Pitching investors is a big part of running your startup, but no matter the outcome of the meeting, the opportunity does not end there. You should not only be logging your hard-earned contacts into a CRM, but also keeping these relationships warm through investor updates.

But what exactly is an investor update?

It’s a regular email a startup sends to its investors to inform them about the company’s recent progress, key metrics, challenges and future plans.

These updates demonstrate to investors your commitment to progress and learning through trial and error. Over time, this builds trust while allowing you to leverage investor expertise and their networks. With enough trust, these investors may participate in your next round and refer you to new potential investors too.

Although it may sound like a simple email, there really is an art to writing an effective investor update. The following is everything you need to know about how to craft and send an update that keeps investors engaged, communicates momentum, and garners support on your journey.

Your update should feel like an insider report that’s almost impartial, letting the facts and figures speak for themselves.

The role of tone and transparency

Investor updates make a critical tool for nurturing relationships, so you’ll want it to come across as genuine and relatable. Strive for transparency rather than salesy or unrealistically optimistic. Your update should feel like an insider report that’s almost impartial, letting the facts and figures speak for themselves.

It’s also perfectly okay to acknowledge areas where you didn’t quite meet your goals. I’ve seen founders turn these types of situations into pure gold by simply spinning them into lessons learned.

Format considerations

For startups at the seed or Series A stage, updates should be about 250 to 750 words, while quarterly and annual updates should be up to 1,500 words to account for more areas of the business. Your investor update should be concise and straight to the point, because investors are often bombarded with emails. Plus, information overload can cloud your main takeaways.

Aside from charts and graphs, your updates should be primarily text. Use bullets and subheadings to break up the text for ease of readability.

Tools for writing, sending and tracking

You can use a number of tools to draft and send along your updates, but don’t let the setup process hold you up if you need to get it out the door. A lot of founders start by just drafting their update with a simple email and BCC-ing everyone.

When you’re ready to explore more advanced options, tools like Paperstreet, Cabal and HubSpot simplify the process of sending the updates. Personally, I like Loops — it’s like Notion but for building emails, so I find the interface intuitive and easy to use.

The two main advantages of using a dedicated sending tool over standard email are better deliverability and the ability to review post-sending analytics. Tracking open and click rates is especially valuable for understanding which prospective investors are most engaged with your content.

Timing and consistency

It’s a good idea to start getting content ready about one to two weeks ahead of time. If you have a team, work with them early to gather the latest information. For seed or Series A startups, monthly and annual updates are the way to go. As your business grows and matures, however, the norm shifts toward quarterly and annual updates.

One thing is true across the board when it comes to frequency: Stay consistent. Sticking to your update schedule builds trust with investors, which is key to getting them involved in your startup.

Components of the investor update

- Introduction: The CEO should open with a brief, personal note. No more than three to four sentences.

- TL;DR: Summarize key points in order of importance, including major news and top-line review numbers.

- Asks: Clearly state what you need support with, be it intros, advice or resources. Include a quick reminder of what your company does and its current focus so they can forward that information easily to their network.

- Performance review: Share recent achievements, growth metrics, and lessons learned. Use real numbers and compare them to your goals and industry standards.

- Future outlook: Outline your goals for the coming period and any strategic shifts.

- Good things: Highlight positive news and key hires and show appreciation for investor support.

- Closing: End with a call to action, such as scheduling a catch-up call.

Example investor update

Subject Line: FakeCo Update | July ’24

Hi all — I’m pleased to report on a pretty monumental last month here at FakeCo. Team morale feels high, and our customers can’t seem to get enough. Let’s dig in!

TL;DR:

- Achieved 15% month-over-month revenue growth, reaching ARR of $217K.

- Successfully launched our new product feature, enhancing user experience.

- Secured a strategic partnership with TechLeaders Inc., expanding our market reach.

Asks

- [Intro Request] Bob Jones, VP of Product at GlobalFirm re: product partnership.

- [Advice] Looking to talk to folks who specialize in B2B marketing with experience in healthcare.

- [Boost] We’re hiring two full-stack engineers to optimize our platform. Please share this job post: <link>

FakeCo specializes in AI-driven analytics for healthcare providers, focusing on improving patient outcomes through data insights. For more information, please visit <link>.

July Performance Review

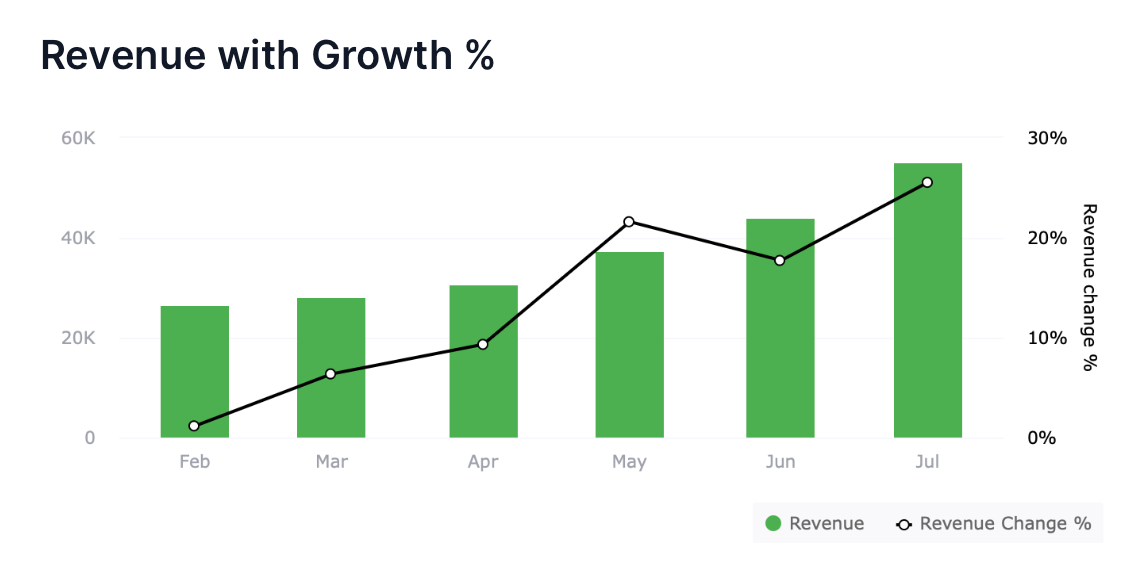

Image Credits: Loops

- Revenue grew by 15% month-over-month, resulting in $217K ARR.

- We experienced a 20% increase in MAUs, mainly due to our activation partnership.

- Despite our growth, we fell short of our customer acquisition target by 10%. However, we’ve identified key areas for improvement in our marketing strategy and are implementing changes to enhance outreach efforts.

- Our NDR stood at an impressive 120%, showcasing strong customer satisfaction and upsell rates.

- Lessons learned: Focusing on targeted marketing campaigns has yielded better conversion rates compared to some of the broader strategies we tried.

Future Outlook: August

- Aiming to launch our new AI feature, which predicts patient health trends.

- Targeting a 10% increase in revenue and a 25% increase in new leads.

- Planning to expand our sales team to begin tapping into new regions and medical practices.

Good Things

- Excited to announce the launch of our latest HealthBotAI feature, which has already received positive feedback from many of our early adopters.

- We welcomed Sally Rhodes, our new VP of Sales. She brings extensive experience and fresh perspectives mainly from medical device sales.

- Shoutout to Sheldon Field from Healthy Capital for the intro to the Head of BD at HealthyCo back in April — this led to a $1 million contract!!

It’s been another great month here at FakeCo. Thank you for all of your ongoing support as we continue this wild ride! Looking forward to discussing these updates and our future plans in more detail.

Please feel free to schedule a catch-up call with me here: <link>

Until next time!

Tim Johnson

Founder & CEO, FakeCo

When sharing this update or any information from this email, I ask that you please do so with careful consideration.

Think of your investor update as a chance to show investors what you’re made of. It’s not just about the numbers and milestones — it’s about giving them a peek into how you think, how carefully you’re paying attention to the details, and just how far you can take your startup. Embrace this tool, and I guarantee that you’ll quickly see its impact.