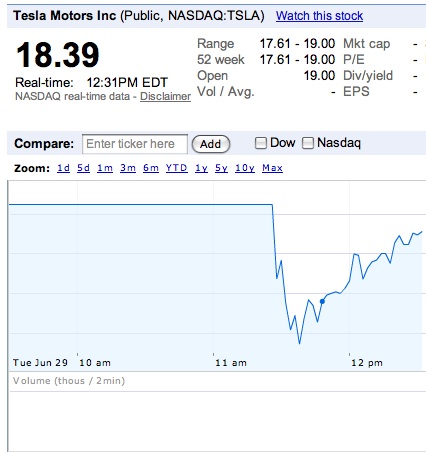

With the Dow down more than 250 points, today is not the best day for an IPO. But Tesla shares are rallying after an initial scare. Tesla Motors rang the Nasdaq opening bell earlier this morning to commemorate its initial public offering under the ticker symbol TSLA The shares opened at $19, a 12% jump from its $17 pricing yesterday. But then they immediately dropped, dipping below $17.70 before rallying again. Currently, they are trading above $18, which gives Tesla a market cap of about $1.7 billion

The company was able to price the shares above its $14 to $16 range, and will collect $202 million from the IPO Tesla is selling 13.3 million shares, 11,880,600 through the company and 1,419,400 through selling stockholders, including founder Elon Musk. This is the first time an automotive company has gone public in more than 50 years. (For a skeptical take on Tesla’s chances, read this in-depth Reuters article, in which GM’s Bob Lutz predicts, “These geniuses always get their comeuppance”).

Any bets on where the shares will end the day?

Update: Tesla’s shares kept rising through the day past the opening price and closed at $23.89, giving the company a market cap $2.2 billion at the end of its first trading day.