Editor’s Note: Semil Shah is an EIR with Javelin Venture Partners and has been a contributor to TechCrunch since January 2011. You can follow him on Twitter at @semil.

“In the Studio” turns the corner into the winter months by welcoming a career finance journalist with a widely-read and often-cited daily email newsletter and, in my opinion, is the single best writer covering venture capital and private equity today.

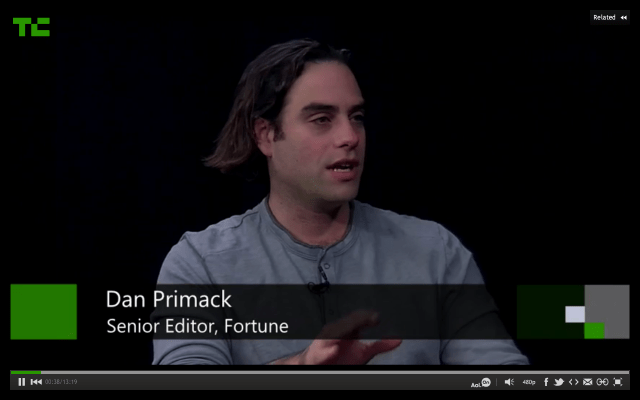

Fortune’s Dan Primack has been covering the world of private equity and venture capital for over a decade. His work speaks for itself, with his daily “Term Sheet” email that reaches nearly everyone in both industries, and his willingness to share his opinions freely and dig and dig to get to the bottom of a story. Primack has a sort of “gumshoe leather” journalistic work ethic, and while he can certainly ruffle feathers (even the feathers of very powerful people) with his work, he has built a loyal following, over many years, that just continues to grow.

In this video, Primack joins me “In the Studio” on one of his recent trips to San Francisco. Because of his deep knowledge covering venture capital, we didn’t really prepare for this session — I just asked him some questions and he filled in all the holes with candid answers. Basically, anyone in venture capital and/or interested in this industry should watch this video. In our talk (originally taped on October 23, 2012), Primack explains why VCs shift from industries, why LinkedIn’s IPO was flawless, the effect of secondary markets on the IPO process, how certain VCs can lose sight of their real customers (limited partners), why it’s unhealthy for founders to take big chunks of money off the table before investors do, and the challenging facing all venture firms, big and small, as the asset class overall continues to shrink, concentrating money in fewer funds and with fewer overall managers.