Amazon is taking the wraps off a new in-app purchasing service today in an effort to make its app store competitive with what Apple and Google offer developers. That should let developers for Amazon’s appstore tap into what has emerged as the most lucrative way of monetizing apps over the past year: staying free but offering virtual currency or other items for purchase inside the app.

After undergoing testing for several months, the new in-app purchasing service is now available for everyone. It’s based off Amazon’s one-click buying experience and applies to digital content like in-game currency, expansion packs, upgrades and subscriptions from inside apps and games.

But as I pointed out last week, the interesting part of this story is not whether Amazon is doing in-app purchases. It’s obvious that the company would do this.

The question is how is it setting up the pricing? You see, Amazon has historically pushed hard for the power to set prices for books and other goods. When it unveiled the appstore last year, it had the ability to discount apps at will. Developers would either earn 20 percent of what they wanted to charge or 70 percent of whatever Amazon ultimately charged — whatever was higher. That irked developers, naturally.

With in-app purchases, it turns out Amazon still has the ability to discount in-app items. But the developers will always earn 70 percent of the list price or what they wanted to charge for it, according to Amazon appstore’s director Aaron Rubenson.

“We’re just following the paradigm that’s out there with the 70-30 split,” he said. “This is a little bit different from the revenue share that we have for paid app sales. We looked at each purchase case separately.”

This is an interesting little compromise that lets Amazon keep its pricing power, while ensuring that developers see no losses as a result of it.

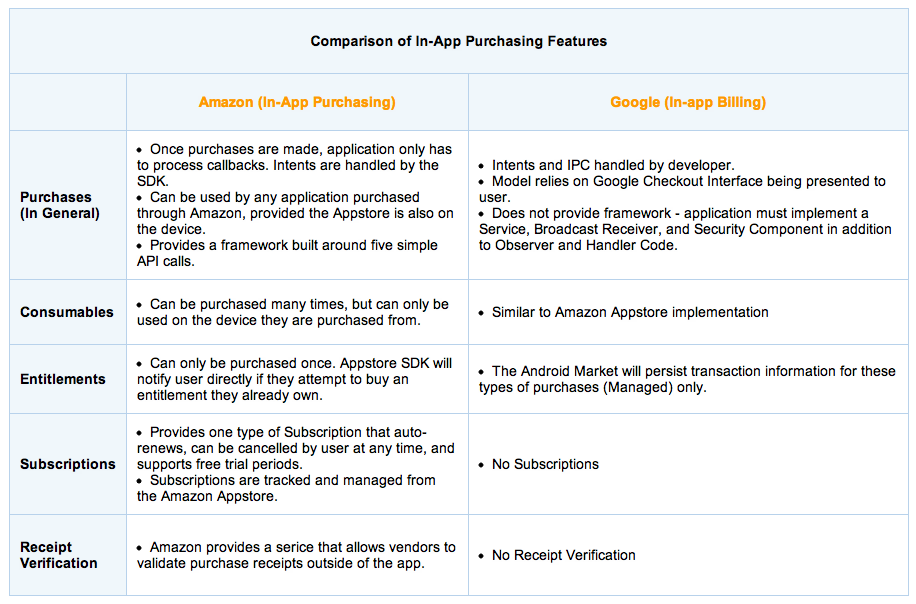

It’s also my understanding that Amazon isn’t mandating that developers only use the company’s in-app purchasing service. That said, Google’s in-app purchasing technology won’t work on the Kindle Fire, according to Rubenson. For that device, developers will have to use Amazon’s system. But on other tablets and phones, developers can use any number of in-app purchasing systems. That’s different from other app stores: Apple prohibits developers from using other in-app purchasing system for digital content. Google technically has the same rule although it hasn’t really enforced it until recently.

Here is the fine print if you want to read it yourself. It looks like there is a special exception for news media products:

4. Royalty; List Price. For each sale of an In-App Product, we will pay you a Royalty equal to 70% of the List Price as of the time of purchase. However, no Royalty is due for (a) In-App Products with a List Price of $0.00, (b) Subscription In-App Products listed in our News or Magazine categories (or similar or successor categories) that we make available to end users at no charge as part of free trial subscriptions or other promotional offers of up to 30 days (or any longer period you approve), or (c) other Subscription In-App Products that we make available to end users at no charge as part of free trial subscriptions or other promotional offers that you approve. For sales of Subscription In-App Products to renewing subscribers, your Royalty will be calculated based on the lower of (i) the then current List Price and (ii) the List Price in effect at the time the applicable end user first subscribed. A Royalty is due only for sales for which we have received final payment from or on behalf of an end user. If an In-App Product is purchased using a credit card or bank account deduction mechanism, final payment will be deemed to have occurred when the applicable credit card company or bank has fully settled the payment for the applicable purchase. “List Price” has the same meaning with respect to In-App Products as the meaning set forth in the Agreement with respect to Apps. You will update the List Price for each In-App Product as necessary to ensure it meets the List Price requirements.

In-app payments are something that Amazon is very well-positioned to do as the company has had a decade to build up expertise in online transactions. Coincidentally, it’s an area that Google is historically weak in providing. And developers are noticing. With about 34,000 apps and a very attractive base of paying customers, Amazon’s app store is becoming one to watch among mobile developers.

Flurry has reported that the average revenue per user from Amazon’s store is about 89 percent of what Apple iOS platform produces. Google lags behind with a revenue per user that sits at about 23 percent of what iOS can do. Keep in mind though that Amazon’s userbase is still much smaller than the audience that Google Play can reach. So Google Play might be able to make up for its weakness in monetization through scale.

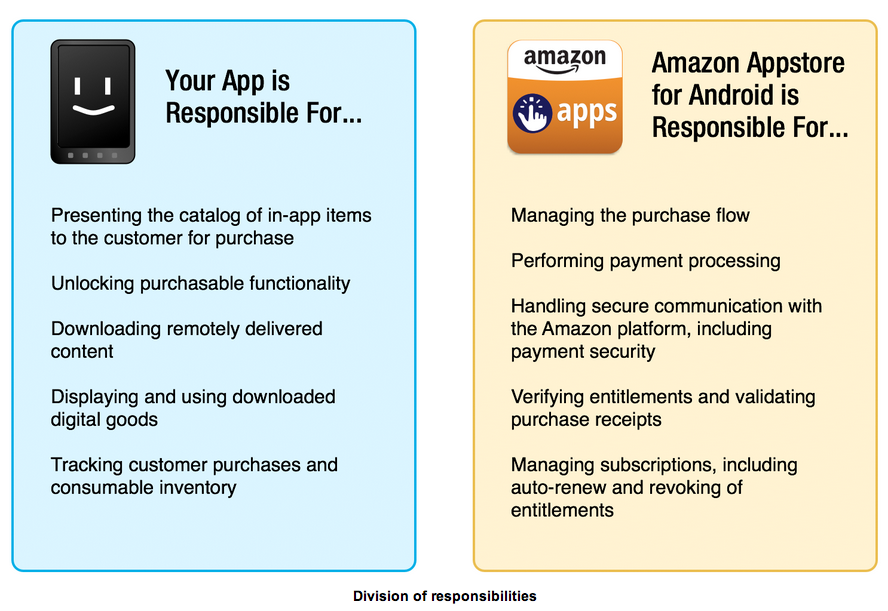

Below is a video explaining Amazon in-app purchases plus some excerpts from the documentation that show the differences between Amazon and Google’s systems: