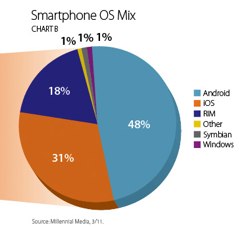

Millennial Media’s monthly mobile report is out today, giving us a view into how each OS and manufacturer is performing on the mobile ad network. Millennial, whose ads reach 90.3 million users monthly in the U.S.; is the third largest network behind Google AdMob and Apple’s iAd, so data shared on Millennial’s network is certainly indicative of the state of mobile advertising. For the fourth month in a row, Android led in terms of the largest impression for Smartphone OS, with 48 percent of impressions on the network. But it’s important to note that Android’s share has consistently fallen over the past two months on the network.

Millennial Media’s monthly mobile report is out today, giving us a view into how each OS and manufacturer is performing on the mobile ad network. Millennial, whose ads reach 90.3 million users monthly in the U.S.; is the third largest network behind Google AdMob and Apple’s iAd, so data shared on Millennial’s network is certainly indicative of the state of mobile advertising. For the fourth month in a row, Android led in terms of the largest impression for Smartphone OS, with 48 percent of impressions on the network. But it’s important to note that Android’s share has consistently fallen over the past two months on the network.

While Android’s share is falling, iOS impression share in the U.S. grew 11 percent month-over-month and represented 31 percent of the impression share of the Smartphone OS Mix. iPhone impressions actually grew 17 percent. Millennial reports that this growth is largely tied to the growth of the Verizon iPhone on the network; the Verizon iPhone actually accounted for 8.2 percent of iPhone impressions in March. RIM accounted for 18% of the impression share on Millennial’s network.

Globally, iOS impressions grew 29 percent month-over-month compared to 23 percent growth for Android impressions and 14 percent growth for RIM. Symbian impressions grew 4 percent month-over-month.

Connected devices (non-phones—like the iPad, iPod Touch and Samsung Galaxy tablet) increased 21% percent month-over-month, and now make up 17 percent of the device impression share (compared to 64 percent for smartphones, and 19 percent for feature phones). Touch Screen devices grew 16 percent month-over-month, with approximately 59 percent share of impressions.

Apple topped the list of leading device manufacturers on Millennial’s network, with 32 percent of the Top 15 Manufacturers impression share in January, an 14 percent increase month-over-month. Android smartphone manufacturer Samsung grew 50 percent month-over-month to reclaim the number two position on list, passing HTC, which took 11.35 percent of share.

In terms of actual devices, the iPhone took the top spot with 16.75 percent share. Android manufacturers Samsung and HTC also performed well in terms of top mobile devices on the ad network. Samsung had four new Smartphones enter the Top 30 Mobile Devices ranking in February with 6 percent of impression share. HTC captured 10 percent of impression share.

In terms of actual devices, the iPhone took the top spot with 16.75 percent share. Android manufacturers Samsung and HTC also performed well in terms of top mobile devices on the ad network. Samsung had four new Smartphones enter the Top 30 Mobile Devices ranking in February with 6 percent of impression share. HTC captured 10 percent of impression share.

Motorola devices represented four of the Top 20 Mobile Phones with a combined impression share of 6 percent in March. All Android devices combined represented 22 percent of the Top 20 Mobile Phone impression share and accounted for 14 of the Top 20 Phones in March.

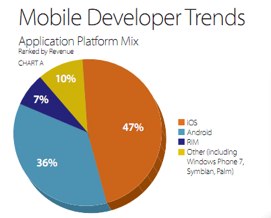

iOS applications represented 47% of the Application Platform Mix, ranked by revenue, in March. iOS led the Application Platform Mix primarily because iPad application revenue doubled month-over-month. Gaming applications reclaimed the number one spot as the leading Application Category on the network, representing 37% of the application revenue in March. Shopping & Retail applications experienced a 40% growth month-over-month. This revenue growth, says Millennial, is largely tied to the increase of

multi-platform retail brand apps where customers can research and shop on their mobile device.