Bill Harris has spent his entire career at the nexus of the financial and technology industries, first as the CEO of Intuit, then PayPal, and then as an investor over the past decade. Now he is bringing all of his experiences together in his latest startup Personal Capital, which is launching today after two years in development with 40 employees and $27 million in capital. (He explains the concept to me in the video above). Personal Capital connects to all of your personal financial accounts from banks, brokerages, and 401(k)s to mortgages, credit cards, and loans. It presents your financial life in easy to read charts and graphs like Mint, except that its overarching goal is to help you come up with the best asset allocation and convince you to manage your money through one of its financial advisers.

The analytics are free, but the financial advisers are not. Personal Capital charges a management fee of just under 1 percent of assets managed, which is all-inclusive of brokerage and other fees. “In some ways Silicon Valley does not really get it about financial services,” Harris tells me. “We think software is the answer to everything. Financial services doesn’t get it either,they don’t use technology to augment their interactions with customers.”

Personal Capital is targeting affluent households with a few hundred thousand to a few million dollars to invest. That is above the level where mutual funds will suffice, but below the threshold of private money managers who focus on people with investable assets of $5 million or above. By bringing in data from all of your financial accounts, Personal Capital promises to give you a complete picture of your financial situation.

Its full-time financial advisers can use the same data to create an investing strategy and asset allocation plan. They also find ways to defer gains and harvest losses to minimize taxes. Harris estimates that each financial adviser will be able to serve between 100 and 200 clients thanks to all the heavy lifting done by the site.

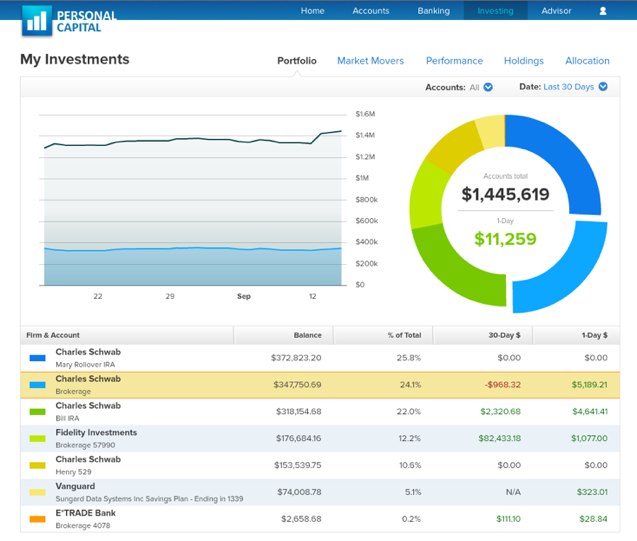

The site shows all of your accounts and your asset allocation across them (stocks, bonds, cash, etc.) It lets you see the big picture in handsome charts, along with the transaction details below. At a glance—assuming you have all of your accounts hooked up—you can see your net worth, cash postion, and investment allocation.

If you decide to allow a Personal Capital financial adviser to manage some of your money, they will craft a personal portfolio just for you. “Mutual funds used to be a good idea, no more,” declares Harris. The cost of trading stocks and bonds is now so low that the economies of scale that mutual funds offer (with one portfolio for everyone) are no longer an advantage. Harris thinks he can bring mass customization to investing by using a combination of software and human advisers.