Even though Facebook’s IPO roadshow video was a mostly touchy-feely affair with videos of friends have coffee and babies blowing out candles, there were some new stats tucked away in it.

For the first time, the company gave a look at how it monetizes on a per user basis in different parts the world. There was one chart of most interest.

It shows that Facebook made about $9.51 in advertising revenue per user in the U.S. and Canada. Europe was about half that much with $4.86 in ad revenue per user. Asia and the rest of the world follow that at $1.79 and $1.42 per user. What this shows is the revenue trajectory that other more economically developed markets like Western Europe and Japan could get to if Facebook successfully grows there or convinces more regional brand advertisers to come on board.

But these revenues are also affected by seasonal and macroeconomic trends. The average price per ad in Europe actually declined in the first quarter from the holiday season because the weak economy there, according to Facebook’s most recent IPO filing.

Plus, Asia and the rest of the world will be a challenge for awhile. These economies can’t support the kind of spending per user that the U.S. or Europe can. Also keep in mind that Facebook is still blocked off from China, where competitors like Sina, Tencent and Renren are thriving.

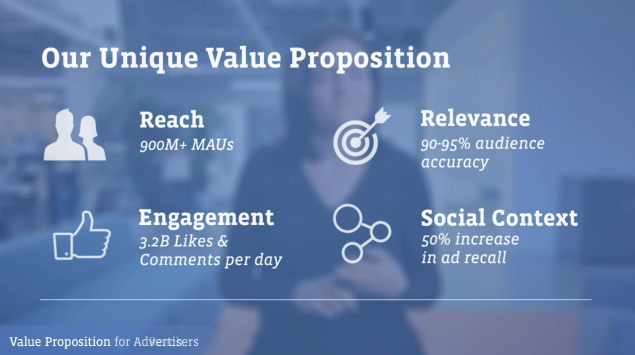

There are six main factors that affect how much Facebook’s advertising revenues can grow over the next several years. They’re listed below and they have to do with raw growth (or how many users Facebook has) to engagement (or how sticky and addictive the product is) to targeting (how well Facebook can route the right ads to the right users).

Facebook is at 901 million monthly active users, so it’s running out of room to grow given the sheer limit of world Internet usage. More importantly, it’s gotten a lot of the low-hanging fruit, or users in developed countries. It’s also continuously changing the product, which can affect short-term revenues. Facebook has bumped up the numbers of ads per page to seven units from four over the past year.

In terms of Facebook’s overall ad pitch, the company’s chief operating officer Sheryl Sandberg said that the company’s long-term goal is to be the place where 70 million businesses worldwide go to offer personalized, relevant advertising.

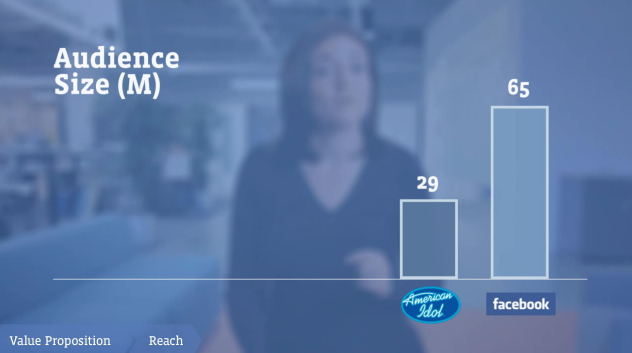

She said, “Every day on Facebook is like the season finale of American Idol times two,” in a reference to the home page.

She also added that advertising budgets are not moving online fast enough to match user behavior. Of the roughly $600 billion spent on advertising every year, only 11 percent of it is devoted toward online ads. Another $1.5 billion in advertising is spent on mobile devices.

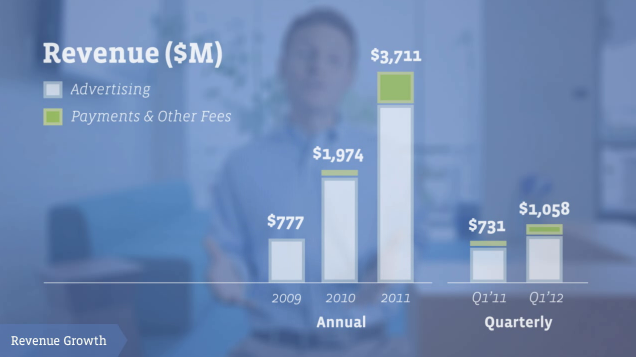

Overall, as we’ve reported before. Facebook’s revenues have two components: advertising and payments. Both are up on a year-over-year basis, but advertising revenue actually declined going into the first quarter, which Facebook says happened because of seasonal spending habits. Plus payments revenue is virtually flat from the fourth quarter into the first one.

If we look closer at payments revenue, it’s up by quite a bit year-over-year. Facebook earns a 30 percent revenue share from apps and games on its platform. But this isn’t a fair comparison since Facebook only made the revenue share mandatory in July. Payments revenue is pretty much flat on a sequential quarter-over-quarter basis, at $186 million from $188 million in the fourth quarter.

The concerning thing is that if you look at games on the platform, Zynga’s quarter-over-quarter bookings for the Facebook canvas aren’t really growing anymore. Most of their bookings growth is coming from mobile. So unless Facebook turns on other kinds of payments revenue soon, this figure is going to stagnate.

Facebook’s chief financial officer David Ebersman stressed that the company may cut its 30 percent revenue share if it expands payments beyond gaming, which we reported on a few weeks ago.

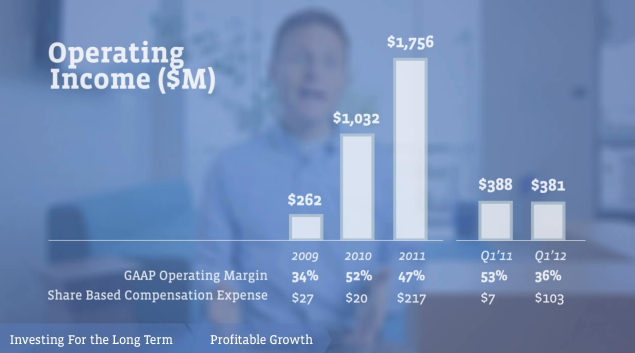

He also pointed out that Facebook’s operating margins are declining. A measure of how profitably the company can run, operating margins fell to 36 percent in the first quarter from 53 percent in the same time a year earlier. Ebersman said this has a lot to do with share-based compensation expenses.

He also added that the company is still in growth mode and will make decisions that will hurt its short-term profitability from time to time. For example, even though Facebook has only started to bring in revenue from its mobile apps, it will still continue to spend aggressively on them.

“We believe mobile usage of Facebook is critical to our future,” he said. “Expect us to invest in it even if mobile monetization is uncertain.”