With a spot of topical timing, given the recent controversy in the app promotion world, research firm Forrester has put out a new report exploring best practices for developers trying to get their apps noticed. Its findings include that word of mouth and social discovery play a key role in new apps finding loyal users, at least in Europe. The research also underlines the dominant role that mainline app stores continue to play in app discovery on the iOS and Android platforms. Forrester polled 4,315 European adults aged 16+ in Q4 2012 who had either an iPhone or an Android phone, some use of apps and were online monthly or more often for the report.

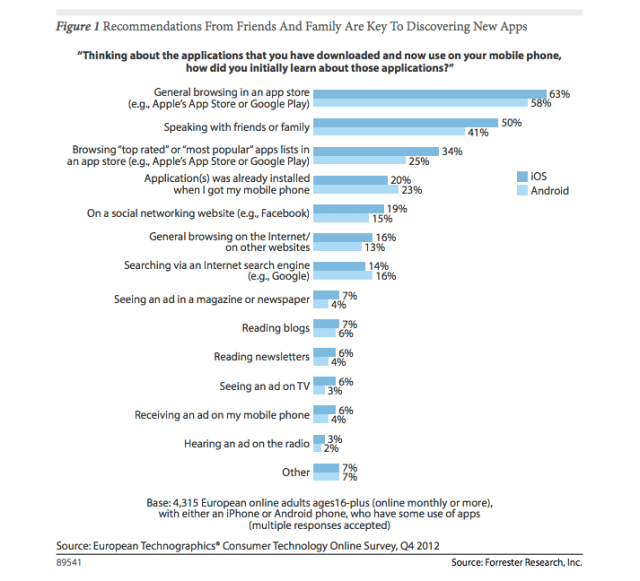

According to the data, far from being tired of flicking through packed app stores to find new stuff, Europe’s smartphone users are evidently spending a lot of time app hunting on mainline stores — with both iPhone and Android users identifying this sort of “general browsing” on the App Store or Google Play as their most oft used method of discovering new apps (i.e. apps that they subsequently downloaded and now use on their phone). Browsing “top rated” and “most popular” app lists in these stores is also flagged up as the third most popular app discovery method. Word of mouth recommendations from friends/family slots between the two, as the second most common way to find new favourite apps.

The high ranking of personal recommendations underlines how pouring effort into marketing can only get an app developer so far, says Forrester. It’s making a good enough app to get recommendations and rise up the app charts that really counts. Keeping audiences engaged enough to recommend an app means having a great app in the first place, not just a great app promotion, notes Forrester’s Thomas Husson in a blog. “Influencing the influencers and integrating social features into your app will be increasingly key,” he writes. “App developers and publishers… needed to measure the customer lifetime value and make sure their audiences would stay engaged.”

Discussing “the growing dependency from publishers and developers to Apple and Google in the app economy”, Husson adds: “Most app stores are considered a “black box.” App store players share little to no information — and marketers have little control over app store merchandising. There are some tips here and there, like the precise 100-character description of your app in the Apple App store, the importance of the app description and icon design, the use of video demonstration in Google Play, the quality of the screenshots submitted, etc. However, having your app stand out from the crowd is far from just mastering App Store optimization or mobile advertising. Even if you could crack the Apple App Store ranking algorithm, you would still have to deliver a differentiated experience to maintain your app in the list of top 50 or top 100 applications. The use of advanced analytics and push notifications to maintain the quality of the app over time is key.”

Forrester’s research also suggests that cutting the odds of discovery by being pre-loaded on a phone can also work well for developers, with pre-loads coming in fourth place for app discovery, just ahead of hearing about an app via social networking websites. Also perhaps surprisingly popular as app discovery methods are general browsing on the internet and searching via search engines — which further underlines how much of an appetite smartphone users have for apps, since they are actively going out and hunting them down, outside of app stores. The report notes that mobile app usage has “grown dramatically over the past year”, with 40% of online European consumers who own a mobile phone using mobile apps at least weekly (a figure that goes up to 56% in Sweden); and 29% using apps at least daily.

Direct advertisements for apps faired poorly in the survey, generating the lowest levels of app discovery that subsequently led to app use. The full chart follows below: