The value of a single Bitcoin has broken the $200 mark for only the second time. The cost of a single Bitcoin hit a high of more than $205 earlier today on the biggest Bitcoin exchange, Mt. Gox, although it’s since dipped slightly. At the time of writing it’s still trading at above $200.

Bitcoin, or BTC, is a decentralised digital cryptocurrency that offers an alternative, peer-to-peer payment method that circumvents costly bank fees if you’re making payments across international borders.

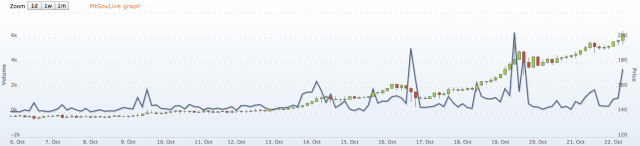

The price of a single Bitcoin traded on Mt. Gox has been tracking up for the past two weeks, gaining close to $70 in value over this period at the peak:

The price of one bitcoin previously peaked at around $265 back in April, as hype around the currency increased and there was a rush to open new accounts. That Bitcoin goldrush caused Mt.Gox to struggle with the influx, and BTC traders to take fright at what they thought was a DDoS attack on the exchange — but was in fact Mt.Gox’s infrastructure creaking under the strength of demand. The result was a price crash to around $150, with the value of Bitcoin remaining below $200 until today.

Bitcoin’s recent price surge also comes after a 15% drop last month, following the FBI seizure of the underground ‘black market’ marketplace Silk Road — where billions worth in Bitcoin had been used to purchase various illegal goods and services since Silk Road was set up. The closure of the service blew a hole in Bitcoin’s valuation — but clearly only a temporary one. Bitcoin quickly recovered the lost value, and has since gone on this latest surge.

The removal of one of the most notorious pipelines linking Bitcoin to the buying and selling of narcotics and other illegal goods and services may actually have helped the cryptocurrency — by improving its reputation and thereby boosting its mainstream appeal.

Bitcoin supports near-anonymous transactions, which encouraged its use on Silk Road. But the cryptocurrency has many other characteristics that potentially make it interesting to a much more mainstream user-base — such as the fact transactions are irreversible, something of potential interest to online retailers wanting to avoid the hassle of chargebacks.

Whether Silk Road’s demise has helped Bitcoin is hard to say for sure (it’s not the only underground marketplace trading in BTC, in any case). But with the most high profile Bitcoin-using black market out of the picture it’s a more comfortable proposition for legitimate businesses to think about getting involved with the cryptocurrency — especially larger ones.

Chinese Internet giant Baidu started accepting Bitcoin as a payment method for Jiasule, its online security and firewall services, on October 14, for instance. And an influx of Chinese investment in Bitcoin is very definite contributory factor to the recent price surge.

Baidu’s corporate stature may well be giving Bitcoin’s perceived legitimacy a boost in China. It’s also clearly helping to increasing BTC trading volumes in the country by giving a chunk of its customer base the option to pay in Bitcoin: Forex Magnates noted last week that China’s largest Bitcoin exchange, BTC China, had more than doubled following the Baidu news.

Whether the current $200+ Bitcoin valuation has more underpinning it than the last time BTC rose so high — when the bubble burst — remains to be seen. But if enough Baidu-sized businesses start getting involved with Bitcoin, a $200+ valuation may end up becoming a lot less remarkable.