Simple has made some serious strides since it opened up to the public last year, but there’s one thing the service has just never been that great at: transferring money from one bank account to another. According to a post on the official Simple blog, those days are finally over — users can link their Simple accounts to existing bank accounts to move their money around.

Frankly, it’s about time.

Let’s back up a minute here first: why is this such a big deal? To answer that, we have to look at how the Simple onboarding process works. When you first set up a Simple account, you’re given the chance to make one initial funds transfer from your old bank account — that’s it. Before the external accounts feature was added, users who wanted to subsequently transfer funds from their existing bank account to a Simple account had to come up with some clever workarounds to get the job done.

My personal favorite: if you linked a Square account to a Simple bank account, you could swipe a transaction to the tune of however much money you wanted to move using your own debit card (and in case you were wondering, yes, I’ve done this a few times).

My personal favorite: if you linked a Square account to a Simple bank account, you could swipe a transaction to the tune of however much money you wanted to move using your own debit card (and in case you were wondering, yes, I’ve done this a few times).

Last November, Simple made that process just a little easier by adding a mobile check deposit feature to its apps — then you could just write yourself a check and deposit it directly into your Simple account. Better, yes, but it still wasn’t as seamless as it should have been.

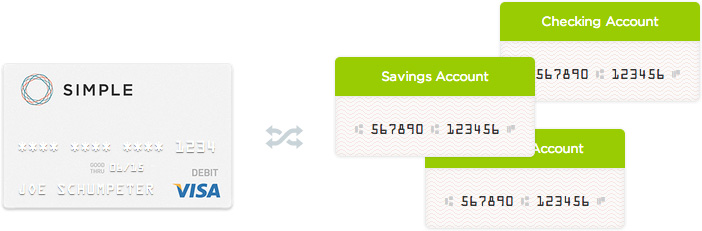

Now, at long last, the process is finally as simple as the company’s name implies. You’re prompted to punch in your account and routing number (you can do this for up to three accounts), after which you’ll have to keeps your eyes peeled for two small transactions to confirm that everything was copacetic. Once all that’s squared away, it’s all the fee-free fund transfers you can handle. Implementing the feature isn’t just a savvy move, it’s a downright necessary one. Simple has spent the few years trying to convince people that it’s a friendlier, more direct way for them to manage their money, and the company has so far managed to win over more than 35,000 users.

That’s not too shabby considering how carefully the team has been handling the invitation process, but if Simple really wants to win over the masses, it has to more effectively blur the line between what it can do and what more traditional banks can do. After all, Simple is still a startup — a smart, well-funded one with the support of a major bank, but a startup nonetheless. With this external accounts feature, Simple isn’t just giving a users a way an easier way to get started, it’s giving them an easier way to bail out if the service just isn’t right for them. Consider it a safety net for those wary of diving into the strange new world of app-centric banking.

For what it’s worth, this whole thing just about has me ready to take the plunge. Since launch I’ve been shunting a few bucks out of each paycheck into my Simple account for random geeky purchases, but now I’m seriously thinking of ditching my old bank entirely. Of course, this is exactly what Simple wants since it makes money in the form of interest margin — if more people get comfortable transferring all their money into their Simple accounts because the process is now so much easier, Simple may soon be laughing all the way to the bank.