With outstanding student debt now over $1 trillion in the U.S., it’s clear that college grads are struggling mightily to make payments and refinance their debt. Meanwhile, thanks to decades of plummeting borrowing costs, millions upon millions of consumers have been able to refinance mortgages and begin paying down debt.

In some irrational alternate universe, one might expect that lenders would be lining up to take advantage of soaring student loan debt by offering more favorable terms than competitors. Nope, because that’s “crazy.” Even when students happen to find a decent job out of college, make payments on time and improve their credit scores, they remain locked into absurdly high fixed rates.

The majority of the big players in the private loan market appear more than happy to maintain the status quo, and wave off refinancing as a threat to the bottom line. Enter: Credible, a San Francisco-based startup launching today that aims to help graduates extricate themselves from high fixed rates, and make it easy to switch lenders and save on their loan payments.

Taking home the “Best 2.0 Company” Award at this week’s Launch Festival, Credible founder Stephen Dash said that, while racked with debt, the truth is that today many students could save a significant amount of money on their loan payments by switching lenders. Yet, the majority of them don’t because they don’t know how, or because the process of switching is so complicated and time-consuming.

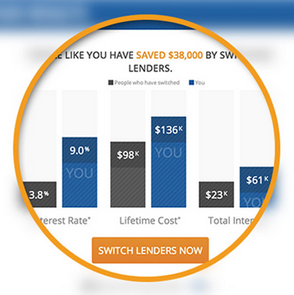

So, Credible has developed a platform that makes it easy for students to find out whether or not they’re eligible for lower interest rates and could benefit from switching lenders. The startup’s loan comparison tools enable students to understand their loan profile relative to their peers and get an indication of what similar borrowers are paying for private loans.

Typically, if a student wants to find out if they’re eligible for lower rates, they have to seek out a handful of different lenders and spend time filling out a bunch of repetitive forms, Dash says. With so much opacity around the degree to which they’ll actually be able to save on their payments and the time required to find out, most students opt against the idea of refinancing.

Typically, if a student wants to find out if they’re eligible for lower rates, they have to seek out a handful of different lenders and spend time filling out a bunch of repetitive forms, Dash says. With so much opacity around the degree to which they’ll actually be able to save on their payments and the time required to find out, most students opt against the idea of refinancing.

To address this friction, Credible allows students to quickly qualify their eligibility in a 7-question process. After answering questions about their current employment, salary, credit score and so on, students enter their email, receive their log-in information and can then view their options.

If they’re eligible for better rates and an appealing amount of savings, students can then opt to begin the process of switching lenders and refinancing their loans. Again, rather than filling out a bunch of different applications, Credible lets students submit a single offer request form, which consolidates the information every lender needs to see to make a refinancing offer.

To do this, in place of applications, students fill out a profile on Credible, link their existing loans, select the lenders with the best rates, enter their I.D. credentials (which Dash says are encrypted and never saved), at which point they’ll be able to view their existing loans.

After entering employment information, students can add a co-signer, upload their driver’s license and a recent pay stub, and then hit “submit.” Lenders then have every piece of information they require, Dash says, and a couple of days later, Credible will notify the student that the lenders’ offers have arrived. Students can then sign into their profile to review and compare the responses in their own private, secure dashboard. They can drill down into loan information, interest rates, total costs and so on, giving them, at least in theory, the opportunity to make a more informed decision.

Dash explains that Credible has essentially opted to take a “marketplace-style” approach to student loan refinancing, inspired by the way sites like Kayak.com have been able to transform the travel market. The Credible team set out to offer a similar experience; in other words, to simplify the complex search for financial services products that are themselves, fairly complex.

Naturally, many students opt to remain in the federal loan market rather than moving into private markets due to the risk of losing many of the protections the federal market provides. What’s more, private market giants like Discover Financial Services and Sallie Mae are the kind of companies that have little incentive to offer their existing customers refinancing options.

As a result of the complex, risky and often frightening world of student loans and loan refinancing, Dash says that it’s extremely important for Credible to be seen as an independent, transparent and customer-first option amidst the jungle. As part of that, Credible offers its service for free, and allows students to decide to which lenders it sends their information.

It’s still early in the process for Credible, so that list of supported lenders will likely expand over the coming year. But, as of now, the startup had 30K students sign up during its beta trial and Dash said that one of its student borrowers is now expecting to be able to save more than $40K in interest payments over the life of their refinanced loans.

It’s still early in the process for Credible, so that list of supported lenders will likely expand over the coming year. But, as of now, the startup had 30K students sign up during its beta trial and Dash said that one of its student borrowers is now expecting to be able to save more than $40K in interest payments over the life of their refinanced loans.

As to how it plans to make money: Dash says that the goal is to, as much as possible, align its business model with both borrowers and lenders. That means that the startup has opted to get paid on disbursed loans as opposed to the Kayak-style lead-gen model, so that a lender must extend and offer a refinancing and a borrower must actively accept that offer before Credible can generate revenue.

To further support its launch and upcoming marketing push, Credible has closed a $500K round of seed financing from a handful of venture capital funds and angel investors, including Carthona Capital, Cthulhu Ventures, Orrick, Cap-Meridian Ventures, Simon Franks, Trevor Loewensohn, Mitch Zuklie and Peter Gammell.

With its funding in the bank, looking forward, Dash sees potential opportunities for Credible’s platform and technology to be applied beyond the world of student loans. After tackling the student loan market, the team’s big goal is to work towards the transformation of “every complex application process in banking and insurance.” The central goal for the startup, whether it’s in student loans or outside, will be to put some of the control back in the hands of the consumer and make it easy to switch lenders and understand their options.

For more, find Credible at home here, and check out their pitch at LAUNCH below: