With the flood, comes the feast. Advertising dollars are pouring into online video. Some of the largest online video ad networks are seeing revenue growth accelerating this quarter, and expect the fourth quarter to be even bigger. “Last year we grew 40%, this year we are growing 90%,” says Keith Richman, CEO of Break Media. He expects Break’s total revenues in the third quarter, which include more than just video advertising, to be well above $10 million for the first time.

Tremor Media, which is one of the largest video ad networks and second only to Hulu in the number of video ads it serves, is also seeing a doubling of ad revenues. “It has reached a frenzy point over last three quarters.” CEO Jason Glickman tells me. “We see television dollars moving to online video,” he declares. The fourth quarter “is lining up to be a monster,” and next year Tremor’s revenues are on track to top $100 million for the year.

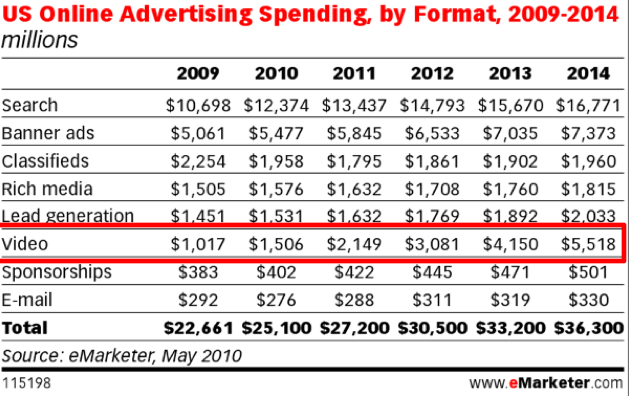

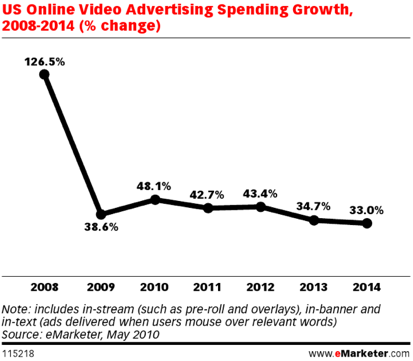

TV advertising still dwarfs online video, with about $70 billion spent on there in the U.S. Online video advertising is estimated to reach $1.5 billion this year, up from $1 billion last year, according to eMarketer. “Our share of the $1 billion or $2 billion pie for online video is insignificant compared to the budgets that are coming over,” says Glickman.

Relatively small shifts in advertising budgets from TV to online can create huge swings in growth for online video. eMarketer estimates that online video advertising will grow 48 percent in 2010, accelerating from 39 percent growth last year (which was a weak year compared to the 127 percent hypergrowth in 2008). But judging by what Tremor and Break are seeing that $1.5 billion estimate might prove to be conservative. Glickman expects revenues next year to top $100 million. Caveat: treat their experience as anecdotal snapshots of the industry which happen to match.

It very well may just be the big ad networks and properties like Hulu that are seeing the vast majority of new ad dollars. “If you are not in the top 10 on comScore you will have a tough time,” notes Richman, “money goes to the guys who are big.” TV advertisers want to match their reach on TV, and online video that is deemed to be safe, professional content is starting to get to those levels. It is not American Idol,” says Glickman, “but it is like a large cable network.” Advertisers can’t yet reach 30 million people in an hour with a single media buy online, but they can reach that many people over the course of a week, and they can target to specific demographics and get some feedback on how the ads are performing, which TV advertising still can’t do very well.

Advertisers are becoming increasingly comfortable with putting their video ads online. Hulu, which may be filing for an IPO, is the largest beneficiary of this trend. If an advertiser already puts ads against House or The Office on TV, it is a no-brainer to match that online on Hulu. But they are also beginning to trust the larger video ad networks like Tremor and Break, which put ads against a wider range of professionally-produced video from guy videos to sports clips and movie trailers.

“I have never seen test budgets that start at half a million dollars,” says Glickman. Usually ad agencies start testing with one tenth as much. Also, he is seeing about a dozen larger commitments in the double-digit millions over the course of the year, deals he calls “online video upfronts” because they are negotiated in advance like regular TV upfronts. According to comScore, Hulu showed the most video ads in July with 783 million, but Tremor came in second with 452 million video ad views.

Video is definitely shaping up to be a large and growing business for the bigger players and ad networks, but will those advertising dollars trickle down to the smaller guys as well?

Photo Credit: Flickr/ Cathy Stanley-Erickson.