourn said that the recent spate of companies like Instacart and Shyp, which have shifted over their 1099 workers to W2 status, doesn’t faze him.

“This is a short-term dislocation. We’re going to find an equilibrium,” he said. “Contractor work is more flexible. W2 works tends to be more repeatable. Both categories lead to very different places. But we’ve created this payment platform that allows you to slice it anyway you want.”