Just what the hell is Microsoft doing making Windows free for small tablets and smartphones? Buying market share.

By cutting the cost of Windows for smartphones, Microsoft is sweetening its pitch towards OEMs, providing new incentives to adopt its mobile platform. OEMs, often paying a per-device fee to Microsoft to ship devices running Google’s Android, now have a separate option that includes no software payments. That’s interesting.

How can Microsoft afford this decision? It’s worth keeping in mind that the revenue streams that Microsoft is deprecating were small. Windows OEM revenues are not small, but they are in modest decline. What was the total top line that Microsoft secured per quarter from Windows Phone handsets? Presume 10 million sold units and a $5 per device royalty, and the revenue sums to a rounding error.

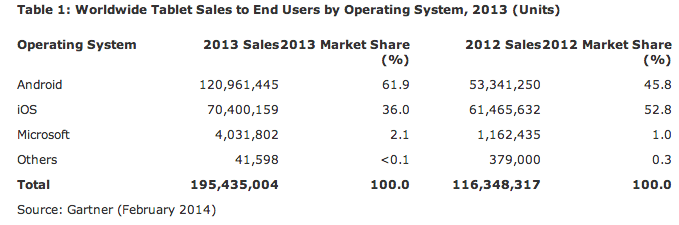

On the other end of the stick, Microsoft tablet market share is minute. Here’s the latest Gartner data:

So that’s a million a quarter, a fraction of which are eligible for free Windows. That revenue is a rounding error of a rounding error.

So Microsoft’s move doesn’t harm it financially, and could reap it precisely what it needs: market share. The company is shifting to garnering top line in other ways than one-time software fees, but we don’t need to suss that out all over again here.

Regarding market share, Microsoft needs better OEM support for Windows Phone, and to make it a financially attractive move to build small Windows tablets that vend at low price points. There is unity between the decision to ax small Windows revenues, and the following:

[W]ith Update 1, Microsoft rejiggered Windows 8.1 to work with devices with 1 gigabyte of RAM, and 16 gigabytes of internal storage. The firm calls these devices 116 devices, wittily.

Bingo. Microsoft extended Windows 8.1 with its Update to support devices that will sell for a price point so low that the cost of Windows itself, had it been maintained, would have represented an outsize percentage. Now, it’s no percentage at all.

For a company like Dell, it means that their per-device profit on popular devices like the Venue 8 Pro (8 inch tablet) just got better. And as Microsoft essentially can’t lose tablet market share — you can’t lose what you don’t have — this can only help its position.

Microsoft cannot afford to lose OEM and other OS revenue from the vast majority of devices that it currently sells. That would quickly impair its financial performance. But if it can keep those revenues mostly stable, its other growing businesses likely provide enough top-line growth to allow Microsoft to not collect fees on Windows for growing device categories that it very much needs to accelerate.

You know, that mobile thing.