Editor’s note: Howard Lindzon is co-founder and CEO of StockTwits, a social network for traders and investors to share real-time ideas and information. You can read his full bio here and find him on Twitter @howardlindzon.

If we had the answer to this question, life would be grand. Grander if we knew the reaction to the answer beforehand.

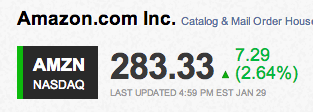

The moves in different directions for Amazon and Apple have been about expectations and guidance. Wall Street has higher expectations for Apple and ‘different’ expectations for Amazon. Wall Street wants Apple’s ‘gross margins’ to grow. They don’t expect Amazon’s ‘profits’ to grow. It sounds silly, but if Apple has reported lower profits and a huge gross margin increase the stock might have shot up. If Amazon had reported record profits today on decreasing margins, Wall Street might have panicked.

Learning the language of the market is not easy. Wall Street loves it that way. If Spanish or Chinese were easy to learn, every American would speak it. The stock market is all about supply/demand, earnings, expectations and mood. The financial media is about headlines. I have spent over 25 years investing and trading and the dirty secret is that survival is about risk management. The best of the best are wrong 50 percent of the time.

Apple and Amazon have been fantastic investments if you have owned them for the last 10 years. Recently Apple has been the ugly duckling of Wall Street. The mood has soured on Apple. It is in uncharted territory as the largest and most profitable company in the world. There is no possible way that Wall Street can predict the earnings, margins, or growth of Apple, let alone the mood of the market one year forward. But… they will try. They have expectations and they get set to spreadsheets.

Those that own Apple (I do) point to the cash balance and earnings and declare the market is rigged or broken (I don’t). Wall Street has stopped caring about Apple’s profits today. They were displeased with forward guidance. Growth rates have slowed measurably at Apple which is understandable for a company of its’ size. Wall Street is worried that growth is slowing and competition from Google and Samsung are taking a toll. Apple has given Wall Street so many wonderful surprises so magic has become the norm. Now that Apple is boring, they have run for the hills.

Meanwhile, Amazon has been able to avoid the ‘profit’ seeking eye of Wall Street analysts. Jeff Bezos has done a miraculous job keeping Wall Street focused on sales growth, market share, the cloud, and now with today’s announcement… margins. Amazon reported margins of 24.1 percent and that was the number that made Wall Street happy.

Next quarter things could change. But I would keep an eye on the gross margin direction of Apple and Amazon until profits come back in vogue. Got it?