There are plenty of companies out there that help you monitor social media activity. Awe.sm has been going deeper into what’s really going on, providing a service that lets developers track all the crucial details of sharing activities, and automatically optimize their own services using that data. Having accumulated some 500 clients using its technology — mostly brands and startups of various sizes — the company has just landed a Series A round of funding led by Foundry Group and GRP Partners.

Don’t think of a cute little graph showing your number of retweets or Likes in the past week. Instead, imagine automatically tracking all the specific actions of those retweets, like how they convert into actual sales of the item that your original tweet had mentioned. That’s just one simple example.

Here’s a more specific one. Stock-tracking platform StockTwits has implemented Awe.sm to track how its users react to things like quarterly earnings reports for public companies. Awe.sm can look at any link that contains its tracking code in any tweet or other mention of a company produced by StockTwits users, auto-detecting the link and letting StockTwits track all of the metadata around who is doing sharing and when it happens. StockTwits can then use this data to generate more sophisticated data around reach and engagement for how word spreads out among users, and alter its product accordingly.

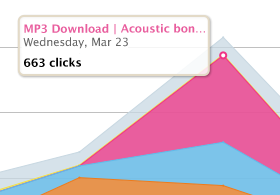

The service is primarily targeted towards developers who are using social sharing as part of their product, who have specific goals they’re looking to accomplish, as cofounder Jonathan Strauss tells me. Anything from figuring out the right types of content to share, to when to share it, who to aim it at, how many clicks it results in, which types of sharing buttons generate the desired types of sharing, which shares result in purchases, etc.

The service is primarily targeted towards developers who are using social sharing as part of their product, who have specific goals they’re looking to accomplish, as cofounder Jonathan Strauss tells me. Anything from figuring out the right types of content to share, to when to share it, who to aim it at, how many clicks it results in, which types of sharing buttons generate the desired types of sharing, which shares result in purchases, etc.

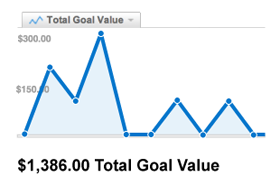

Provided as APIs, Awe.sm sells access based on usage to developers, with the idea that they’ll integrate it into more general analytics services like Google Analytics or Omniture, or into their own custom tools. This also means that developers can use Awe.sm to programmatically change their own services (so no humans staring at graphs). Demandforce’s Timely app, for example, schedules and publishes your tweets when it calculates they’ll have the highest impact. It uses Awe.sm to track all of its tweets, and automatically adjusts the timing for any tweet based on the reactions that it’s seeing across Twitter.

Other clients include GroupOn, Playdom, and LocalResponse.

Many companies are still at the early stages of figuring out how to use sharing. Other tools that are more user-oriented are probably a better fit for them. For example, Facebook’s own analytics product, Insights, can go a long way. Speaking of Facebook, for anyone tracking results from Likes, shares across news feeds, or other activity, they’ll most likely want to use more specific products offered by page management companies or Facebook-focused analytics companies like Kontagent. Awe.sm’s value in these situations may just be in being an additional layer that a more advance page owner ads, or that is added by the service provider. Awe.sm’s hardcore focus on performance marketing also takes it further away from competing against historical rivals like Bit.ly, which offers some of the same enterprise features, but also targets its products more broadly at social media monitoring.

Long-term, Strauss says the goal is to be part of the plumbing that makes the web more efficient as more people come online, and as more companies build products for them. Its focus on customers who can pay, and a revenue model to match, should make it a good business.

The investors, many of whom have invested in similar types of technology providers, seem to think so. “In a world where companies are mindlessly paying money for ‘Likes’ or ‘Followers’, we welcome the new era in which people will use Awe.sm data to start spending their social media budgets on real metrics like customer conversions,” backer Mark Suster from GRP Partners gushes in a press release. “I believe the end of the hyped phase of social media has begun.”

While Foundry Group and GRP Partners led the round, existing investor Neu Venture Capital joined, as did new investor kbs+p Ventures, the investing arm of advertising agency Kirshenbaum Bond Senecal + Partners. The company had previously raised $1 million led by GRP Partners with participation from Neu Venture Capital and Apricot Capital.