There’s an interesting article up on Inc.com that reveals interesting tidbits about the backstory to the 2009 acquisition of online shoes and clothing retailer Zappos by Amazon for roughly $1.2 billion in stock.

There’s an interesting article up on Inc.com that reveals interesting tidbits about the backstory to the 2009 acquisition of online shoes and clothing retailer Zappos by Amazon for roughly $1.2 billion in stock.

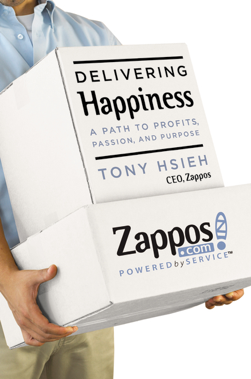

The article is actually adapted from Zappos co-founder and CEO Tony Hsieh‘s new book, Delivering Happiness, while Purpose. Inc. senior writer Max Chafkin contributed additional reporting.

Hsieh writes how he was first approached by Amazon as early as 2005, but immediately turned the company down because he felt they were just getting started at Zappos.

Interestingly, Hsieh also says that he was reluctant to sell to Amazon 4 years later as well, and that he would much rather have kept growing the company to eventually go public.

But as we know, that’s not what happened.

That the deal with Amazon was ultimately signed anyway is largely a result of pressure by Zappos’ board of directors, which includes partner from outside investors, including Sequoia Capital, which injected $48 million into the e-commerce company.

Rather bitterly, Hsieh recalls that the recession and the credit crisis forced Zappos to reconsider its future, and that its investors were not convinced about the advantages to its distinctive, widely talked about and oft-lauded company culture:

As the economy deteriorated, the appraised value of our inventory began to fall, which meant that even if we hit our numbers, we might eventually find ourselves without enough cash to buy inventory.

These issues had nothing to do with the underlying performance of our business, but they increased tensions on our board of directors. Some board members had always viewed our company culture as a pet project — “Tony’s social experiments,” they called it. I disagreed. I believe that getting the culture right is the most important thing a company can do. But the board took the conventional view — namely, that a business should focus on profitability first and then use the profits to do nice things for its employees.

It was enough reason for Hsieh and his trusted partners to come up with a plan to find new investors and ultimately buy out the board of directors for roughly $200 million. That number seems to have been right on the mark, in hindsight: Sequoia ended up making $248 million from the exit.

Instead of regaining full control of the company along with new investors, Hsieh rekindled talks with Amazon head Jeff Bezos in Seattle. Bezos reassured him that Zappos could operate relatively independently even if after a 100% acquisition, and that its remarkable culture would be maintained. Reading the article, I can’t help but think that had Hsieh not had such a good conversation with the man that day, things would have turned out very differently.

It’s a fascinating read that is getting a lot of attention in blogger world.

Felix Salmon at Reuters concludes Sequoia ‘forced’ Zappos to sell, while Ben Metcalfe raises some questions about Zappos’ way of treating customers and employees, saying this approach appears to not pay off in the end. Dan Primack at peHUB, meanwhile, says he was right about the rumblings in the Zappos board room all along (they reported rumors about Sequoia pressuring Zappos for a liquidity event right after the deal was announced).