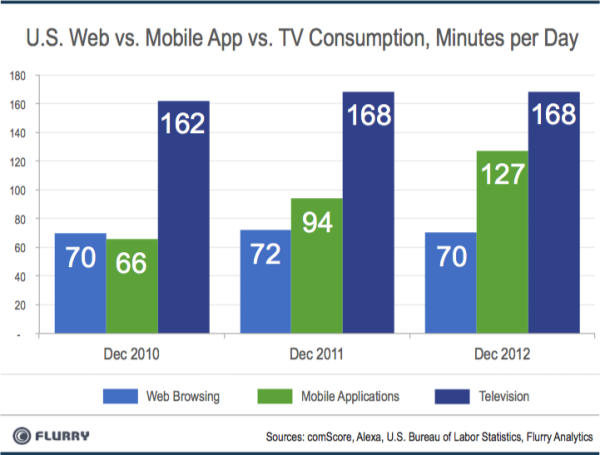

Now that usage of mobile apps has overtaken browsing on the desktop web, it’s starting to challenge television, Flurry says. The San Francisco-based mobile analytics startup says that consumers are spending 127 minutes per day in mobile apps, up 35 percent from 94 minutes a day in the same time last year. At the same time, desktop web usage actually declined slightly by 2.4 percent from 72 to 70 minutes.

This means that U.S. consumers are spending nearly two times more time in mobile apps than on the web. And this time spent is now starting to challenge time spent watching TV. Flurry estimates that the average U.S. consumer watches 168 minutes of television per day, based on data from the United States Bureau of Labor Statistics for 2010 and 2011.

“We ultimately expect apps on tablets and smartphones to challenge broadcast television as the dominant channel for media consumption,” said Flurry CEO Simon Khalaf.

Flurry’s CEO Simon Khalaf says in spite of recent VC hand wringing over how hard it is to invest in consumer mobile apps, there’s still a golden opportunity.

The difference is that user and traffic acquisition on mobile platforms is still changing rapidly and most investors and entrepreneurs don’t quite fully understand it. He was referring to Fred Wilson’s recent argument that investor sentiment is changing and firms are now starting to favor enterprise plays more than consumer investments. This is partly because of the recent post-IPO performances of Groupon, Zynga and Facebook and how difficult it is to acquire users on mobile platforms.

Wilson said in a post this week that he’s refining his thoughts on mobile first, web second. “What I want to focus on is the paradox that mobile is where the growth is right now and that mobile is very very hard to build a large user base on…. Building an audience on mobile is a bitch.”

But Khalaf says we’re still figuring out how to grow mobile applications successfully and predictably beyond rudimentary tactics like having a favorable relationship with Apple or less scrupulous ways of gaming the charts.

He wrote:

“The web comes with an understood set of metrics like page views, visits, unique users, returning visitors and bounce rates, to name a few. And there’s still a standard way of buying traffic (SEM) and getting traffic organically (SEO). There’s a clear index and path to the web, called Google, and most VCs understand Google economics. They understand the lifetime value vs. cost per acquisition equation. They can value businesses accordingly. What the venture industry doesn’t yet understand is mobile and apps. Traffic acquisition is still an art more than a measurable science.”

Of course, he’s tooting Flurry’s horn. The company’s business model is all about helping developers acquire users through incentivized video ads and other means.

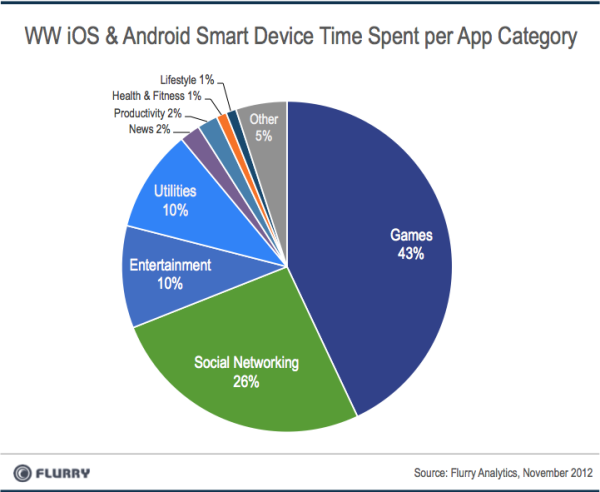

Flurry also did its annual look at how consumers spend time in apps across different categories. Like before, games lead the way, but at a slightly lower marketshare than in previous years.

Entertainment apps and utilities gained marketshare at the expense of social networking and games. Last year, games took up 50 percent of time spent in mobile apps while social networking accounted for 30 percent. This year, gaming’s marketshare is down to 43 percent while social networking comes in at 26 percent.