The iPhone 15 and its many iterations comprised more than half of Apple’s Q4 smartphone shipments of nearly 2.8 million units in India, Canalys said in its quarterly report. The handset has seen remarkable success in India as Apple pushed the latest models during the festive sales, which occur across online and offline channels in the country while its large population celebrates Diwali in the last quarter of the year and bring discounts and offers to attract customers.

While Diwali — the festival of light — usually comes in October, it occurred in November last year, per the Hindu calendar, which gave Apple room to push the iPhone 15 during festival sales, Sanyam Chaurasia, senior analyst at Canalys, told TechCrunch.

Apple introduced the iPhone 15 series with a few noticeable changes over its previous generations, including USB-C, the capsule-shaped Dynamic Island and matte back finish across all models. These changes have attracted new and existing iPhone buyers in India, where Android dominates with over 95% market share.

In addition to the design-level changes, easy financing, better consumer environment and increasing retail presence helped Apple to make the iPhone 15 series more appealing to Indian customers than any of its previous generations, Chaurasia said.

Apple started selling the iPhone 15 series in India in the first batch of its availability in September. For the first time, the initial iPhone lot that went on sale was locally assembled in the country, as the Cupertino company, similar to other smartphone makers, considers the South Asian nation its global manufacturing hub and expanded its local production footprint.

Apple is still not a top smartphone vendor in the world’s second-biggest smartphone market and captured a negligible share — 7% in particular — in the fourth quarter, according to Canalys.

Chaurasia told TechCrunch Apple’s shipments grew close to 32% quarter-on-quarter in the fourth quarter.

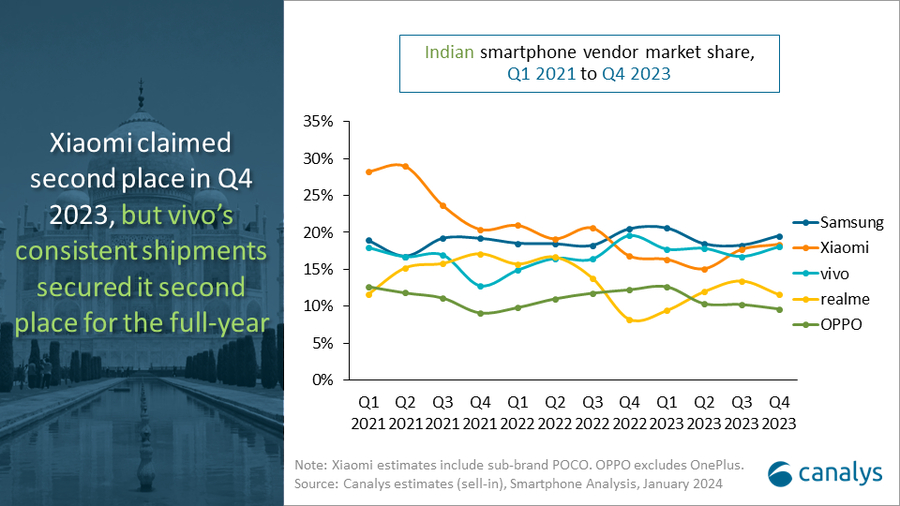

Samsung and Xiaomi emerged as the two leading smartphone vendors in the Indian market in the fourth quarter, with 21% and 17% share, respectively. Notwithstanding, Vivo secured its second position after Samsung in full-year shipments, with a 3% annual growth by shipping 26.1 million smartphone units in 2023, helping to capture a share of 18% — just 1% less than the South Korean company, which saw 1% drop in its annual growth by shipping 28.4 million units.

Image Credits: Canalys

The key reason Apple has not yet been a leading smartphone maker in India from a shipments perspective is the high pricing of the iPhone models in the country, which is home to a large number of price-sensitive buyers. Despite local assembling, the retail iPhone price in India is still significantly higher than in the U.S. For instance, the iPhone 15, which starts at $799 in the U.S., retails at 79,900 Indian rupees ($961). However, the average smartphone selling price in the Indian market is around $250 — unlike $790 in the U.S.

Nonetheless, Apple is becoming a familiar brand in the Indian smartphone market and is rapidly growing its local presence. The company saw the highest-ever quarterly iPhone shipments in the country in the third quarter, with over 2.5 million iPhone units shipped between July and September, per Counterpoint. The iPhone maker also opened two of its physical stores in India last year to expand its marketing efforts and appeal to more Indian consumers.

Overall, Indian smartphone shipments went back on track after seeing a decline for five quarters, with a 20% year-on-year growth in the fourth quarter, with nearly 39 million units shipped, Canalys noted. However, the country saw a minimal 2% yearly drop, with 148.6 million smartphone units shipped in 2023.

“In 2023, growing investment in mainline retail space proved beneficial not only for vendors but also allowed the overall market to stabilize,” Chaurasia said in the report. “Canalys expects the Indian smartphone market to grow by mid-single digits in 2024, driven by affordable 5G and the pandemic period replacement cycle. But the biggest challenge for vendors this year will be to manage the rising bill of materials costs.”