Editor’s note: Manish Goyal is the senior manager and Bharat Ramnani is head of business of valuation and advisory services at Aranca.

Do we have a ticking time bomb on hand? The debate over whether Silicon Valley is sitting on another tech bubble rages on. It is being fueled by many celebrated “unicorns” that have attracted billions of investor dollars at sky-high valuations without demonstrating the returns.

These unicorns are fast becoming the new normal in the VC space. CB Insights states that over 103 startups in the U.S. have bagged over a $1 billion valuation right now. Most of them are not even remotely close to making any profit. The race to find the next Facebook is driving many on the Sand Hill Road to write outrageous checks for unsubstantiated concepts. Metrics like operating margins, break-even points and future cash flows seem to have taken a backseat.

Some of the passionate bulls have already labeled doomsayers as disgruntled wannabes who do not understand tech investing. But not Mark Cuban, one of the renowned moguls in the VC world. Voicing concerns, Cuban, in a widely discussed and debated blog post, claims that this bubble may just be much worse than ever. Many find his assertion extreme, but not without conceding that even if there is a bubble, it seems quite different from the 2000 dot-com one.

So, who’d get hit the most eventually? Our readings suggest that, quite unlike the popular notion, VCs may not suffer that much. Rather, the biggest losers may be the employees and, perhaps, even the founders.

The Next Big One

Investors are betting solely on distant futuristic expectations and happily throwing old-school models of valuations rooted in fundamentals of visible earnings out the window. Several of these startups like Uber are disrupting industries by focusing on market share rather than earnings.

The breakneck speed at which valuations have travelled among subsequent rounds has surpassed the stretch of imagination of even die-hard optimists. For instance, Uber moved from $17 billion to $40 billion between the two funding rounds within six months.

A bubble, it is. But will it erode the real capital of investors overnight, particularly the retail ones? Perhaps, not.

Interestingly, there is reasonable sanity prevailing in the public markets as the tech bubble, at large, is being driven by the surge in late stage VC financings. It is taking much longer for tech companies today to go public, unlike 2000 when several rushed to go public before any revenues. And as the number of IPOs has reduced significantly, more IPO companies are profitable than ever before.

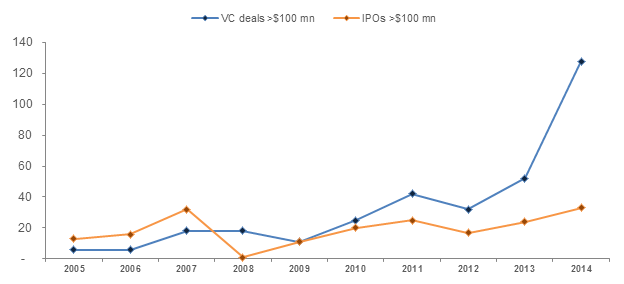

IPOs and Private Financing Deals above $100 Million in the Tech Sector (Global) Source: Renaissance Capital

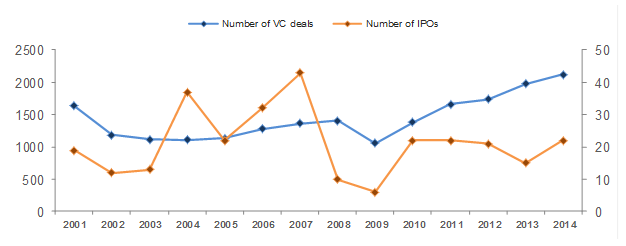

IPOs and Private Financing Deals in the Tech Sector since 2000 (United States) Source: PwC/NVCA MoneyTree Report, Bloomberg

As can be seen from the above figures, VC deals and investment amounts in tech are soaring at a pace that will soon match the 2000 (bubble) levels. But even with the NASDAQ index surging beyond 5,000, a trading P/E of 36.5 is nowhere close to the insane levels witnessed during 2000. So in all likelihood, we are not looking at a 2000-like burst that eroded billions of worth of capital of retail investors overnight. Here’s where it changes its spectrum.

At the Receiving End

This bubble is bound to burst. While there is a current mega trend of mega private financings and almost preposterous valuations, this time private markets shall take the hit. Unlike the 2000s, VCs will not be in the line of fire. Employees and founders would take the fall. And quite a bad one, perhaps.

To understand this, let’s analyze some of the top billion-dollar tech valuations closely:

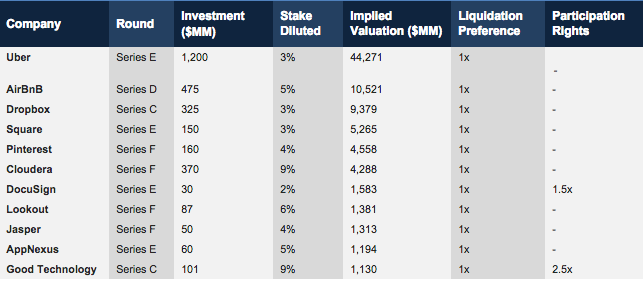

Source: VC Experts

While the implied valuation for all the above companies is north of $1 billion, it’s clear that the actual money invested is merely a fraction of that. When the liquidation preferences kick in, VC investors always have a great chance to recover their money. And then some.

As a valuation and advisory firm offering opinions to hundreds of VC-backed companies, including some of such unicorns, we have observed that funding rounds are increasingly seeing term sheets with creative rights. To protect themselves, VC investors have been seeking participation rights over and above liquidation preferences, in the hope to make a desired return on their investments, when things go south. This goes on to prove the old maxim of “You pick the valuation and I’ll pick the terms.”

Unfortunately, common shareholders and option holders do not have the benefit of such preferential rights. Employees calculate notional gains based on high post-money valuations, but usually end up with options that are worthless. Even founders owning common stock eventually realize that the billions of dollars’ worth of wealth, they had purportedly created, was only on paper.

Take Uber and Airbnb for example. Both co-founders and one of the executives of Uber, and Airbnb’s three co-founders made it to the Forbes’ Billionaires List released this year. Needless to say, their wealth was calculated on the basis of notional post-money valuations, figures far in excess of what these companies could actually be sold at in the market right now.

If, in future, Uber and Airbnb were to not meet their distant growth expectations and make an exit at say 0.1x of their post-money valuations, investors would recover their investment and perhaps walk away with a positive return. But, what will be wiped off for sure would be the billions their employees and founders have “made.”

Hard Fall

In a nutshell, FOMO is driving many investors in a hustle to be a part of the next Facebook or Twitter and put in huge investments for a fraction of stake. And, they don’t see much risk in it as long as they get the downside protection. Earlier VCs would do some math to come up with a number on a company, and the liquidation preferences and other such rights were somewhat ceremonial. Now, these have suddenly become a bigger fallback.

It’s a race where people don’t mind running for an unlikely but big win, as long as failing to win wouldn’t cost much. Would they buy the entire company at these high valuations? Hell no.

The situation created by betting on more powerful stakeholders in the ecosystem may leave employees, and perhaps founders staring down at the wrong end of barrel. The 12.5 million (and growing) Americans employed in VC-backed companies see stock options as the key motivation to invest significant part of their lives working in a start-up. This is in anticipation of the big payday at exit, based mostly on the long-term futuristic growth prospects of these companies.

Someday, pretty soon, these will be put to the test, and valuations based on visibility of earnings will matter again. A few will succeed of course, but several others will fall – it remains to be seen how miserably. VCs will most likely walk away with their invested money, if not more. It’s the employees and founders who will see their million-dollar dreams crash and burn.

A speculative bubble requires a “who’s the greater fool” syndrome to fuel it. Timing of the burst is what determines who in the market ecosystem would have a harder fall. Right now, cross-hair is clearly on the employees and founders. Not the VCs, for sure.