Bitcoin’s record highs and the ensuring surge in hacking attempts and thefts may be grabbing headlines. However, beneath the chaos, Silicon Valley’s best-known venture firms are finally starting to make real bets around the crypto-currency.

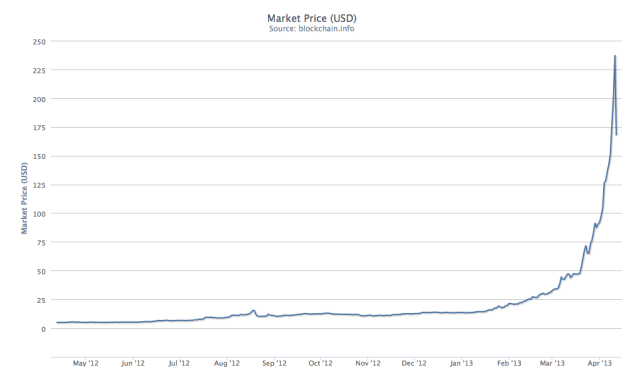

The price of a single bitcoin had more than quintupled to $265 amid a banking crisis in Cyprus and new signs from the U.S. Treasury’s Financial Crimes Enforcement Network that regulators will tolerate the currency. It then settled back down to $120 as increased volumes and DDOS attacks hit the biggest Bitcoin exchanges today and yesterday. While anyone who has ever worked in trading knows that a chart like this often ends in a world of pain, there is a growing sense that Bitcoin, or another math-based currency like it, is here to stay.

“It’s far from certain that Bitcoin is going to be a big deal,” said Lightspeed Venture Partners’ Jeremy Liew, who has made two investments in the space. “But the potential for disruption is enormous. If Bitcoin realizes its full potential, you’re talking about disrupting Visa, First Data, MasterCard, a lot of the banks, Western Union. These are huge multibillion dollars companies. It’s far from certain. But if it happens, a lot of value will be destroyed and a lot of value will be created. That’s when venture capitalists should be looking.”

While there have been attacks on independently-run Bitcoin wallets and exchanges, the core 31,000 lines of Bitcoin haven’t been compromised despite being available to the world’s best hackers and cryptographers for the last four years. On top of that, the currency is starting to become a speculative asset for well-heeled investors that want a gold-like hedge against U.S. dollar inflation or instability in the European Union.

“My feeling is that Bitcoin has moved away from nerdy tech types and is now attracting more of the finance and Wall Street types,” said Jered Kenna, who just re-launched TradeHill, a Bitcoin exchange targeted at accredited investors and high-net worth individuals. After launching a few weeks ago, he says he’s had investors open accounts and individually send in more than $1 million to buy Bitcoin. Even the Winklevii, the twins who famously sued Mark Zuckerberg over the creation of Facebook, have accumulated one of the world’s largest stakes in the crypto-currency. They say they own 1 percent of all Bitcoins in circulation.

With that growing acceptance, VCs are betting that Bitcoin will need a more reliable ecosystem of payments processors, exchanges, wallets and financial instruments.

The funding rounds are still small and exploratory, ranging from a few hundred thousand dollars in seed money to a few million. But they do underscore real VC interest in the space.

“Basically, payment is just a form of information and every other type of information — music, media and so on — is accessible across borders. But payments is one of these weird things that’s not,” said Kleiner Perkins’ Chi-Hua Chien, who has yet to make a bet but has spent the last two weeks immersed in everything Bitcoin.

It’s easy and frictionless, for example, to send a music track to a friend in Egypt, but sending money is much more complicated and there are transaction fees skimmed along the way.

Bitcoin was designed to be a pure peer-to-peer currency that wouldn’t need to rely on trusted third parties like banks for transactions. It is the work of a mysterious, pseudonymous hacker called Satoshi Nakamoto who was clearly frustrated with the fallout of the 2008 financial crisis when central banks cut interest rates to zero or near zero and the U.S. started expanding the money supply through quantitative easing.

In contrast, Bitcoin was designed to have a mathematically predictable, fixed supply that increases until sometime around the year 2140. In that sense, its behavior is somewhere in between that of a commodity and currency.

It is even “mined” like a precious metal; to generate new Bitcoin, a great deal of computational power has to be expended to add to the currency’s public record of transactions with some Bitcoin as the reward. Bitcoin’s fixed supply has made economists like Paul Krugman criticize its design for encouraging hoarding. With its recent surge, Bitcoin has behaved like a store of value, but its volatility and proneness to deflation undermine it as a medium of exchange.

Yet a fervent, core following has helped Bitcoin gain gradual, broader acceptance. “I’m a huge fan of taking monetary policy out of the government and putting it back into the hands of the people,” said 24-year-old Charlie Shrem, who co-founded BitInstant, a platform for instant Bitcoin transfers.

An Unusual World

Few of the Bitcoin entrepreneurs fit the typical psychological profile of a Valley founder.

While building the version of his Bitcoin payments processor, Shrem absconded to a remote town in Southern Norway for months while crashing with a hacker friend named Polynomial he had never met in real-life.

“I wanted to be secluded,” he said. “He told me I could stay with him. I just took that risk, flew out of meet him and he was the nicest guy in the whole world.”

He’s never even had a face-to-face meeting with his co-founder, a reclusive Welsh hacker named Gareth Nelson.

“It’s nerve-wracking. I’m nervous to meet him,” said Shrem, who runs a team of 15 from New York’s Flatiron district. “We’ve built this relationship and this multi-million dollar business around the fact that I don’t see him. I guess I’ll go in a few months.”

TradeHill’s Kenna is an ex-Marine who built the first version of the exchange while living in Vina Del Mar on the Chilean coast. In his spare time, he converted a 41-room building in San Francisco’s Mission District into a “hacker hotel” where he collects rent in Bitcoin. “I collect dollars too,” he added.

“I have to be careful not to sound like a kid who wants to blow stuff up, but I’ve never been content with a normal life,” said Kenna, who backpacked through most of the “Stan” countries of the former Soviet Union after leaving the military. “I went from having no professional experience in finance to being in the industry leader in a new field and being one of the most knowledgeable people in the world on one of the oddest, most obscure assets.”

Some Bitcoin founders are driven less by ideological passion and more by personal experience — especially if they grew up in countries with unstable currencies. They are keenly aware of how fragile faith in a government’s ability to repay its debts can be. (We in the U.S., Europe and Japan are lucky to grow up in countries with the world’s major reserve currencies.)

Wences Casares, a Bitcoin enthusiast and miner who runs mobile wallet startup Lemon, is the son of Patagonian sheep ranchers who lost their life savings in the 1990s to hyper-inflation during the Carlos Menem years in Argentina.

“I remember my parents losing everything. I was 14,” said Casares, who founded the Argentina’s first Internet service provider before moving to the U.S. He got into Bitcoin two years ago and is looking for ways to bring it to smartphone platforms. “I remember the feeling I had when I saw the web for the first time in 1992. That’s how I feel about Bitcoin. It feels like the Internet before the browser.”

His company has attracted well-known firms like Lightspeed and Chamath Palihapitiya’s Social+Capital Partnership.

“The interesting part of diligencing Bitcoin deals won’t be the technical part. What’s unique about the Bitcoin world is that it’s spread all over the world,” Chien said. “It’s not based in Silicon Valley and that’s partially because of the very distributed nature of the system.”

Even the best-known Bitcoin exchange in the world, Mt. Gox, processes $121 million in transactions a month from Tokyo’s central Shibuya district.

Because of the global nature of Bitcoin, it will be interesting to see how Silicon Valley fares as the currency matures. While the Valley has been at the center of the last waves of innovation in social networking and in new smartphone platforms like Android and iOS, it is just one geographic node out of many in the Bitcoin universe.

Kenna chose to relocate from South America to Silicon Valley to be close to investors. TradeHill, which shut down two years ago amid a conflict with Dwolla over chargebacks, has been reborn as a new entity and just closed $300,000 in funding. He said he came to the Valley to do TradeHill the right way in recruiting a technical co-founder from Google named Miron Cuperman who had worked on PCI compliance and privacy.

“When I looked at reforming TradeHill, I wanted three things: operating capital to do it right, regulatory certainty and a good team,” he said. “It’s hard to run a tech company from Chile when investors want to meet with you on-demand.”

But others are staying where they are. Atlanta-based BitPay just processed $5.2 million in Bitcoin transactions last month and just closed a little over a half-million dollars in funding from angels like Path and Spotify’s Shakil Khan and SecondMarket’s Barry Silbert. They’re now hiring aggressively.

One of the most interesting startups to watch will be OpenCoin, which has one of the most pedigreed teams. CEO Chris Larsen was a founder of E-LOAN and peer-to-peer lending platform Prosper and co-founder Jed McCaleb, was behind eDonkey and Mt. Gox. They just closed an angel round of undisclosed size from Andreessen Horowitz, FF Angel, Lightspeed Venture Parnters, Vast Ventures and Bitcoin Opporunity Fund.

Along with operating an exchange for Bitcoin and national currencies like the dollar, OpenCoin supports an alternate math-based currency called the Ripple. The startup has a really unusual business model; the number of Ripples in the world is fixed at 100 billion but OpenCoin has bestowed upon itself a fraction of that. The company intends to give away as many Ripples as it can.

If the startup develops enough support and infrastructure for the currency that people starting putting trust in it, the currency will strengthen. That in turn will also make OpenCoin’s valuation rise as the value of its currency holdings appreciates. It feels analogous to the business models of other open-source companies.

“The Ripple network is like Bitcoin in certain ways. The currency exists as a public good,” Larsen said. “But we thought it was good to have a company to help nurture the development of the code.”

Ripple is designed to address a few of Bitcoin’s issues. For one, it doesn’t require mining and two, it is invulnerable to what’s known as the “51% attack.” Bitcoin is secure as long as at least half of the computing power in its network is controlled by nodes that are “honest” or are not attacking the network. Nakamoto designed it this way.

At this point though, the network supporting Bitcoin is so large that it would not only cost tens of millions dollars to bring Bitcoin down, the supply of hardware necessary to do Bitcoin mining is so limited and expensive that it would be logistically difficult to pull off. Even Casares had to plunk down $30,000 six months ago to buy specialized mining equipment, which now pays for itself.

“The challenge would be how to get your hands on enough computing equipment. There are only so many Bitcoin mining chips in the world,” said BitPay CEO Tony Gallippi. “The bottleneck is really just the supply of hardware. Even if you wanted to throw hundreds of millions of dollars at taking Bitcoin down, you’d have to create your own semi-conductor fab line.”

Regulatory And Security Risks

For investors who are still trying to figure out how to wrap their heads around Bitcoin, there are plenty of concerns: 1) regulatory risk if governments act against Bitcoin 2) security risks with so many third-party services being attacked and hacked constantly and 3) adoption risk, or whether the broader public will warm up to math-based currencies.

Regulatory risk was cleared up a bit last month when the U.S. Treasury’s Financial Crimes Enforcement Network issued a statement about virtual currencies. While the document itself is still a bit vague, it did make it clearer that individual Bitcoin users or miners wouldn’t be regulated. Exchanges, on the other hand, look like they will need to get a money transmitter license.

Security is a constant concern. Bitcoin transactions are irreversible and anonymous, which makes the currency an ideal target for hackers. Once Bitcoin is stolen, reclaiming it is pretty much impossible. There have been several wallets that have shut down after attacks over the past few years. In some cases, it’s not even clear whether those attacks were real like with MyBitcoin, an early wallet that controversially shut down in 2011. Claiming a hacking attack could have been an easy excuse for an unethical wallet provider to walk off with people’s Bitcoin savings.

Liew estimates that somewhere around 10 percent of all Bitcoins have been lost or stolen at some point. Even the biggest exchange, Mt. Gox, suffered lags last week as the company coped with a massive distributed denial of service attack. Today it said it was doing a 12-hour halt or “cooldown” to deal with increased trading volumes after the U.S. dollar value of Bitcoins fell by half.

“You can’t trust anyone,” Shrem said. “If you’re able to stay alive by this point, hopefully you’re making some money. Everyone else that’s failed has gotten hacked, become insolvent or had bad management.”

When Kenna launched the first version of TradeHill, he said he was constantly getting hit by hacking attempts out of Russia. One of the reasons he says he’s been able to relaunch and keep TradeHill’s brand name is because he returned whatever he could to the company’s customers back in 2011. TradeHill’s first incarnation shut down after their payments network Dwolla started doing chargebacks on their transactions. A suit between the two companies is still ongoing.

“Shutting down was painful but I knew it was the right thing to do,” Kenna said. “When we gave people their money back, it assured people that there were legitimate people with integrity in Bitcoin.”

But as I said above, the core Bitcoin protocol hasn’t been compromised, which is one reason why VCs are still interested in it.

“All of modern cryptography is based on certain assumptions that could go away tomorrow,” said Chris Dixon, a general partner at Andreessen Horowitz who has experience in security after selling SiteAdivsor to McAfee in 2006. “But Bitcoin’s been out there and has been battle-tested. Maybe there’s some core flaw in all of our security systems, but if that were the case, we’d have much bigger problems.”

While researching Bitcoin, Lemon’s Casares hired two separate teams of hackers to examine the Bitcoin source code for vulnerabilities for about a half-year.

“They are arguably the best in the world. I spent a lot of time and money on the best hackers I could find and came back from that convinced that Bitcoin’s security is robust,” he said. “What they found was very, very compelling for me.”

The last investor risk is around whether people will increasingly have faith in Bitcoin itself. For now, the currency spikes with every bit of media attention and companies like WordPress are starting to accept it. Bitcoin’s estimated daily trading volume of $31.1 million is infinitesimally small in the pool of $5 trillion in currency trades that happen every day. It isn’t even a drop in the bucket, but it continues to grow.

The irony is that if an ecosystem of trusted third-party Bitcoin wallets, banks and exchanges succeeds, it goes against the original peer-to-peer design of Bitcoin that Nakamoto envisioned. The point of Bitcoin was not to have to rely on a third-party financial institution.

But who knows what Nakamoto’s ultimate intent was? He mysteriously disappeared two years ago, saying that he had moved onto other projects. Nobody ever figured out who Nakamoto was.

“I wouldn’t say Satoshi was full of himself. But he was sure of himself,” said Shrem, who says he corresponded with Nakamoto a few times on IRC. “He seemed to know what Bitcoin was going to do every step of the way.”