Dave McClure, the founding partner of 500 Startups, wants his investment shop to be the biggest venture capital shop in the world and is confused that the firm is now larger than 500 startups. It’s more like 1,000 startups, he said.

What might be hubris coming from any other investor is a simple statement of fact for McClure. “We intend to be the largest VC firm on the planet in the next five years,” he told TechCrunch’s Mike Butcher today at Disrupt NY. “I think VC firms, surprisingly, are all about investing in scalable businesses, and yet the VC industry hasn’t been.”

500 Startups has certainly been scaling. Over the past five years McClure’s shop has grown from an early-stage accelerator program to a full-fledged venture shop with $170 million in assets under management through three main funds and six microfunds.

That money is managed by a 50-person-strong staff (half of whom are women) that speaks 20 languages and comes from a veritable United Nations of countries. McClure expects to have around 70 people by the end of the year.

So far, 500 Startups has invested $100 million in over 50 countries and in 1,000 investments over the past five years.

The firm (and it is now a firm) has had 18 accelerator cohorts, which have graduated over 400 individuals.

All of that investment activity has produced 2 “unicorn” companies worth over $1 billion and 25 “centaurs” (a term that McClure applies to the companies that exit at roughly $100 million).

Of the 1,000 companies in the portfolio, 300 investments have come from outside the U.S., primarily in Asia and Latin America, which have seen 200 investments and 100 across Europe and the Middle East.

While McClure is bullish about his firm’s strategy, he’s under no illusion about the number of those companies that will thrive. At least 300 companies in the 500 Startups portfolio are dead or dying, and McClure expects that another 300 will be validating exits for the firm. The firm expects 15 percent of its portfolio to get to an exit and another 15 percent will get to a big exit. “I’m very comfortable with those numbers,” McClure said.

I would say spray not pray. There’s a method to our madness. Dave McClure

Limited partners haven’t had a problem with the success rate at 500 Startups, because they keep funding the firm’s ever-expanding forays into emerging markets. In the past year alone, it has launched funds for Thailand and Korea, and is raising a third main fund of $100 million.

“I would say spray not pray,” McClure said of his investment thesis. “There’s a method to our madness.” Just as diversification has been the trend among New York’s big money managers, the same should be true for venture capital.

That diversification takes the form of more than just backing a thousand companies. for 500 Startups, diversity in the firm’s cohorts along gender, racial and geographic lines is critically important.

“Globally we’re very excited about the opportunities internationally,” said McClure. It’s looking at opportunities in Asia, Africa, the Middle East and Europe.

For McClure, the focus on investing in global entrepreneurs is not about social justice. “This is not a social mission,” he said. “I’m a greedy fucking bastard.”

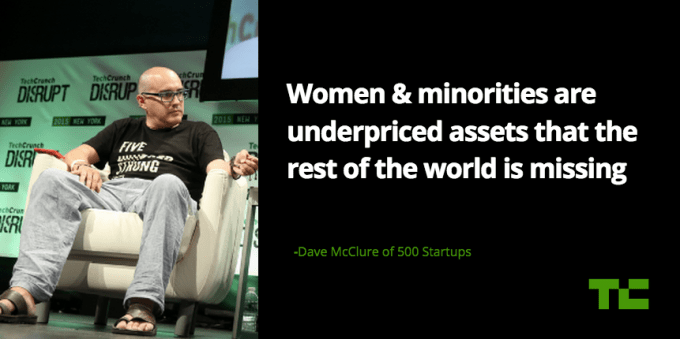

The firm’s international investments stem from the same thesis as its investments in women and minorities, McClure said. “We think they’re underpriced assets that the rest of the world is missing.”

This is not a social mission. I’m a greedy fucking bastard. Dave McClure

Mobile penetration in emerging markets, and blistering economic growth in developing nations, have pushed McClure to one observation. There’s a shit-ton of money to be made investing in entrepreneurs outside the U.S. “As smartphone penetration and credit card usage tips from 30 percent to 50 percent there is nowhere near as much capital as there is opportunity,” said McClure.

“There’s this myopia among American venture capitalists to not go anywhere beyond Silicon Valley and New York,” McClure said.

Meanwhile, the U.S. is not keeping pace with emerging markets in terms of innovation around mobile e-commerce. And while the firm’s two unicorns: Twilio and Credit Karma, are based in the U.S., GrabTaxi out of Singapore is looking like it could soon join the unicorn club (if it hasn’t already).

“If you’re looking backwards for the map to the future, you’re going to be looking at your own asshole,” McClure said, asserting that the future of technology may not find its center of gravity in the same place in the next five to 10 years as it’s been historically. “Places like Beijing will be bigger than Silicon Valley if it’s not already,” McClure said.

[gallery ids="1154135,1154137,1154138,1154139,1154140,1154141,1154142,1154143,1154145,1154146,1154147,1154148,1154150,1154151,1154152,1154153,1154154,1154155,1154156,1154157,1154158,1154159,1154165,1154166,1154167,1154170"]