Are you gearing up to secure funding for your startup or maybe you’ve raised a little bit already? If so, ensuring your cap table and data room are pristine could be the difference between a smooth, swift raise and a drawn-out, costly process. At TechCrunch Early Stage 2024, join Fidelity Private Shares’ session, “Preparing to Raise: Cap Table Best Practices to Help You Close Fast” to gain invaluable insights from industry experts. This session promises to equip founders with the essential knowledge needed to navigate the fundraising landscape efficiently.

Attendees of this session will walk away with actionable guidance from three experts representing the legal, investor, and founder perspectives. Whether you’re a first-time founder or a seasoned entrepreneur, mastering cap table management is essential for a successful fundraising journey. Don’t miss this opportunity to learn from the best and streamline your path to funding success at TechCrunch Early Stage 2024.

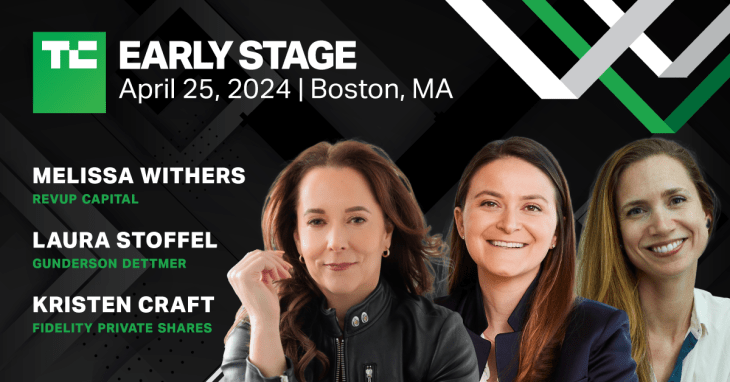

Meet the speakers

Kristen Craft, vice president and business partner manager at Fidelity Private Shares, brings a wealth of experience from both sides of the startup equation. With her background as a founder and startup operator, Kristen understands the challenges firsthand. At Fidelity, she spearheads initiatives to support founders and investors with equity management tools, fundraising strategy, and go-to-market best practices.

Laura Stoffel, partner at Gunderson Dettmer, adds legal expertise to the discussion. As a seasoned attorney specializing in the innovation economy, Laura guides entrepreneurs through the complexities of forming and structuring businesses, securing financing, and executing M&A transactions. Her deep understanding of governance and venture financing matters makes her an invaluable resource for startups at every stage of growth.

Melissa Withers, founder and managing partner of RevUp Capital, rounds out the panel with her unique perspective on early-stage investing. A trailblazer in the field, Melissa pioneered revenue-based funding with RevUp, offering startups an alternative to traditional equity models. With a commitment to supporting diverse founders and fostering innovation, Melissa’s approach to investing is reshaping the landscape of startup finance.

What are you waiting for? Book your passes now before prices go up at the door.