As we approach Peak iWatch, it’s important to consider just what the new device (if it even launches) will do to the watch market as a whole. I can assure you – and this is based on a deep and nuanced understanding of the Swiss watch industry – that the jolly watchmakers of Geneva aren’t giving the iWatch a second thought.

First, let’s address where we got the idea that the Swiss are, to put it bluntly, fucked. Apparently Jonathan Ive chortled that the iWatch would tear down the Swiss watch hegemony. Low-end watchmaker Fossil has even gone so far as to join Intel on future wearables, a partnership that could bring about such delightful but also awful chimeras as the Palm Watch and Microsoft’s SPOT platform. Silicon Valley watchmakers have failed so many times that they are barely a contender.

But the thought that the Swiss watch industry is concerned about the iWatch is a tantalizing one. It’s also full of hubris and a fundamental misunderstanding of how that strange, incestuous, and sometimes predatory clan does business. While I’m sure Ive knows this, it bears exploration.

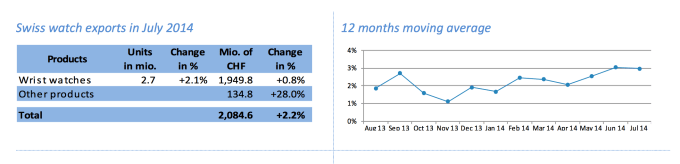

First, the Swiss watch industry is not Apple’s target market. The real niche here is the limited wearables space. First, no one will admit how many wearables have sold so far but estimates have ranged from the low tens of millions to as high as 90 million. I am more than willing to assume that the wearables market is that large. We know, thanks to the Federation Of The Swiss Watch Industry, that Swiss makers sold 28.1 million timepieces last year for a total of $23 billion. That’s an average of $836 a watch, but is skewed by the very cheap (Swatch) and the obscenely expensive (stuff like this.)

Time has been running out for the wristwatch for almost a decade. Today better than 60 percent of 18-34 year olds get the time from their phones. Watches are rare in the wild and when you see them they are worn for a reason. The most expensive watches go to collectors, whose rationality is suspect, and the very rich. The mid-range watches go to folks who appreciate the artistry of a fine mechanical timepiece. And the wearables – the iWatch, if you will – will go to everyone else. The Swiss watch industry knows that and is more than willing to let it happen.

Watches, particularly luxury watches, are rarely purchased because they tell time. For that you have your phone, your Timex Ironman with Velcro strap, and your microwave. Instead, luxury watches are either purchased as a fashion statement or as a nod to an old and storied tradition. Even on the low end, in the Swatch world, Switzerland doing is fine. You buy a Swatch because you like the styling and the slightly wicked, slightly retro feeling of insolence that comes with wearing a watch with hands. Swatch sales, in fact, buoy most luxury watch sales, at least when it comes to brands like Omega, Breguet, and Tissot.

The watch world generally works like this: Watches priced between about $1,000 and $8,000 are approximately all the same. There may be slight cosmetic differences, but the bill of materials is so cheap (in real terms) that the profit would make Jony Ive cry. A few dollars in steel, a movement that costs about $500 assembled, and a nice band are all it takes to make a luxury watch. This means you could sell a $510 watch for $8,000. If you’d like to team up and make a watch brand, let’s go in on this movement and hire a metalsmith for a day. It will cost us a few thousand in total to make a $10,000 limited edition timepiece.

Still not convinced? Check out this page for a moment. All the watches there are intrinsically the same. They are as alike as any page of laptops on the Best Buy website. The only thing that differs are the materials used and the marketing involved. That is it.

Anything over $8,000 – anything from $10,000 to $100,000 (to the millions, but let’s not go there) – means you’re getting a one-of-a-kind piece with little or no mass-produced parts. These watches are called “manufacture” and a manufacture movement is rare and very desirable. In fact, buying a $100,000 watch means you are probably helping a single watchmaker with a small team of assemblers make his next boat payment. You are essentially paying them a stipend to make you a piece of art.

Then there is the very low end. This keeps all of these other business alive. The late Swatch Group CEO Nicholas Hayek told me the industry was a pyramid. Swatch was on the bottom, massive and dense, and the more expensive models hid out in the rarefied air near the top. Even if the base is decimated, he believed, the rest of the industry could survive.

The profit on most jewelry is nearly 100%. Official distributors buy watches for $2,000 and sell them for $4,000. Rules and regulations force these sellers to stick to these rules against the pain of losing their license. And people will pay these outrageous prices because they understand that they are receiving either a true piece of art or they’re making a statement of conspicuous consumption. We can’t begrudge anyone either of these, and this behavior has been happening since the first cave lady hoarded a cache of seashells that she then wove into a handsome bracelet.

The market for Swiss watches is not the iWatch market. The market for Swiss watches is populated primarily by people who want to own a fine watch because it is a fine watch, not because they want something that can tell the time. To suggest that the iWatch will influence Swiss watch buyers is like saying the market for a fine Bordeaux is affected by the advent of a new flavor of Vitamin Water.

Who, then, is fucked? Fossil. Fitbit. Pebble. Intel. Android Wear. Motorola. LG. In short, everyone who is trying to produce smartwatches and wearables. Those guys are royally fucked. Just as makers of MP3 players imploded once the iPod arrived, these companies will have to face a similar threat and many will fail. I don’t particularly want that to happen – I love the Fitbit and the Pebble – but it will.

In short, the only way Switzerland can fail is if people with money stop buying things. And this would also ruin Apple’s day. But that is the only overlap here. The iWatch isn’t playing in Switzerland’s turf and Switzerland will never play in Apple’s.

Moleskine notebook sales didn’t tank after the iPad launched. In fact, the company sold 3.3 million units in 2013 and is probably selling more this year. Muji stores didn’t go out of business once the Surface landed with its electronic stylus. In fact, the company expanded around the world, selling pencils and odd stationery to millions of Luddites. The market for fine Japanese pens does not overlap on the market for the Adobe Ink & Slide. And the existence of a $12,000 Rolex, however ludicrous it seems to the uninitiated, does not preclude the popularity of a quickly obsoleted bauble by even the best hardware company on earth.