It’s not a good day to be a public technology company. Today despite beating non-GAAP revenue and non-GAAP profit expectations, Tesla is down around 5 perecent in after-hours trading.

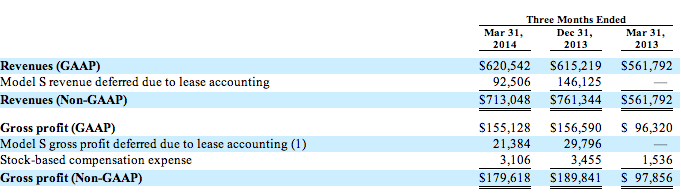

The company reported $713 million in non-GAAP revenue and non-GAAP earnings per share of $0.12. Both figures were ahead of the street’s expectations of $699 in non-GAAP revenue, and $0.10 in non-GAAP earnings. (There are 44 mentions of ‘non-GAAP’ in Tesla’s letter to shareholders. The company of course also releases GAAP figures, but I do find its public-facing use of adjusted numbers humorous.)

What were the GAAP numbers? Quite different. The company’s first-quarter revenue totaled $620.54 million, up a micro fraction from its fourth quarter 2013 figure of $615.22 million (GAAP).

Tesla lost $49.8 million in the quarter on a GAAP basis, or $0.40 cents per share.

In the first quarter, Tesla delivered 6,457 Model S cars, and built 7,535. The company also did not change its guidance of 35,500 Model S deliveries.

Why is the stock down? It isn’t too clear, but it could be that investors aren’t excited by the new $2 billion in convertible notes that could have imparted future dilution. That and GAAP losses and a market in a decline could be enough.

Want to reconcile the company’s GAAP and non-GAAP numbers? We can do that:

Criticism of how Tesla handles its accounting abounds. Also, in 2012 Tesla admitted that it has “material weakness in [its] internal control” regarding its “financial reporting.” That’s not something that you want to hear. Groupon had a similar situation back when it was a newly public firm. Material weakness is a stern phrase that is employed when the apple cart is no longer sitting on its wheels.

So I’d keep a closer eye on its GAAP revenue and how quickly that figure rises, as well as other numbers. But given its quick expansion, the market appears mostly willing to allow Tesla to push its non-GAAP revenue figures as much as it allows other firms to push non-GAAP earnings per share.

And as BusinessInsider points out, Tesla is still up over 30 percent this year.

IMAGE BY FLICKR USER EDSEL LITTLE UNDER CC BY 2.0 LICENSE (IMAGE HAS BEEN CROPPED)