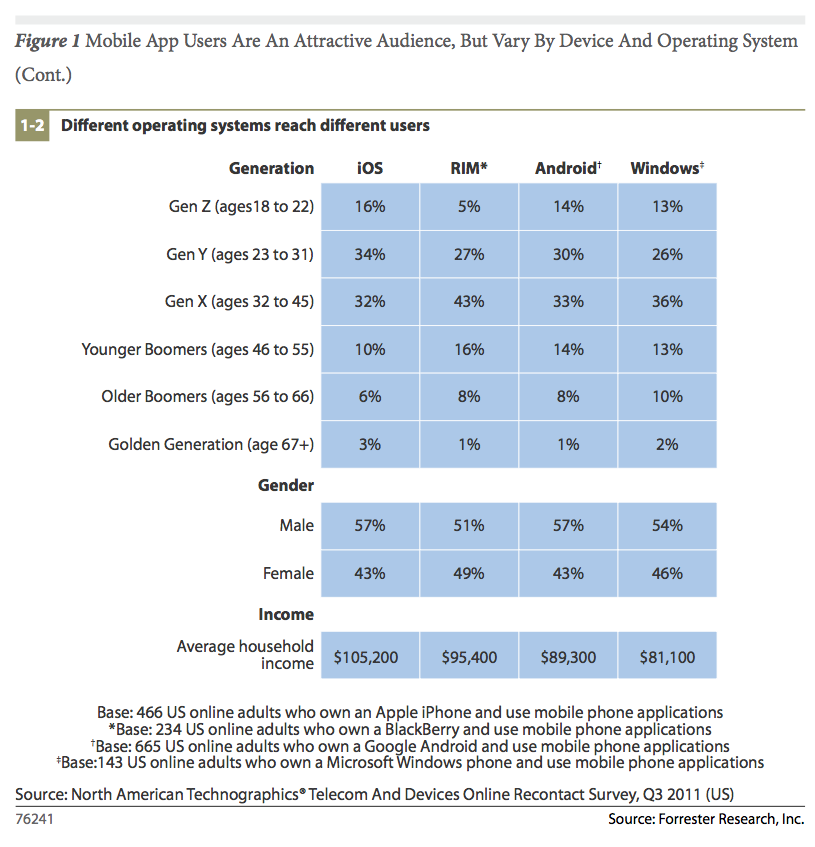

According to a new Forrester Research report, among U.S. mobile device users, those who use apps tend to be younger and more affluent than those who stick just to the web. Nearly one-third of those who use mobile apps fall between the ages of 23 and 31, and another third are in the 32 to 45 category. Usage varies by OS, however, and Apple’s iPhone app audience are generally younger and better off financially, while those on Android tend to be older and less moneyed.

RIM also tends to find its audience among the older end of the age spectrum, which is not a good sign for its chances of sparking interest in BB10 among the younger set. For the leading platforms, however, this is a very good adoption picture, since users tend not only to be young, but also fairly well off, with an average household income of $89,000 for mobile phone app users and $109,400 for those using apps on tablets, vs. an average income of just $76,000 across all online U.S. adults.

iPhone users also tend to be the most affluent of all, with an average household income of $105,200, with Android trailing on that count with average income of $89,300. That’s a key metric for developers and brands looking to recoup the investment associated with creating software, since it stands to reason that customers with access to more disposable income represent a better target market, all other factors being equal.

Forrester also provided insight as to how users find the apps they’re using. Most go through the legitimate storefronts on their device, like the Apple App Store and Google Play, but pre-installed apps represent a very large piece of the pie, as you can see below. People also tend to find out about apps mostly through word of mouth, according to the report, with recommendations and featured spots in App Stores coming in next. Search actually represents a relatively small piece of the discovery pie, and it’s unclear yet whether changes to the App Store on iOS will improve or decrease the chances an app has of being found through that mechanism.

In its report, Forrester notes that the barriers to actual app use are in fact quite high, since they require a user to find, download and then regularly open and use a piece of software. Weighing the cost of app creation vs. its potential return is definitely a key concern for brands, and targeting the most engaged users on the most lucrative platform is always a concern. As it stands, it looks like Apple’s mobile devices are still the best bet in terms of overall value.