Network growth has become the holy grail for tech startups. Airbnb revolutionized tourism with their hospitality network. Ride sharing apps used the strength of networked relationships to up-end the taxi industry. Now, payments are the next legacy system undergoing a networked revolution.

What’s broken with business payments

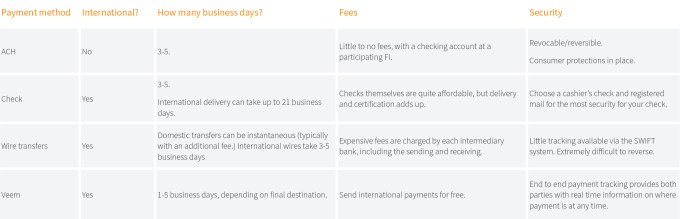

The majority of today’s international payments utilize processes and technology from the 1970s. The SWIFT system uses intermediary banks to send funds from institution to institution to its final destination. Each stop along the journey incurs another fee, making international payments especially pricey.

This system is expensive and opaque. Once funds leave a bank account, neither the sender nor the receiver can track their location. This lack of transparency erodes trust and damages relationships.

In our modern age, it’s easier to track your dinner, your ride, or your online shopping than your business payments. Clearly, the legacy financial system is ripe for a change.

A new way to do business

Enter the next generation of transfers: relationship-based business payments.

At the heart of every payment, there is a relationship. A relationship between supplier and manufacturer, a relationship between a freelancer and their client, a relationship between a business and the customers they rely upon.

At the heart of all relationships is trust, and business relationships are no exception. When both parties are connected by a single network, transparency and trust are introduced and the relationship between them is strengthened.

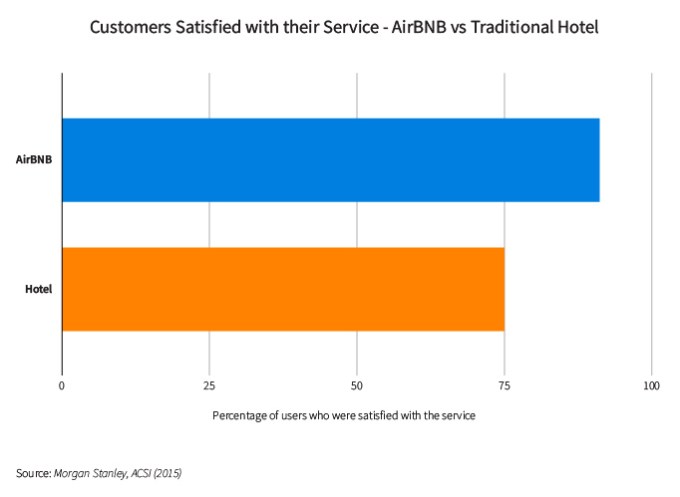

For example, Airbnb connects both the host and the guest on a centralized network. Both parties can see each other’s history, transaction record, user rating, and more. As a host, knowing that your guest has a five star rating significantly enhances the level of trust.

Conversely, a guest with many negative reviews isn’t likely to be approved, as the host has no reason to trust them. Because both the guest and the host are connected via the Airbnb platform, they share a relationship and are consequently more likely to trust each other. Both parties are incentivized to fulfill their obligations, lest they be slapped with a one star review. The shared network creates trust and facilitates stronger relationships between two formerly disparate individuals.

When it comes to international business payments, both parties must trust that the other will uphold their end of the bargain, whether that means paying an invoice, fulfilling an order, or honoring a contract. When a common network that connects businesses is introduced, it builds trust and strengthens the relationships between all parties on the platform.

Peer to peer networks are already being used to bring security, convenience, and trust to personal finance. Venmo, Zelle, Square Case, and Wechat Pay are all examples of fintech that use social networks to simplify daily finances. Yet business payments are stuck using outdated, opaque, and expensive systems.

Small and medium sized businesses (SMB) are at a particular disadvantage, as they lack the negotiating power and favorable rates offered to multinational corporations by large financial institutions.

Enter Veem, a global business payments network that is democratizing legacy financial systems. Designed with the needs of small businesses in mind, Veem’s relationship-based payment model enhances transparency, security, and efficiency in international business relationships.

The benefits of relationship-based payments

Payment Tracking and Transparency

If you’ve ever had to chase down a missing payment or overdue invoice, you know how awkward a “where’s my money” conversation can be. Missing, lost, or delayed payments can severely damage the trust that forms the basis of profitable business relationships.

Relationship-based payments provide both parties with visibility into the other side of the transaction, eliminating the need for back-and-forth notifications about the payment’s status. At any time, either party can track the location of the funds via the centralized network. Because both parties are connected via the shared platform, payments can be tracked by anyone, at any time. Knowing precisely where your funds are (and when they will arrive) creates certainty and reduces anxiety, especially when dealing with large or time-sensitive payments.

Security

Another benefit of relationship-based payments is the added security created by the network. With traditional bank wires, the sender must provide sensitive information about the receiver, including name, address, bank account number, business license, SWIFT codes and more. Worse, the sender must provide this information every time they want to send a payment.

The constant sharing and resharing of sensitive banking information invites errors, which can cause lost or missed payments. As well, both parties are at an increased exposure to potential fraud.

When all parties store their information on a secure central network, both the sender and the receiver reduce their risk of fraud or identity theft. The potential for errors decreases significantly, as each party only has to enter their own information once (as opposed to re-entering your receiver’s information each time you send a wire transfer).

Efficiency

Relationship-based payment models meet the needs of both the sender and the receiver. Whereas traditional wires and remittance payments are accounts-payable centric, relationship-based payment networks are built upon two-way connections.

Relationship-based payments allow both accounts payable (sending funds) and accounts receivable (accepting funds) to be executed on the same platform. For smaller businesses with a single financial department, this function is invaluable. A single platform to send and receive saves businesses valuable time.

Fees and Foreign Exchange

Another way that traditional wire transfers penalize the receiver is currency exchange. When wiring or sending money internationally, it’s common for the recipient to pay hefty foreign exchange fees to convert their payment to their local currency.

Relationship-based payment systems allow the currency exchange to be paid by either the sender or the receiver, at lower rates than the bank. This provides flexibility for both parties and ensures there is a fair price when payments are converted to different currencies.

When you send a traditional wire transfer or remittance payment, each intermediary bank charges an additional fee. As there can be many intermediaries before the payment reaches its final destination, this often adds up to a hefty sum.

Under a relationship-based payment model, the network replaces the intermediaries. Users are connected directly, while the platform acts as the medium for their connection, offering features and support where and when they’re needed. No money is lost to excessive fees, and both parties enjoy favorable exchange rates.

Integration of Data and Payments

In the world of global business, the flow of data is almost as important as the flow of money. Under the traditional bank wire system, the invoice, the payment, and the accounting systems are separate rails that require manual integration. This is time consuming and invites accounting errors.

In a relationship-based payments model, the central network integrates the data with the payment as a complete package. Both sides have all of the necessary information required to reconcile transactions at their fingertips. Not only are the users connected, but the platform integrates with other platforms that fill user needs.

Make your payments simple

Veem is the only relationship-based payment model built for SMBs, trusted by over 150 000 businesses worldwide.

Robust encryption keeps your payments safe, while Veem’s transparent payment tracker allows all parties to see where funds are in real-time. Integrations with popular accounting software makes reconciling payments simple and automatic.

Veem’s relationship-based payment network connects both the sender and receiver together on a central system. This connection harnesses network effects to build trust and strengthen connections. Veem allows businesses around the world to pay and get paid saving SMB’s valuable time. Best of all, there are no fees to set up or maintain your account. Veem it, and it’s paid.