eBay hasn’t been a big deal since Beanie Babies. Back when an auction was the coolest thing on the web and real-time JavaScript countdown timers were all the rage, eBay’s main draw was a sort of theatre of commerce aimed at the bored and competitive. You, too, could win a genuine fake quartz Rolex or a broken Barney Rubble bank if you put in the time.

The auction/commerce company, which will soon split in two, isn’t doing poorly. Revenue increased 14% this year and the stock price has been hovering around $50 for the past 52 weeks. But Amazon’s stock price, while volatile, is four times that on a bad day, and Alibaba, the ultimate in middle-man commerce, just landed like the Iron Giant in a junkyard.

eBay has long been the commerce site of last resort. Forums and private markets have replaced its value to collectors and, unless you enjoy interacting with five scammers to every actual buyer, it is no longer a seller’s paradise. The company has tried to become a store by adding specially curated Buy It Now items and pushing the auctions far below the surface, but the past is always there, lurking. You don’t go to eBay to buy 12 rolls of duct tape. You go there to buy a Victorian-style hairbrush.

Then there’s PayPal, a company that is primarily in the news for shutting down funding efforts for nebulous reasons. The company is the first name in online payments – until Apple Pay, Stripe, Square, and Bitcoin get done with it – and the split couldn’t come at a better time. Thanks to new competition, the slow and steady PayPal has its work cut out for it. By relieving itself of the eBay albatross, the company may have a fighting chance.

But I doubt it.

eBay and PayPal are mature. And mature means old. And old means dead. There is little place for a grumpy, slow middleman in both sales and payments when there are so many potentially better solutions. Apple Pay will revolutionize NFC payments, Square has become the way to pay friends without worrying that your cash will be frozen, and Bitcoin is the flavor of the month that will, without a doubt, soon become co-opted and adopted by almost every commerce provider. eBay and PayPal’s half-hearted efforts to support cryptocurrency – in very specific situations for very specific clients – speaks to both their inability to innovate and their failure to give the people what they want. Overstock didn’t add bitcoin sales because it supports the political mission of Satoshi Nakamoto. It went bitcoin because it paints the company in a positive light among certain online factions.

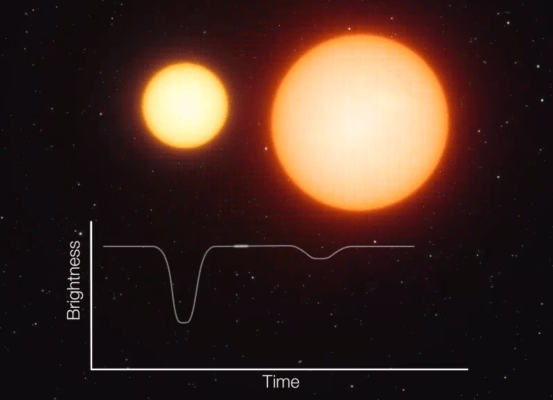

I welcome the dissolution of this terrible binary star of ecommerce. While it seems cruel to say, the move will either hasten the demise of both or make both stronger. eBay knows it can depend on PayPal for financial support and PayPal knows it can depend on eBay for customers. But once both have to start fighting a little harder, I suspect we’ll see how stable each part of this duumvirate is after the props are finally pulled out.