Putting a value on private companies is hard enough for insiders and venture capitalists who have full access to the company’s financial statements. When outsiders try to do it, even well-informed ones, it is nothing more than a guessing game. But it is nonetheless perhaps one of Silicon Valley’s favorite parlor activities.

Putting a value on private companies is hard enough for insiders and venture capitalists who have full access to the company’s financial statements. When outsiders try to do it, even well-informed ones, it is nothing more than a guessing game. But it is nonetheless perhaps one of Silicon Valley’s favorite parlor activities.

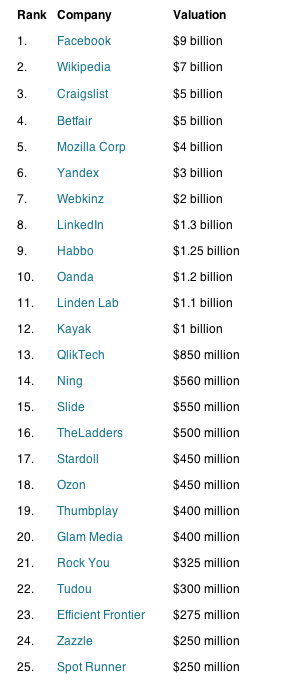

Today, Henry Blodget & Co. at Silicon Alley Insider try to peg valuations on 25 private Web companies. Facebook is at the top of the list, but it is valued at $9 billion instead of the $15 billion that Microsoft’s investment put on the company. Why? Because everyone knows that the $15 billion is too high, so SAI decided to apply a 25X multiple on Facebook’s 2008 revenue forecast of $350 million. Does that make its valuation correct? Probably not. But in the absence of any true market pricing, anyone can go ahead and make a guess.

The same goes for any of the valuations on the SIA 25 list, which puts Wikipedia’s worth at $7 billion, Craigslist’s at $5 billion, Mozilla’s at $4 billion, LinkedIn’s at $1.3 billion, Ning’s at $560 million, RockYou’s at $325 million, and Spot Runner’s at $250 million. Note that three of the top five (Wikipedia, Craigslist, Mozilla) are essentially not-for-profits sitting on very valuable assets. The valuations for those three are based on what they would be worth if they were run differently with an eye towards maximizing revenues—which, of course, could impact how consumers interact with them, which in turn would impact their valuations.

Another 25 startups make up the contenders list, which includes Federated Media ($245 million), Yelp ($225 million), Meebo ($220 million), Mahalo ($150 million), Digg ($125 million), Etsy ($115 million), Powerset ($80 million), and Twitter ($75 million). A full list that changes dynamically every 20 minutes, based on changes in the Nasdaq, can be found here (although, exactly how the valuations are linked to the Nasdaq is never clearly explained)

Some of these valuations have more merit than others. Some have none whatsoever. For instance, SAI gets at its $125 million valuation for Digg by “splitting the difference” between a $200 million buyout rumor we reported and the $60-to-$80 million that Kara Swisher came up with. Splitting the difference between two rumors is not exactly the height of financial analysis.

But what are you gonna do? At least SAI acknowledges that the list is an imperfect work in progress. Don’t get too caught up in the actual numbers. It is more useful really as a starting point to think about relative valuation between different startups. Is Meebo really worth three times as much as Twitter? Is Ning worth as much as Slide? Let the parlor game begin.