NFC for mobile payments has struggled with adoption. Not least because the user needs to have an NFC-enabled phone in order to be able to make these contactless payments — in addition to the retailer itself being set up to accept NFC payments.

Well, here’s an alternative payment technology that strips away one layer of complexity at least to help lower the barrier to entry — by using a biometric identifier to power payments: specifically, the user’s palm. More specifically still, the pattern of veins inside their palm.

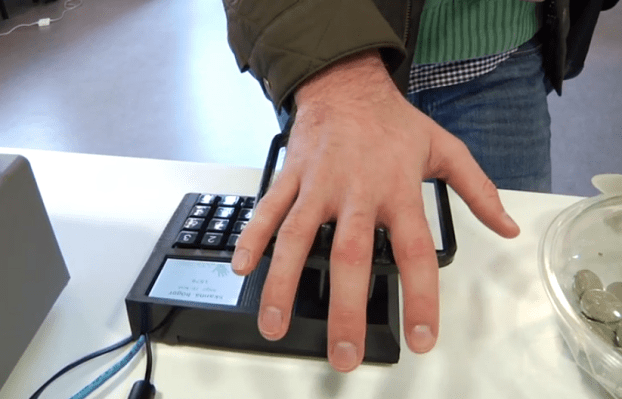

Swedish startup Quixter demos its pay by palm technology in the below video. The idea is the brainchild of Fredrik Leifland, an engineering student at Lund University, who wanted to come up with a quicker system for making card payments that did away with the related faff of fishing cards out of wallets and all that jazz.

The Quixter system uses vein-scanning technology to identify the individual — based on the unique vein-pattern in an individual’s palm — deducting payment from their previously linked bank account. “We’re are working with all major swedish banks at the moment,” says Leifland.

Vein-scanning technology is not new in itself. It’s been incorporated into ATMs by banks in Japan (and elsewhere) for several years, as a way to provide another layer of security for large transactions. However Quixter’s Leifland claims no one else has launched a payments system leveraging the palm — ergo, he says his startup is first to market with a tech system.

“There are other companies looking at similar solutions but they’re not on the market yet,” he notes in the video.

Generally speaking, Quixter’s palm-scanning system has the advantage of enabling a payment to be made without the person needing to have any physical money or payment cards on their person. Or, indeed, an NFC-phone.

Another mooted advantage is security — with Leifland making the bold claim that there is “no way” to commit fraud with this system. Short of, presumably, strong-arming someone else’s hand into buying your hot-cross bun for you.

Whether Quixter’s palm-scanning tech is hugely quicker than making a credit or debit card payment is debatable, since the system, as it currently is, also asks users to tap in the last four digits of their phone number and then put their hand on a terminal to be scanned. So it’s not a one-stage payment process.

But the phone number digits were apparently added partly to slow things down so the user has time to consult the terminal to see how much they are being charged — presumably to avoid being overcharged and paying before you realise you’re being fleeced.

Quixter’s system is currently up and running in around 15 locations on campus at Lund University, with some 1,600 (presumably mostly student) users at this point. Its business model is to take a cut of transactions, much like credit card payments.

As with NFC, palm-payment would require significant buy in from retailers to get any mass market momentum. Targeting small communities, such as university campuses, therefore makes sense as a rollout strategy. Albeit, it may be as far as such a system is able to roll in the short term.

Getting buy-in from all the players in the payments value chain has caused many a payment ‘revolution’ to wither on the vine. Or, as may be the case, the vein.

Leifland concedes a major job of work for the startup over the past two years, since he first had the idea, has been connecting up all those players. And that’s just for a deployment on one university campus.

So, while it’s undoubtedly an interesting technology — and Quixter says it has plans to expand the business further — don’t expect it to speed into a store near you any time soon.