Editor’s note: Group buying sites are growing like mushrooms. In this teardown, guest author Steven Carpenter goes through a detailed teardown of the largest social commerce site, Groupon, and its competitors to see what exactly is going on here. Carpenter was the founder and CEO of Cake Financial, a TechCrunch40 Finalist that developed a service for mainstream investors to manage their investments, which was sold to E*Trade earlier this year. Before Cake, Steve worked in digital music managing strategy and the day-to-day operations for Rhapsody. He was also the director of business development at financial services startup myCFO, founded by Jim Clark and backed by Kleiner Perkins, and online photo site, Snapfish.

Much has been written about the rapid growth and success of Chicago-based local daily deal company, Groupon. And it is for good reason. No other startup has gone more quickly from launch to $1 billion+ in valuation except YouTube (12 months), which Groupon achieved in 16 months with its latest $135 million infusion two weeks ago. Just as unprecedented, the popularizer of the “group coupon” increased its valuation 4X in the span of just 3 months. What is going on here? Is Groupon yet another example of frothy venture capital valuations or is the company one of the next, enduring consumer Internet brands?

The Teardown

To find out, I did a teardown of Groupon’s business with data available on its website over the most recent quarter, compared my findings to what I calculated for the final three months of 2009, and then looked at how all of this compares to the top competitors. I conducted two analyses: 1) I looked at every deal across the Groupon network for a single day last November and a day this past April to see how revenue is scaling and how the company is benefiting from rapidly opening support for new cities. I then analyzed every deal listed on the Groupon website across 5 cities (San Francisco, Boston, St. Louis, San Diego, and Denver ) for all of Q4 2009 and Q1 2010 to determine how the company is growing once it enters a market and to see how the product mix is changing. The key finding is that Groupon is achieving considerable revenue growth across all measures: more customers, higher deal prices, and rapidly expanding markets.

How Groupon Makes Money

Groupon takes the old Entertainment Coupon Books that your mom used to buy and brings it to the social web. Groupon sells a “Deal of the Day” in each of it’s now 52 supported cities offering significant savings for local restaurants, service providers, activities and memberships, and takes a commission. The trick is that the deal is only “triggered” once enough people buy in. This creates the incentive to share the deal with friends and family, until “the deal is on.” It’s great for local businesses because they can set the parameters for the offer and they know a minimum for how many offers they will have sold in advance. By combining the social web and virality with hard-to-replicate deals, Groupon has created a network-effects business for commerce that makes its model highly attractive (hence, every week seems to bring new copycats).

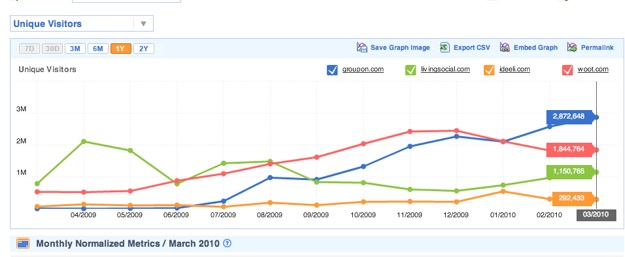

Traffic

Groupon had nearly 3 million unique visitors in March, up from 900,000 in September. It is now bigger than Woot, in terms of traffic, and quickly approaching Zappos (5 million). According to Compete, Groupon gets more of its traffic from Facebook than any other site, including Google, and when people are searching they are typing “groupon”- meaning it is already enjoying the benefits of its brand equity as the company becomes synonymous with the category. As a result, Groupon is spending very little money on search engine marketing (as opposed to say Netflix or Amazon), which is a significant cost advantage. Leading direct competitor, LivingSocial, by contrast, flattened out at 900,000 but now appears to be ramping up again.

What Are People Buying?

Coupons for restaurants, massages, discounted memberships to fitness clubs and museums, local activities, tourist attractions, and merchandise continue to make up the bulk of what is being sold. You can tell a lot about a city by what is being bought on Groupon. To wit:

- Boston residents love laser hair removal (655 purchases), gliding around town on Segways (4,311), and learning how to fly a helicopter (2,575). Hopefully not all on the same day.

- St. Louis residents love their plants and garden supplies (6,106) and, of course, Llwelyn’s Pub (5,832)

- San Diegans are into Pole Dancing and unlimited carnival rides (3,875)

- Denver loves them some Cold Stone Creamery (7,110) and Speed Raceway (1,938)

- Atlanta is into NASCAR (1,063)

- Chicagoans enjoy the Tall Ships (7,119)

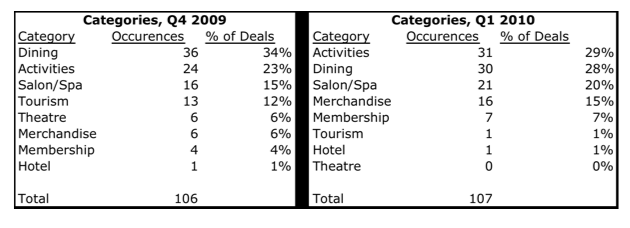

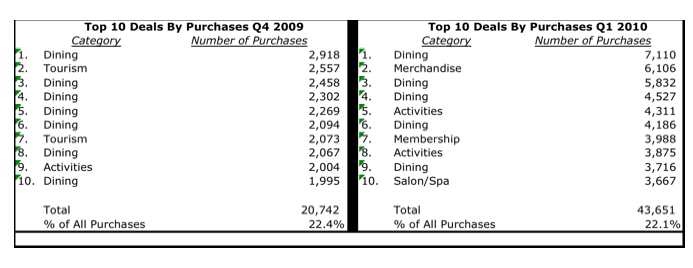

If you look at the top 10 deals by number of purchases, local merchants appear to be getting more comfortable with the Groupon marketing channel. Restaurant coupons will also be popular but offers like discounted clothing, flowers, house cleaning, and local events like boat shows are increasingly appearing on the site. As you can see below, between the fourth quarter of 2009 to first quarter of 2010, “Activities” replaced “Dining” as the #1 category and “Merchandise” took a big jump. My guess is that this will become more prevalent as Groupon increases its salesforce and these more local merchants begin to experiment with unique offers. Consumers will benefit as they have the opportunity to grab more of their favorite things at deep discounts.

How Big Is Groupon’s Business and How Fast Is It Growing?

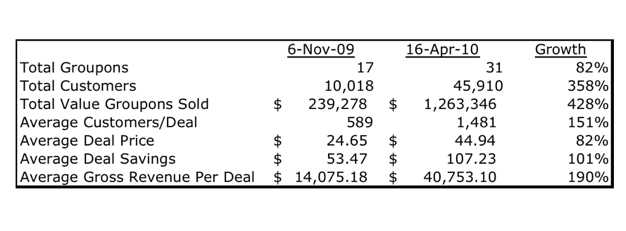

On April 16, 2010, Groupon had 31 deals, 45,910 paying customers and sold nearly $1.3 million worth of coupons. This was a significant increase from the 17 deals, 10,018 customers and $240,000 in gross sales it had on November 6, 2009. Along every measurement I looked at—the number of deals /day, average customers/deal, average deal price, average gross revenue/deal—Groupon is seeing tremendous growth. Of particular importance is that its average deal price is increasing (from $24.65 to $44.94) and it is rapidly opening up new markets.

All of this is what is causing Groupon’s revenues to scale quickly. Assuming a 30% revenue share, Groupon netted $72,000, last November for a monthly run rate of close to $1.5 million, assuming 20 deal days each month. In April this had jumped 5X to $380,000, implying a monthly run rate of $7.6 million. As you can see from the chart below, not only is the number of deals increasing, but the number of customers per deal more than doubled and Groupon was able to elevate the price per deal. That formula of (more deals + more customers) X (higher ticket items) seems to be working.

Based on these numbers and the company’s growth rate, Groupon should easily surpass $150 million in revenues in 2010. And as revenue ramps, most of this will be pure profit since the company does not hold any physical inventory and its customer acquisition costs are so low.

How Is Groupon Doing Once It Gets Into A Market?

(Note: For some reason, there are not deals listed for every day but this seemed to be the case for both time periods, so we are looking at an apples-to-apples comparison. )

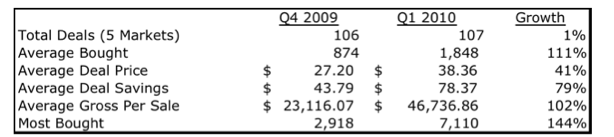

While there were nearly the identical number of deals during the two time periods (106 vs. 107), Groupon more than doubled its average gross revenues per sale from $23,000 to $47,000. The company doubled the average number of customers per deal from 874 to over 1,800 and increased the deal price from an overage of $27.20 in Q4 to $38.36 in Q1. I also thought it was interesting that the most purchased deal in Q1 was 7,119 (for a $16 ticket to ride the Tall Ships in Chicago), more than double the most popular sale in Q4 (2,918 for a $15 Vegetarian Dinner in Denver).

How Is The Rampant Competition Affecting Groupon?

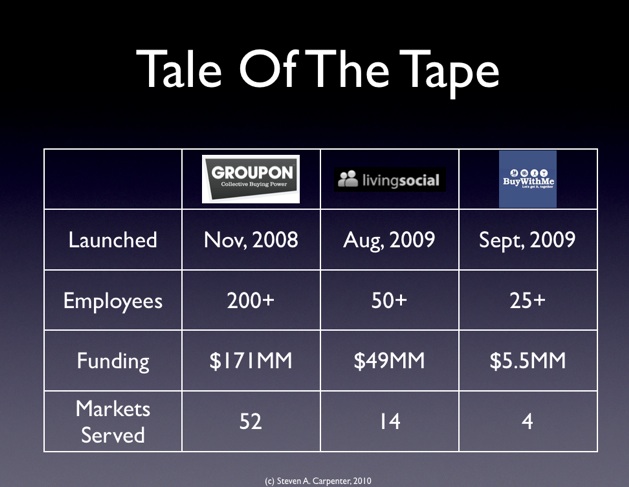

Obviously I am not the only one running these numbers. Because of this dramatic growth and the wild profit potential of the emerging daily deals category, a number of companies are trying to become fast followers. You can see a comparison below of Groupon with its two most well-funded followers, LivingSocial and BuyWithMe (which recently brought on an experienced CEO in Cheryl Rosner, formerly CEO of TicketsNow and Hotels.com). Groupon has raised a total of $171 million to-date, employs more than 200 people, and serves 52 markets. Its next biggest competitor, LivingSocial, has raised $49 million, employs about 50 people, and serves 14 markets.

Of the companies the press likes to mention as competitors, the reality is that only LivingSocial has established enough traction to provide sufficient data to draw a comparison. LivingSocial is now in 14 markets compared to Groupon’s 52. I compared the daily deals for Groupon and LivingSocial for the same day as above, April 16.

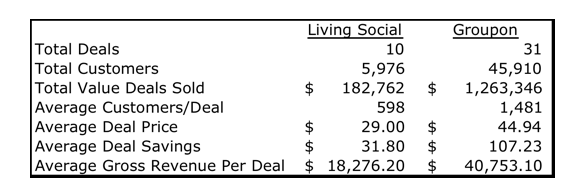

As you can see below, LivingSocial looks a lot like Groupon did 6 months ago. LivingSocial had 10 deals compared to Groupon’s 31. On every measurement, total customers (45,910 vs. 5,976), average customers/deal (1,481 vs. 598), average deal price ($44.94 vs. $29.00), and average gross revenue per deal ($40,753 vs. $18,276), Groupon is far ahead. The data suggests that Groupon is not yet feeling the impact of all the new entrants.

The $1 Billion Question: Is This a Winner-Take All Market?

I think the potential for these kinds of offers on the web is a $5B+ opportunity. There is no reason to believe that this concept couldn’t be extended to virtually any category or service provider.

But I do not think this is a winner-take-all market like auctions were when eBay took that market.

There are no real technology advantages, there is nothing preventing a local vendor from using multiple platforms, and buyers don’t care where they buy so long as the deals are good.

That said, my take is that this is a winner-take-most market and looks more like search, where the bulk of the revenues will fall to the leader. There are definitely network effects in play and they appear to be stronger than I initially assumed. When Groupon enters a new market it is starting from scratch but it can leverage its significant investment in its platform. This is the reason it has raised so much capital and it is racing to get into new cities before the competition. The question remains whether fast followers like LivingSocial and BuyWithMe will be able to grow into mini-Groupons with Groupon already firmly entrenched in a city.

Bugatti teardown photo credit: Flickr/David Villarreal Fernández