In its first quarterly earnings since it announced plans to hike prices for DVD subscribers who also stream videos, Netflix tried to put the best face on its new decision. In a shareholder letter (PDF) accompanying earnings, CEO Reed Hastings and CFO David Wells report that during “the quarter, the streaming only plan continued to gain in popularity, with nearly 75% of our new

subscribers signing up for it.”

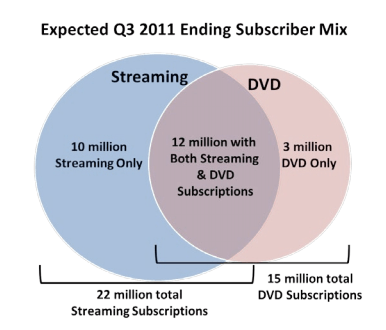

Nevertheless, net domestic subscribers increased by only 1.8 million versus 3.8 million new subscribers last quarter. (Netflix now has a total of 24.6 million subscribers in the U.S. and about another 1 million abroad). The big impact of the price change, of course, will come next quarter, when the company expects total subscribers to stay at around 25 million, with 22 million getting streaming video in some fashion, 15 million still getting DVDs, and a overlap of about 12 million getting both.

Many customers are up in arms about the price change, but Netflix’s attitude seems to be love it or leave it. Again, from the letter:

It is expected and unfortunate that our DVD subscribers who also use streaming don’t like our price change, which can be as much as a 60% increase for them from $9.99 to $15.98, when it goes into effect for each subscriber upon their renewal date in September

. . . We hate making our subscribers upset with us, but we feel like we provide a fantastic service and we’re working hard to further improve the quality and range of our streaming content in Q4 and beyond.

Netflix acknowledges that it still needs to improve the quality of its streaming selection, but it would rather encourage customers to abandon its DVD business and take those savings in shipping and other costs to pour into better streaming content. This transition will obviously take more than a couple of quarters, but Netflix’s policies seem to be designed to speed it along.

In the letter, Reed and Wells also make a point to turn up their noses at Hulu, which they don’t want to buy:

Hulu Plus added about 325,000 subs in Q2; we added close to 2 million. We invest much more than Hulu Plus in content, in marketing, and in R&D. Since Hulu is likely to be sold in the near term, it is unknown who will run it and how much they will invest in the subscription part of the Hulu service. We aren’t planning to bid on Hulu because most of its revenue is from providing free ad-supported streaming of current season TV shows, which is not our focus.

Netflix ended the quarter with $788.6 million in revenue, up 52 percent. Net income was up 55 percent to $68.2 million. EPS came in at $1.26 (versus consensus estimates of $1.11, but Wall Street still isn’t happy with the slowdown in store for the third quarter). Total subscribers were up 70 percent from the year before. Full details in the letter and P&L below.