Mobile security company Location Labs is being acquired by online security firm AVG in a deal worth up to $220 million. AVG said today it will pay around $140 million initially to buy Location Labs, plus up to an additional $80 million in cash consideration over the next two years, based on certain performance metrics and milestones being met.

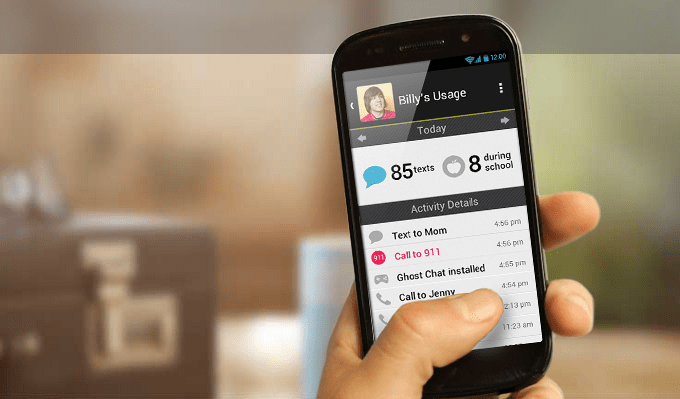

The acquisition is aimed at beefing up AVG’s mobile credentials, with Location Labs offering a swathe of security products for phone users — including antivirus, cloud backup plus a series of family-focused controls so that parents can, for instance, lock out phone use during school hours, view a log of phone activity, and get alerts when a phone is used for certain activities or to contact certain people. The company has also established a range of carrier partnerships in the US to promote its software.

Location Labs now has more than 1.3 million monthly paying subscribers for its mobile safety and security products. Its software has a penetration rate of 2.7 devices per household as multiple users within families are engaged with it. The company is profitable, and currently generates around $33 million in annual revenue. It has raised around $26 million in funding, with its last funding round being back in 2007.

A spokeswoman for AVG said the appeal for the company to acquire Location Lab is to expand its consumer product range, and especially to grow on mobile. The carrier partnerships and integration are also a draw for AVG. It is likely Location Lab will continue to operate independently post-acquisition, she added.

Commenting on the acquisition in a statement, AVG CEO Gary Kovacs said: “Location Labs has built a successful business model with industry partners that has effectively cracked the code for mobile monetization. This acquisition significantly accelerates AVG’s mobile strategy in this area.

“According to industry estimates, the number of mobile-connected devices will exceed the world’s population by the end of this year alone. The combined existing mobile user base of both companies gives us the unprecedented opportunity to deliver online security to approximately a quarter of a billion mobile customers and their devices over the next 12 months.”

The transaction is expected to close during the fourth quarter of 2014 and is subject to standard closing conditions, including shareholder approval.