About 2% of the world’s CO₂ emissions come from pressurized, jet-powered sausages careening through the air. Earlier this week, I covered one startup, Metafuels, that thinks it has a solution for reducing aircraft emissions.

I was able to talk the company’s founders into giving me the pitch deck for their $8 million seed round so we could do a deep dive into the materials it used to raise the funding.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Metafuels was kind enough to share its full deck with TechCrunch+ for this teardown. There are some minor redactions, but the bulk of this slide deck is intact.

- Cover slide

- Market size slide

- Product/technology slide

- Product manufacturing slide

- Unit economics (production at scale numbers)

- Unique selling points

- Technology roadmap

- Business model slide (production)

- Business model slide (licensing)

- Commercialization slide

- Market traction slide

- Team slide

- Closing slide

Three things to love

If you’ve been reading my Pitch Deck Teardowns, even skimming the list of slides above will make you go, “Uh-oh, Haje’s not gonna be happy with this — there’s a ton of information missing!” And yes, you would absolutely be right. This is an interesting challenge with deep tech startups, however: If it’s going to take a hot minute to get your product to market, there will, by definition, be a lot of things missing.

Is it a bird? Is it a plane? No, it’s a high-soaring market size

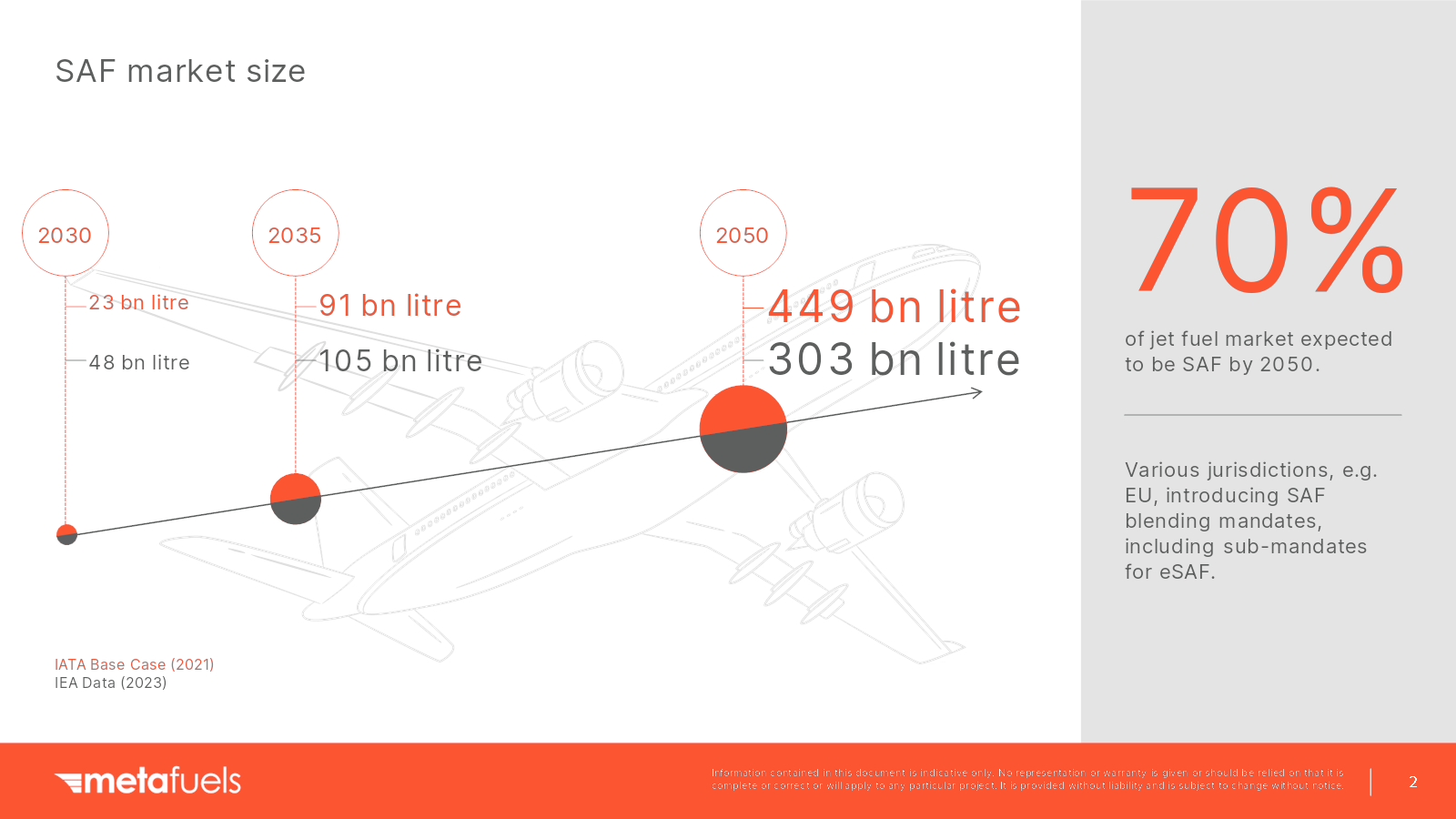

It takes a special kind of chutzpah to say “all aircraft fuel” is your market, but that’s what Metafuels is doing here.

[Slide 2] Gunning for 70% of the plane fuel market is hella bold. I like it. Image Credits: Metafuels

In other words, SAF represents around 0.17% of all aviation fuel consumed.

It’s no surprise, then, that Metafuels decided to start its projections from 2030. That’s when the company will hit its stride going into full production, and when the market is likely to take off. The big forcing function is the RefuelEU Aviation regulation, which sets targets for blending sustainable fuel in with its petroleum counterparts.

Metafuels tells the story well: You get a picture of a rapidly growing market, and the company positions itself as a crucial player in it.

You can learn from this slide how to tie the “why now?” part of your story to wider macro changes. If you know which way the wind is blowing, you can set your company up to make the most of it.

Let yourself nerd out about the tech

When you’re building a deep tech company, the tallest pole in the tent is always going to be the tech itself. What have you figured out that nobody else has been able to nail down?

[Slide 4] Ugh, yes, talk nerdy to me, baby. Image Credits: Metafuels

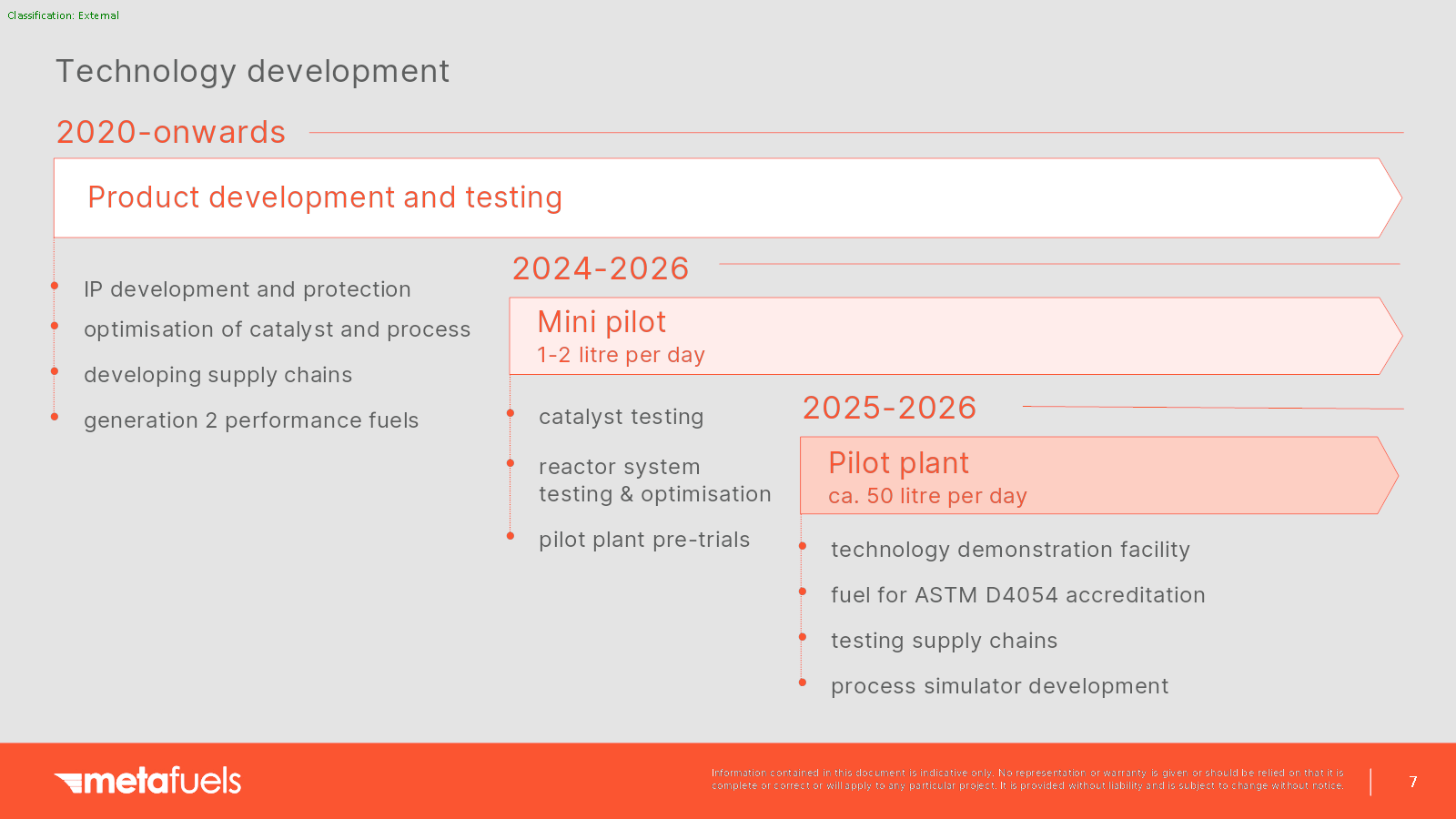

A clear roadmap

[Slide 7] I love the clarity of Metafuels’ plan. Image Credits: Metafuels

The main takeaway from this part of the deck is to keep an eye on the future and how you can scale later. Having a clear view of the unit economics in particular (i.e., how the financials of your products change as you start increasing volume) is often a crucial part of the story.

Here, Metafuels is talking about producing 1 to 2 liters per day, then scaling that by 700 million. That’s . . . a hell of an undertaking. And while the manufacturing processes and factories for producing that much fuel will be expensive, the cost per liter will come down dramatically. Metafuels is tackling that beautifully in this deck.

In the rest of this teardown, we’ll look at three things Metafuels could have improved or done differently, along with its full pitch deck!

Three things that could be improved

There are some absolute doozies in this deck.

So about that team slide . . .

[Slide 12] You’re going to change the world, and this is the best team slide you can come up with? Image Credits: Metafuels

Sure, we have a mechanical engineer, a chemical engineer and whatever a “Dipl. Ing. (Industrial)” is, but it’s almost painfully devoid of any reasons to invest. Who are these people? What have they done in the past? What do they have that, say, LanzaJet’s founders don’t?

Hell, even just letting ChatGPT loose on the founder’s LinkedIn page produces something far better than this slide:

Saurabh Kapoor, with his background in mechanical engineering and roles in clean energy, is perfectly suited to lead a sustainable aviation fuel company. His experience includes co-founding Metafuels, focusing on carbon-neutral air travel, and Industria Mundum, a consultancy in decarbonization. His work in project development and risk management at notable firms like Capture Power Limited and GE Power further underscores his expertise in the field of sustainable energy solutions.

This is a good example of what not to do with a team slide. Startups should do their best to ensure that your investors have a fighting chance of understanding your startup and founding team well and thoroughly.

Where the hell is the competition slide?

Look, pretending you don’t have competitors is not a great look, especially when you’re kind of a latecomer to the game. It’s crucial to explain what is happening in the market and how your tech or approach differs from what’s out there. A couple of quick Google searches tells me that the competition in this space is fierce:

- Neste: Neste is one of the world’s leading companies in SAF and is on track to become the largest provider of renewable fuels globally. This is a publicly listed company with a $26.77 billion market cap. That looks to me like a pretty serious competitor.

- Alder Renewables: A newer player in the market, Alder Renewables is developing low-carbon jet fuel. The company has secured a multi-million-dollar investment from United and Honeywell, along with a record-breaking purchase agreement from United for 1.5 billion gallons of sustainable aviation fuel.

- SkyNRG: SkyNRG supplies over 30 airlines across all continents. According to data from PitchBook, the company has raised almost $190 million.

There’s a whole bunch of players in this space, and not addressing any of them in the deck is a rookie mistake.

Startups should lean into their competitive landscape. If you can’t explain how you are different or better, or somehow have an edge over your competitors, you’re going to have a rough time.

No clear ask and use of funds

The company doesn’t specifically say how much it is raising, nor does it go into detail about how it is going to deploy the funds. Those details could be inferred from the deck, of course, but from a storytelling point of view, it’s absolutely crucial to be far more explicit about the fundraise and what the deliverables are for this round.

As a startup founder, your fundraising goal should be specifically tailored to reaching the milestones necessary for your next funding round. This means focusing on reducing risks related to product development, technical challenges, regulatory approvals, and financial metrics. You must select key metrics and set specific, achievable and measurable goals. Additionally, you should involve your team in a detailed discussion about the resources needed to hit these milestones. This includes budgeting for development, operations and marketing, and adding a contingency buffer for unforeseen expenses. Achieving these milestones is vital for securing future funding and ensuring the growth and success of your startup.

I was surprised to see so little of this in Metafuels’ deck. It’s clear that the company has done some great medium- and long-term planning, so tying its current fundraising round to specific milestones would have been pretty easy and would have made conversations with the investors so much easier along the way.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!