Towers Watson’s M&A practice recently published the results of Quarterly Deal Performance Monitor (QDPM), which is conducted in partnership with Cass Business School, and has examined the data on all deals over $100 million completed in 2012. The results are really interesting, especially when you look at what was happening in the public markets. In 2012, there were 94 deals in the tech sector with an average value of $717 million. In 2012, there were 768 M&A deals across all sectors above $100 million.

Compare this to 2011 which saw 75 tech M&A deals with an average value of $512 million. Why the jump? One theory is that it’s a combination of the softening of IPO opportunities for large companies, as well as some of the effects of the rise in valuations over the past year.

Amid Facebook’s surprising negative performance on the public markets, and the plummet in value of other tech stocks like Groupon and Zynga, going public at a billion-plus valuation wasn’t as appealing as exiting at a fairly high valuation.

In 2012, we saw Yammer’s $1.2 billon exit, as well as Kayak’s exit (as a recently public company) to Priceline for $1.8 billion. Yammer could have been seen as an IPO candidate, but founder David Sacks chose to sell to Microsoft. Kayak was already a public company (and was performing decently on the public markets) but the Priceline deal was too good to pass up.

Last year, there was also Facebook’s $1 billion acquisition of Instagram, and Cisco’s $1.2 billion purchase of Meraki.

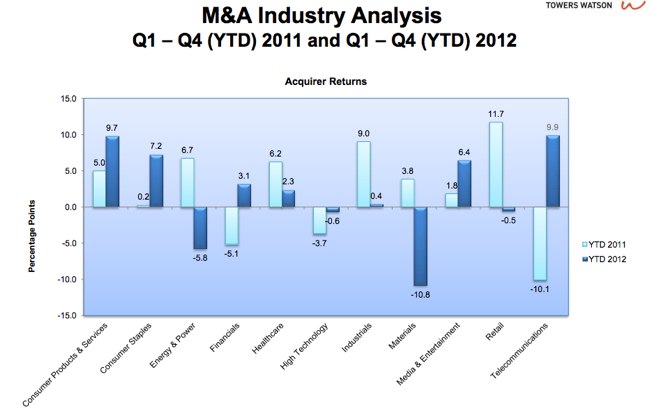

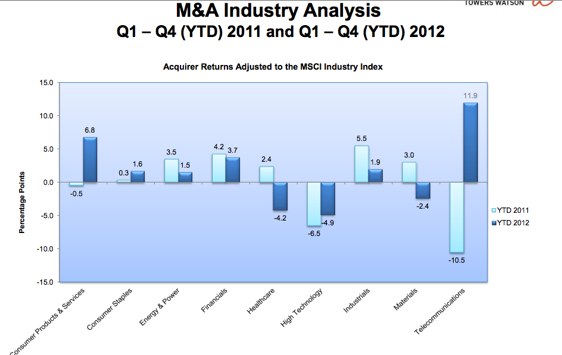

Another point noted in the report — the high-tech sector, compared to other business markets, is more risky for companies conducting M&A. For example, in 2012, tech acquirers’ returns were -0.6 percentage points relative to the MSCI World Index and -4.9 percentage points relative to the MSCI Industry Index. This compares to say the telecoms sector, where acquirer returns were 9.9 percentage points relative to the MSCI World Index and 11.9 percentage points relative to the MSCI Industry Index.

While some tech deals succeed in acquisitions, the report says that performance of buyers in the high-tech sector falls significantly below industry benchmarks and there is little to no shareholder value created. Why these deals don’t succeed is another story. The study highlights that the merging of companies of different sizes, development technologies and cultures often gets in the way of a successful integration.

Photo Credit/Flickr/401(K) 2013