The mobile card reader space is a crowded one in Europe, even though U.S. early mover Square still hasn’t waded in. Contenders include iZettle, Rocket Internet-backed Payleven and SumUp to name three. All three share the same flat fee structure, charging 2.75% per transaction and no monthly fee, enabling the startups to put card payments within reach of small businesses. Or rather they shared that rate until now, but iZettle has decided to shift the goal posts by launching a new per transaction pricing structure that means its fee can fall as low as 1.5%, depending on the monthly sales volume of each business.

iZettle is keeping the 2.75% per transaction as its ceiling but once a small businesses takes more than £2,000 per month the fee starts dropping, bottoming out at 1.5%. iZettle is doing the rate reduction calculations itself, and to keep things simple UK MD Jens Münch said it will be charging 2.75% on all transactions during the month and then doing an end of month reckoning. Businesses that exceed the £2,000 sales threshold will receive cashback, based on the reduced rate associated with their total monthly sales.

“The 2.75% [rate] is a hangover from the U.S.,” Münch tells TechCrunch. “Square essentially said 2.75% because of U.S. cost structure which is quite different from Europe, and that was brought over [by European mobile payment startups]. So we knew that at some point that was going to be challenged.”

Münch said iZettle assessed various options for reducing the rate, included rate bands and charging monthly fees, but settled on a sliding reducing fee based on monthly transaction volume in order to keep things as simple as possible for its small business customers, while still creating a new lower fee floor that undercuts its rivals.

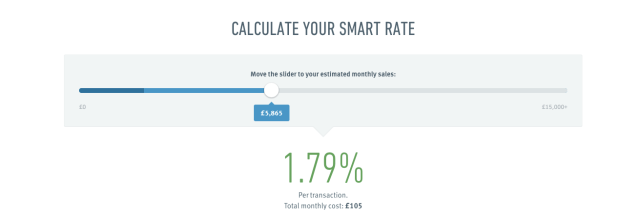

iZettle has created an online slider tool to allow businesses to visualise how the rate drops as their monthly sales ramp up:

The startup was already offering (free) analytics tools to its customers which Munch stressed are a core part of its differentiation play. “The only way you can make a small business interested is by first of all removing the conversation that [taking card payments is] too expensive,” he said. “And then you can have a conversation what actually is it I get? I can have a product library, I can have a full POS system, I can do my accounting with this, I can record my cash in this.

“Analytics is where we differentiate from the competition. If you try to sign up with SumUp or Payleven you basically have type in the amount, take a payment and that’s it. All of the stuff we’re doing which is how many of your customers are recurring in a month, we can tell you that, or a week. Many of them will use the same card, which is a good proxy for recurring visits… or we can tell you what are your best selling products over the last week or day. And we’re improving that as well, over the next few weeks and months.”

“The exciting stuff isn’t payments, the exciting stuff is all the things we’re building off the back of that,” he added.

iZettle is using the U.K. as a testbed for the reduced rate, with a view to potentially rolling it out into the other markets where it currently operates — namely: Spain, Germany, Sweden, Denmark, Norway, Finland and most recently Mexico. However Münch said it is likely that the approach will not make sense in every market where it operates, owing to local differences. “Markets are interestingly different in Europe, so I’m not sure that this would be a one-size fits all model,” he said, adding that Mexico is also distinct.

iZettle does not yet break out customer numbers, either per market or across all its operational markets, but commenting on current U.K. traction Münch said: “I’m seeing really great growth.”