TinyCo, a mobile gaming startup backed by Andreessen Horowitz, is yet another major game developer that has come forward to show that revenue per user on Amazon’s appstore is tracking much higher than it is on Google Play.

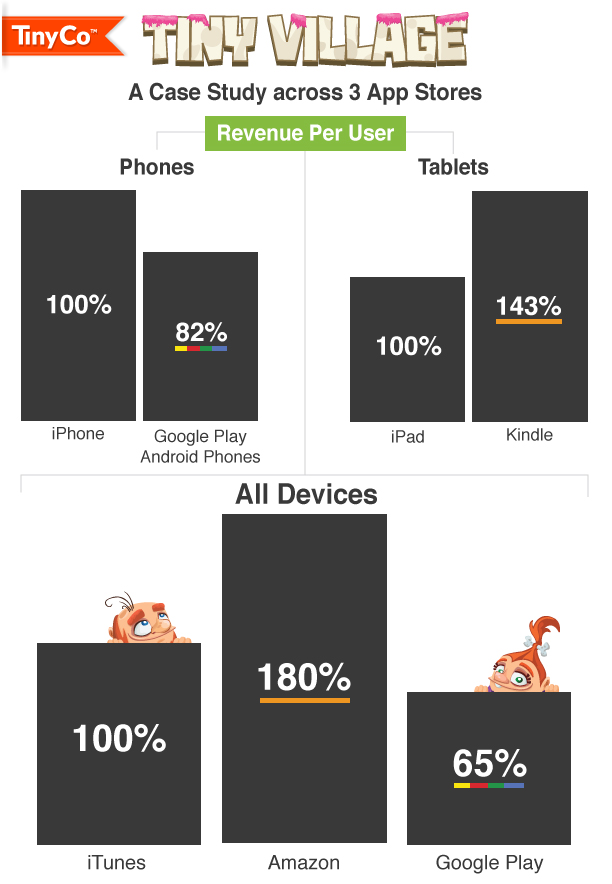

The company, which has top #25 grossing games on both iOS and Android, looked at its title Tiny Village, a prehistoric-themed simulation game that’s available on all three stores from Google, Apple and Amazon, and found that when you break it out by platform, Amazon’s store monetizes 80 percent better per user than iTunes. If you break out the tablet market, Amazon Kindles monetize 43 percent better per user than iPads do. So Amazon is doing even better than Apple is, according to their numbers.

This is not to rag on Google Play though. TinyCo’s numbers are actually not that bad when looking at Google’s store. When you look at just Android phones (which would exclude any Amazon devices since they don’t offer a phone), these devices generate 82 percent of the revenue-per-user that iPhones do.

Update: Some readers are complaining that I am pointing to an isolated case of a single developer, which of course isn’t representative of an entire market. So here’s the thing: TinyCo is one of a few dozen game developers that has actually had top grossing rankings in all three stores. Amazon’s market is still small and they only released in-app purchases out of beta a few weeks ago, so there really aren’t that many developers who have meaningful ARPU (average revenue per user) data.

And here’s the broader picture: TinyCo’s numbers are a little bit different from recent data out of mobile analytics provider Flurry, which looked at a basket of apps that were available across all three stores. Flurry found that for every $1 generated per user in the iOS store, Amazon’s store generated $0.89 and Google Play produced $0.23. Flurry’s analytics are in more than 150,000 apps, so they have a very large sample size.

Another big, independent developer also shared some promising stats about Amazon’s Appstore a few weeks ago: Storm8 said it generated $700,000 in revenue during its first month in Amazon’s store.

There are a couple things to think about with any early data out of the Amazon store, however. 1) Google hasn’t had the years experience that Amazon has in processing payments and managing an e-commerce-centric revenue model. 2) They lack the database of credit cards that both Amazon and Apple have, which creates extra friction for consumers when they want to pay and have to enter in their personal information. 3) It’s still early days so Amazon Kindles may just be selling to early adopters, who have more disposable income. Over time, revenue-per-user numbers may trend downward as a device or platform crosses over into the mainstream. 4) Amazon’s Appstore is still only available to U.S. consumers. So the iTunes and Google Play numbers are averaging in customers from less lucrative international markets.