A slew of consumer tech and companies focused on consumer packaged goods (CPG) have gobbled up venture capital in the past year. Keychain, Harmonya, Highlight, Ramani, SupplyPike, Vividly and Turing Labs, just to name a few, captured investor attention for their technologies.

Companies weren’t the only ones getting funding. Investor firms focused on consumer and CPG were, too. That includes VMG Catalyst, Alethia and Humble Growth.

Traditional CPG products have had their moments. However, these companies in and of themselves aren’t necessarily VC worthy. That’s because consumers’ tastes constantly change, grocery shelf space is finite and e-commerce takes finesse to cut through the noise. Many of the capital-worthy companies mentioned above fall more into the category of enablement: helping CPGs be better businesses.

But why are investors so interested in consumer tech and CPG as an opportunity now?

Some of that is most likely excitement around artificial intelligence, which Dana Kim, co-founder and CEO of Highlight, noticed while going after Series A funding for her product testing startup.

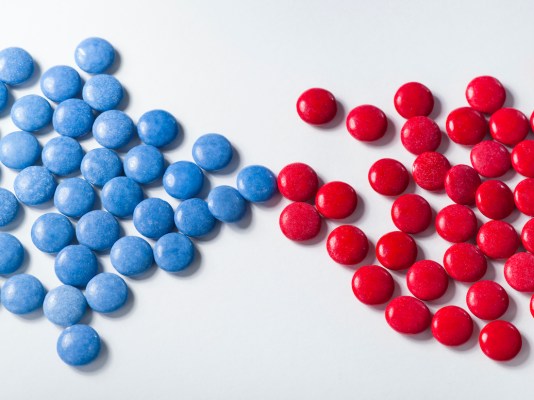

“A surprising question that we got throughout the fundraising process was, ‘What role does AI play in your organization?’” Kim told TechCrunch+. “What gave folks a lot of comfort was that Highlight was not being disrupted overnight by some sort of generative AI application at the end of the day. Oreo is going to need to know whether Oreo A or Oreo B tastes better, and that’s not something that generative AI can spit out. In the face of disruptive technology, having really solid data was key.”

Kim said that while speaking with a bunch of traditional CPG investors — those who typically invest strictly in consumer products — were now looking to diversify their portfolio and move into adjacent spaces. Think enablement, e-commerce software, data and analytics. The latter being what Highlight does.

Some investors even revealed to Kim that many of their portfolio companies were struggling with consumer testing and collecting real consumer feedback.

She attributed much of that to a difficult commerce environment, exacerbated by the pandemic, that brought to light supply chain scalability issues. With lower gross margin profiles and interest in higher and more attractive unit economics, some investors with portfolios composed entirely of CPG companies began looking for other places to deploy capital, Kim said.

“The best way to create value is going to be to invest directly in a brand or invest in tools and technology that makes existing brands more effective,” said Jason Stoffer, general partner at consumer VC firm Maveron. “That’s what’s driving that shift. Investing in a direct-to-consumer brand, you can make a lot of money doing it, but it’s a much more difficult proposition than it was when venture capital was abundant, multiples were really high and ads were cheap.”

Stoffer also noted that the customer playbook doesn’t really work anymore because “acquiring customers is too expensive and standing out from the noise is really hard.” That’s why we see more retail businesses fueled by social media fame. That playbook of launching, creating an Instagram-friendly position and an influencer network continues to work, he said.

He also points to some 2023 exits, like sandal-maker Birkenstock and beauty and wellness company Oddity, which both went public — and not necessarily with VC dollars.

“In a world where VCs are kind of running from consumer, I’d argue that on the CPG side, it does feel like private equity is driving a lot of the returns,” Stoffer said. “There’s a real question around are CPG businesses right for venture capital? There’s an element of playing roulette when you’re betting on these types of brands because how do you know that this particular Gen Z-focused cosmetics business is going to take off compared to the 10 others that look kind of similar?”