Azimo, the UK-based social money transfer service aiming to disrupt an industry dominated by legacy players Western Union and Moneygram, is rolling out integration with Facebook to make it easy for users of the uber-social network to send money to one another. A first for the remittance industry, claims the company, with perhaps PayPal-to-PayPal transfers coming closest.

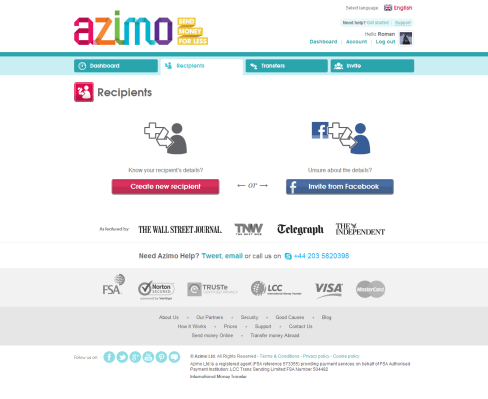

Using Azimo to send money via Facebook works as follows: The sender invites their intended recipient to sign up to Azimo via an automatically sent Facebook message. The recipient then logs into Azimo’s Facebook app and fills out their details, including where they want the money sent to, which could be one of the 150,000 payout desks in the 125 countries supported, a mobile phone ‘top up’, or a bank account. And since the recipient fills out that crucial information, those details are kept hidden from the sender, while the company claims that less mistakes are likely, too.

In addition, in order to reduce the likelihood of fraud, Azimo says that it analyses “key pieces of information about individual Facebook profiles to verify that they are genuine”. These include the length of time a Facebook profile has existed, how active it is, how many friends the account has and whether it’s linked to a genuine email address bearing the same name as the person who owns the account. That makes sense and serves as another reminder of how our social media data can be minded by companies, particularly in the financial sector, and Azimo certainly isn’t the first to do so.

Joining Azimo’s existing apps for iOS and Android, the decision to build a Facebook app was based on surveying its UK customers who regularly send money home or to friends and family. “[We] found nearly three quarters regularly use Facebook – and of those, over 60% were in touch with the person they wanted to send money to”, says Michael Kent, founder of Azimo, in a statement. It therefore made sense to piggyback the social graph and the way users already stay in touch — and gives a further shot in the arm to the company’s battle with Western Union et. al., who it says charge much higher fees than are needed.

“Azimo’s aim is to charge only what is fair – between 1-2% of the transaction – and to make it quick and easy for anyone to transfer their money overseas,” says Kent. In contrast, Western Union and MoneyGram levy “double-digit charges for a service that amounts to little more than a few clicks of a computer mouse”, claims the company.

That’s a sentiment echoed by another European money transfer startup, TransferWise, which is often seen as a direct competitor to Azimo, when in actual fact the latter is more about consumer transfers via collection points akin to Western Union, while TransferWise largely targets bank transfers, particularly by businesses, not least startups.

Founded in 2012, Azimo launched its social money transfer platform in August 2012. In January 2013, it secured angel investment totalling £300,000.