Yahoo today reported its financial results for the third quarter of 2012, its first full quarter with new CEO Marissa Mayer at the helm. Mayer is back at work full-time after taking a short maternity leave following the birth of her first child, and is expected to speak about the financial results on her first conference call with Yahoo investors as CEO later this afternoon.

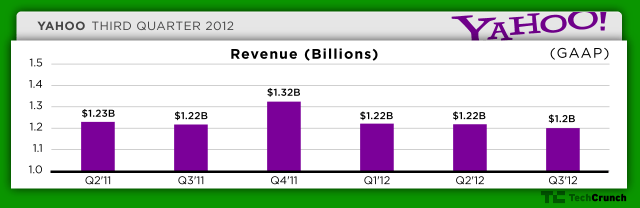

In all it was a solid quarter for Yahoo: The company made $1.2 billion in GAAP revenue, down slightly from the $1.22 billion it posted in the second quarter of 2012 and down one percent year-over-year from the $1.217 billion it made in the third quarter of 2011. On a non-GAAP basis, which is where many Yahoo analysts prefer to focus their evaluation of the company’s top line results, Yahoo’s revenue excluding traffic acquisition costs (ex-TAC) was $1.089 billion, up slightly from the second quarter’s revenue ex-TAC of $1.081 and up two percent year-over-year from Q3 2011’s revenue ex-TAC of $1.072 billion.

Here is the company’s GAAP revenue history in handy graph form, courtesy of TechCrunch designer Bryce Durbin (click to enlarge):

At the bottom line, Yahoo had earnings per share of $0.35 on a non-GAAP basis, which excludes a gain of $2.8 billion that Yahoo made through its sale of Alibaba shares as well as $16 million in restructuring charges. When those two things are factored in, Yahoo’s GAAP EPS is $2.64, but the company is designating that result as “not meaningful” presumably because of the size of the Alibaba share sale. Regardless, both these earnings results — GAAP and non-GAAP — are up substantially from the EPS of $0.27 Yahoo posted in Q2 2012 and the $0.23 EPS the company posted in Q3 2011.

But it’s worth noting that while strategic moves such as the Alibaba share sale helped bolster the overall earnings picture, Yahoo’s income from operations is down on a year-over-year basis: The company reported GAAP income from operations of $152 million, up significantly from last quarter’s $55 million income from operations but down fourteen percent from the $177 million in made in income from operations during Q3 2011.

Nevertheless, Wall Street analysts projected that Yahoo’s EPS would be $0.26 and its revenue would be $1.08, so the company’s results certainly exceeded both those expectations. The stock market so far seems to be encouraged by the news: Within 20 minutes of the company’s earnings report, Yahoo’s stock price had already jumped three percent in after-hours trading.

In a press release regarding the quarterly report, Marissa Mayer is quoted as saying,

“Yahoo! had a solid third quarter, and we are encouraged by the stabilization in search and display revenue. We’re taking important steps to position Yahoo! for long-term success, and we’re confident that our focus on quality and improving the user experience will drive increased value for our advertisers, partners and shareholders.”

Yahoo has also tightened up ship with a smaller employee count: Yahoo reported 12,000 full-time staffers as of the end of Q3 2012, down twelve percent from its headcount of 13,700 a year ago. Meanwhile, the company engaged in serious share buybacks, which is often seen as a sign of confidence: Yahoo repurchased a total of $190 million worth of its shares during the third quarter of 2012, bringing its total repurchase amount to over $4 billion since 2009.

As encouraging as they are, the numbers are only part of the story, however — investors will surely be eager to hear more about Mayer’s overall vision for restoring Yahoo’s stance as an Internet industry powerhouse. In recent weeks Mayer has started to stock the upper ranks at Yahoo with a strong new slate of executives, the latest being her former Google colleague Henrique De Castro in the COO role and tech industry vet Ken Goldman in the CFO role. Wall Street will certainly be keen to hear more detail about exactly what she and her executive team will be working on in the weeks and months ahead, so this earnings call should be one to watch.