While Zynga and other gaming companies seem to be doing everything possible to claw their way off the Facebook canvas, at least one San Francisco company is still in. Big time.

With just shy of 5 million monthly active users on Facebook, Kixeye is ranked a dismal 72nd on the developer leaderboard behind Zynga, EA and Angry Birds-maker Rovio, according to tracking service AppData.

But the astonishing revenue Kixeye makes per user has the company on track to gross more than $100 million in total revenue this year. That’s up from between $25 to $50 million last year, according to an independent source familiar with Kixeye’s financials. For comparison, Zynga says it will do between $1.35 and $1.45 billion in bookings this year and it had 240 million monthly active users during the fourth quarter, according to the most recent earnings report. So Kixeye is doing 1/14th of Zynga’s revenue on about 1/50th the number of users.

Kixeye is part of a class of companies that is taking Facebook gaming far from its “Cow Clicker” past. The company doesn’t target the stereotypical 35-year-old female demographic that Zynga is well-known for, but rather a subset of hardcore gamers that are willing to pay up.

Think fewer virtual potatoes and more epic sea battles with pirates.

“We haven’t sold our souls,” said Kixeye’s chief executive Will Harbin, who plays the company’s games for a few hours every day. “We have found a formula where we can make games that we’re super proud of and that are efficient at contributing to our bottom line.” (That’s Harbin in the picture at the top. Yes, really.)

The company only has a few games under its belt, but they have a longer life cycle than other Facebook games as players stick around for longer.

Battle Pirates is set in a post-apocalyptic world where the entire Earth is submerged under water (kind of like Waterworld minus Kevin Costner). Players have to build and defend bases against the Draconian Empire. Then there’s Backyard Monsters, which has had a surprisingly long lifespan for a Facebook game after launching more than two years ago. The real-time strategy game has players building and raising a monster army. It’s gotten edgier over its life as Kixeye has gotten more comfortable with its demographic.

That strategy of building very immersive games for a smaller, but more lucrative, segment of the market represents a shift that’s happened on the Facebook platform over the past year. Games on the platform are becoming a lot more diverse than the casual, resource-management or simulation games that have dominated over the past two years. There are games with rich storylines, hidden object titles and bingo. The audience that Kixeye and other similar developers like Kabam and KlickNation, which EA acquired, is just one corner of this changing landscape.

Facebook seems eager to embrace this change too. “It’s our job in the ecosystem to make sure that quality is highly-rewarded,” said Matt Wyndowe, a product manager for games at Facebook. “Developers are finding that there is enormous potential in higher-quality gaming brackets.”

Meanwhile, casual mass-market developers are finding a tougher competitive landscape. You can see a visible slowdown in Zynga’s bookings growth over the past year as Facebook’s 30 percent revenue share ate into the company’s margins. Other social game developers like Kabam, Crowdstar, Funzio and perhaps most notably, OMGPOP, have diversified onto mobile platforms like iOS and Android in the face of thinning profit margins on Facebook.

“Frankly, we don’t need the viral bullshit that other developers depend on,” Harbin said in his characteristically blunt way. “We have the luxury to make the games we want to make.”

Just to give you a rundown of how sticky Kixeye’s games are, the company shared some stats on engagement. The average session length in a Kixeye title is more than 30 minutes and the company’s daily active users have been playing its titles for more than seven months on average. While the average social game might make 4 cents per day per user, Kixeye makes about 20 times that on a per-user basis. (Zynga’s was 6.1 cents per day in the fourth quarter of last year, according to its earnings report.)

Surprisingly, Harbin says he’s not that interested in mobile for the time being. He’s laser-focused on browser-based games. Of course, the long-term question is about how large Kixeye’s market opportunity will ultimately be. Their approach is niche by definition, so how far can it scale?

“Our market is maybe 8 percent saturated,” Harbin said.

To grow its base, Kixeye is looking to launch a web destination off Facebook sometime in the summer. He says Facebook gaming still has a certain stigma attached to it and Kixeye’s hardcore players might feel more comfortable on a site that the company wholly owns.

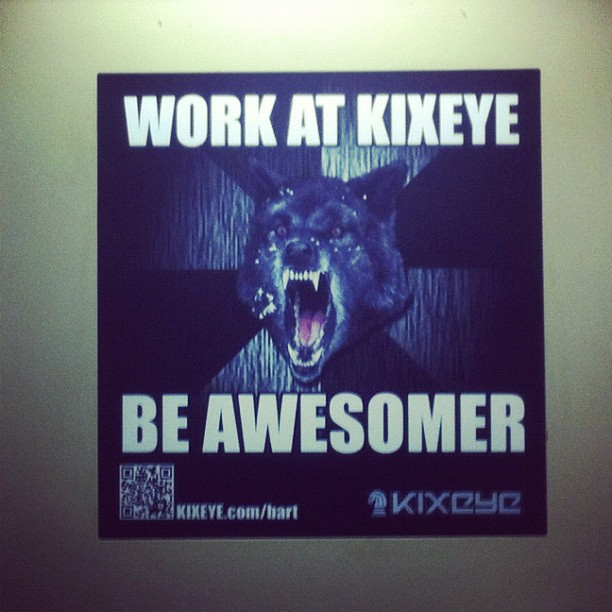

By next year, the company would like to have a 50-50 split in revenue from Facebook and from its own destination. Kixeye is also looking to staff up to about 300 people by year-end. To do so, they’ve stocked up on these ads with wolves (pictured below) that you might have seen while riding the BART trains around the San Francisco Bay Area.

The company’s momentum has piqued the interest of both investors and prospective buyers. When Andrew Trader, who was part of Zynga’s founding team, came onto the company’s board of directors last fall, Kixeye’s $18 million funding round was so oversubscribed that he couldn’t get his venture firm Maveron into the deal.

“Kixeye’s execution has been incredible,” Trader said. “They’re able to monetize revenge. When one of my friends comes to blow up my base in Battle Pirates, I can’t wait to repay the favor and I’ll pay for the privilege to speed that up.”

Born under the name Casual Collective, Kixeye has raised $19 million to date from Lightspeed Venture Partners, Jafco Ventures and Trinity Ventures. This raises the long-term question of whether Kixeye wants to stay independent or join a larger entity. Another company focused on the same demographic, KlickNation, was acquired by EA last fall.

Like many CEOs I talk to, Harbin deflects the question.

“We’re financially independent. We don’t need funding. We don’t need to sell,” he said. ” But obviously, at some point we’ll have to provide liquidity for our shareholders.”

There are interesting candidates out there. Nexon, the Asian freemium gaming company that went public just days before Zynga did, is focused on immersive games. And just because EA did KlickNation, that doesn’t mean it wouldn’t consider another gaming company like Kixeye.

Although Zynga chief executive Mark Pincus has said he’s willing to put the company’s $1.8 billion in cash and short-term securities to work on acquisitions, a Kixeye deal would frankly be an odd fit. Zynga’s mission is to do mass-market, casual and social games. While Kixeye has social titles, they are neither casual nor mass-market.

Plus, given how much Harbin harps on the strategy of other casual game-makers, it seems like he would rather be struck by a lightning bolt than be bought by Zynga. Never say never though.