Chinese mobile maker Huawei rose to third place in the worldwide smartphone rankings for the first time in the fourth quarter of last year, according to analyst Gartner’s latest global mobile report (Canalys and IDC have also pegged Huawei in third in Q4). In the full year 2012, Huawei sold 27.2 million smartphones to end users, according to Gartner up 73.8 per cent from 2011. However the gap between number three in the global smartphone rankings and the top two, Samsung and Apple, is more like a gulf.

“There is no manufacturer that can firmly lay claim to the No. 3 spot in global smartphone sales,” said Anshul Gupta, principal research analyst at Gartner in a statement. “The success of Apple and Samsung is based on the strength of their brands as much as their actual products. Their direct competitors, including those with comparable products, struggle to achieve the same brand appreciation among consumers, who, in a tough economic environment, go for cheaper products over brand.”

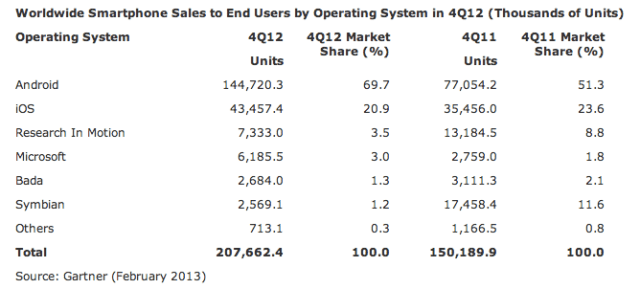

While worldwide mobile phone sales continue to decline, down 1.7 per cent from 2011 sales, smartphones continued to drive overall phone sales, said Gartner, with record smartphone sales in Q4 last year — of 207.7 million units, up 38.3 per cent from the same period last year.

2013 will be the year of the rise of the third ecosystem

Together, Apple and Samsung accounted for 52 per cent of the smartphone pie in Q4, up from 46.4 per cent in Q3 2012. Samsung ended the year top in both worldwide smartphone sales and overall mobile phone sales. While former third placed Nokia continued to slide down the global smartphone marketshare rankings. In the full year 2012, Gartner said Nokia clocked up 39.3 million smartphone sales worldwide — down 53.6 per cent from 2011.

For Samsung, it’s the opposite story: accelerating growth. In Q4 the Korean mobile maker’s overall smartphone sales rose to 64.5 million units, up 85.3 per cent from Q4 2011. In full year 2012, Samsung accrued sales of 384.6 million mobile phones, of which just over half (53.5 per cent) were smartphone sales. This is a considerable jump on 2011 when more than a quarter of its sales (28 per cent) were smartphones.

“With Samsung commanding over 42.5 per cent of the Android market globally, and the next vendor at just 6 per cent share, the Android brand is being overshadowed by Samsung’s brand with the Galaxy name nearly a synonym for Android phones in consumers’ mind share,” added Gupta. The next Android vendor after Samsung is presumably Huawei.

Apple’s smartphone sales hit 43.5 million units in Q4, up 22.6 per cent year-on-year. For the full year 2012, Apple sold 130 million smartphones worldwide. Gartner noted that while consumer demand for iPhones in the quarter remained strong, buyers favored the less expensive iPhone 4 and 4S models over the newer iPhone 5. The analyst also said some consumers now face a dilemma about whether to spend on the iPad Mini, rather than buying a new iPhone.

In the smartphone OS wars, Android continues to dominate — capturing 69.7 per cent of the OS market in Q4, growing 87.8 per cent and widening the gap with iOS which declined slightly to take 20.9 per cent of the market. Over the same period BlackBerry-maker RIM declined 44.4 per cent. Meanwhile Windows Phone maker Microsoft had a better fourth quarter, according to Gartner, with its share growing 1.2 percentage points, and its smartphone sales increasing 124.2 per cent year-on-year.

Gartner predicts that 2013 will see a third mobile ecosystem emerge to soften — if not challenge — the dominance of Android and iOS. “2013 will be the year of the rise of the third ecosystem as the battle between the new BlackBerry10 and Widows Phone intensifies,” said Gupta. “As carriers and vendors feel the pressure of the strong Android’s growth, alternative operating systems such as Tizen, Firefox, Ubuntu and Jolla will try and carve out an opportunity by positioning themselves as profitable alternatives.”