Editor’s note: Patricia Nakache is a partner at Trinity Ventures. She has active investments in companies including m–commerce players Care.com, EAT Club, and ThredUP. Phil Carter is an associate at Trinity Ventures, where he focuses on mobile-enabled marketplaces and services and has supported recent investments in RelayRides and ZIRX.

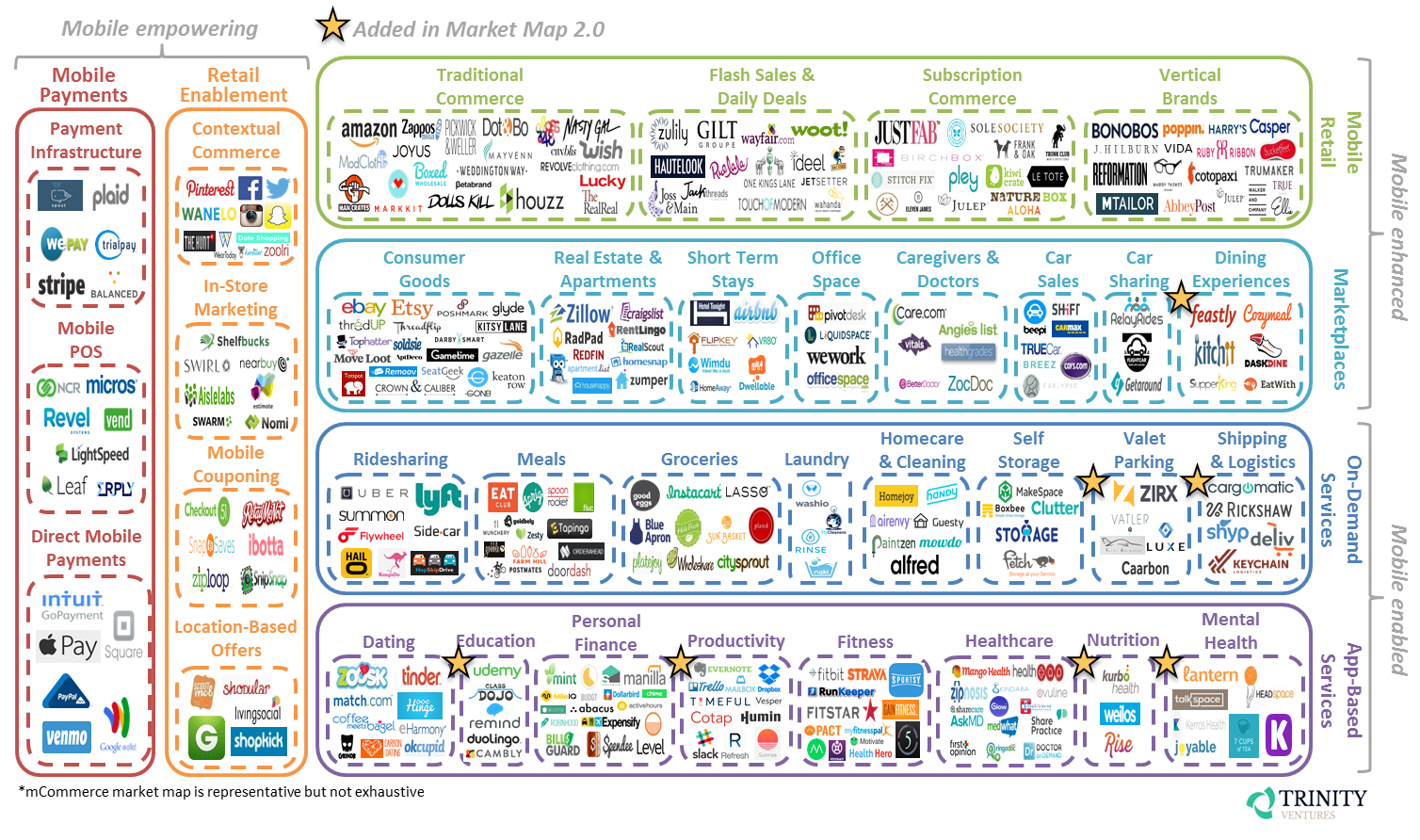

Last year represented a tipping point in mobile commerce investment, so as we begin a new year, we wanted to take stock by updating our m-commerce market map and offering our predictions for 2015.

A recent report by Digi-Capital estimates that VCs invested $4.2 billion in m-commerce from Q3 2013 to Q3 2014, far surpassing the $1.2 billion invested in 2013 and the $829 million invested in the previous two years combined. While much of this capital was poured into a few multibillion dollar juggernauts like Uber and Pinterest, it has also continued to fuel an explosion of m-commerce startups, including several in new subcategories.

In marketplaces, startups like EatWith and Feastly are betting they can replicate the success of P2P models like Airbnb and RelayRides to disrupt the $600 billion U.S. restaurant industry with in-home dining experiences. Meanwhile, On-Demand Services are emerging in several new subcategories, particularly in dense urban areas with high-frequency use cases. ZIRX and Luxe make commercial parking easier with on-demand valet services that let drivers drop cars off wherever they want, with optional add-on services like gas refills and car washes included.

And B2B models like Keychain Logistics, Cargomatic, and Deliv are revolutionizing logistics at every part of the supply chain. Finally, in app-based services, there’s been a proliferation of new businesses focused on mobile health and wellness from Rise and Kurbo Health in nutrition to Lantern, Talkspace, and 7 Cups of Tea in mental health, among many others.

These startups are leveraging smartphones to intercept users in the course of their daily routines and help them to lead healthier, happier lives. We also added education and productivity, two established app-based service categories that did not appear in the first version of the market map.

Given that mobile devices only account for 1 percent of the $3.25T U.S. retail spending market, m-commerce is clearly still in its infancy, and we expect continued rapid growth in 2015.

A year of reckoning for on-demand services

If there was one m-commerce theme that summed up 2014, it was the explosion in on-demand services. In the last 12 months, many articles have been written about the “Uberification” of our economy, with Steve Schlafman’s deck published in April providing a helpful summary.

This trend has been led by Uber itself, whose value skyrocketed from a few billion dollars at the beginning of 2014 to $17 billion in June and $41 billion in its most recent $1.2 billion round. Yet there have been plenty of on-demand services that have failed to replicate Uber’s success, including many of Uber’s competitors in the ridesharing space that have struggled to demonstrate either exponential growth or positive contribution margins.

At issue for some on-demand services is not only intense competition in certain subcategories, but that their value proposition is not dramatically better than that of incumbents.

For example, in the home cleaning and laundry service categories, the benefits provided by a mobile application are less dramatic relative to ridesharing because these services are typically not delivered on a truly on-demand basis.

In subcategories where the market size is too small, the capital required to scale is too large, or the improvement relative to incumbent models is too marginal, we expect there to be a significant shakeout in 2015 as VC investment in on-demand services slows down and startups with no discernable path to profitability sell or go out of business.

The rise of visual commerce

The web is an increasingly visual experience, and it’s no secret that companies have capitalized on this trend by using photo rich content to attract large user bases. Pinterest is perhaps the poster child of this movement, having amassed 60-70 million users that are now being monetized through the use of promoted pins. Similarly, e-commerce companies such as Zulily have learned that high-quality photos consistently boost conversion rates.

On mobile, photos are even more important given small screen sizes, and contextual commerce companies large and small are increasingly using photos not just to acquire users but to monetize them.

According to a Pew Research Center survey conducted last year, 18 percent of smartphone users were using Instagram and 9 percent were using Snapchat as of October 2013. And just as Pinterest did on the web, these apps are creating new forms of visual advertising to capitalize on their user traffic.

Instagram launched video ads in October, letting brands directly target users in their feeds rather than relying on traffic to their corporate accounts, and expectations are that the service will introduce commercial transaction capabilities. Similarly, Snapchat released its first “snapvertisements,” which are interspersed in a user’s story feed and disappear forever after a single viewing just like ordinary messages.

We expect the trend toward visual commerce to expand as Facebook and Twitter build infrastructure to support transactions and other m-commerce startups increasingly rely on photos and videos to attract and monetize users.

The proliferation of “specialty” app-based services

In the same way that offline commerce has seen the rise of specialty retail, the App-Based Services category is also experiencing a proliferation of startups targeting niche markets, with the potential to expand into larger platforms.

Given the constraints imposed by mobile, it has become increasingly clear that App-Based Service startups are better off doing a great job meeting one need rather than trying to do a good job meeting many needs. We see this pattern in mobile health, where Glow and Ovuline have amassed highly engaged female user bases with initial products focused entirely on personalized fertility tracking and pregnancy support, and in personal finance, where apps like ActiveHours and MileIQ have achieved impressive app store rankings despite targeting narrow initial use cases in payday loans and business mileage tax deductions, respectively.

Going into 2015, we expect the trend toward specialization to expand into many other app-based service subcategories.

Annual m-commerce investment activity has risen more than 10x over the last few years. Every quarter, entirely new subcategories of mobile-enabled services are emerging, and we expect the momentum to continue in 2015 as VCs invest behind trends such as visual commerce and specialized app-based services. At the same time, in crowded categories like on-demand services, we predict that competition and heavy capital requirements will force consolidation over time, with players that have established positive contribution margins and favorable customer acquisition economics emerging as winners.