Not a day goes by without some drama involving Twitter X.

According to a recent report by Bloomberg, X’s ad revenue is expected to fall to $2.5 billion in 2023, and X is disputing the news, calling it incomplete. Still, the report’s numbers line up neatly with what X’s owner said earlier this summer.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

So, to form our own opinions about this matter, let’s take the new information, bundle it with what we already know and stack all that against the company’s most recent internal valuation. We’ll also revisit our previous look at Snap, another social network that is close-ish to X in scale and worth, to compare the two companies.

The question today is whether X’s revenues and valuation square up, so let’s dive in!

What’s new?

The Bloomberg report pegs X’s advertising revenue at “a little more than $600 million” in each of the first three quarters of the year, and cited sources as saying that a similar result is expected in the fourth quarter. Those figures “make up between 70% and 75%” of the company’s total revenue, which would mean total revenue for the year is likely to land between $3.2 billion and $3.4 billion approximately.

Those numbers are $200 million to $400 million better than what we estimated X would generate. Still, given that the company’s value has not changed since we last dug into its worth in October, our revenue metrics for the company have not improved very much.

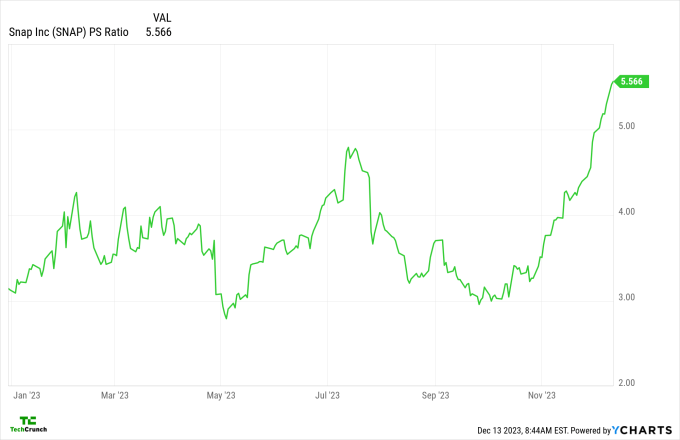

However, a key public-market comparable, Snap, is now worth much more than the last time we last checked in on the company, which means that social media network valuation multiples have changed in recent weeks. That could potentially help X’s own valuation.

When we last looked at Snap, it was worth about $16 billion. Today, its market cap is at $26 billion. What changed? The company’s price/sales ratio:

Image Credits: YCharts

So if we use that 5.6x price/sales multiple for X, full-year revenue of $3.2 billion to $3.4 billion would result in a valuation of around $18 billion to $19 billion. That’s right in line with its internal pricing.

Case closed, X is valued correctly and we can dust our hands of the matter, right? Actually, no. In fact, that may be too expensive a price tag for X despite its comparables faring better.

There are three main reasons we feel this way:

- Snap has far less debt than X: Yes, Snap is rather indebted for its size, with $3.75 billion in convertible notes on its balance sheet. But X borrowed around $13 billion to fund its own takeover, so it is in even deeper hock. That makes it harder to apply Snap’s price/sales multiple to the microblogging platform without adjusting for the debt.

- Snap is expecting revenue to rise in Q4, while X is seemingly not: In its Q3 2023 report, Snap said it expects Q4 revenue to land between $1.32 billion and $1.375 billion. That’s a nice bump from its Q3 revenue of $1.19 billion. In contrast, the Bloomberg report cites sources as saying that X will report a “similar performance” to its other quarterly results this year. That implies X’s revenue may be increasing at a slower clip than Snap’s, which means the company is therefore not likely going to warrant a similar price/sales multiple.

- Snap is often cash-flow positive: Musk has mentioned several times this year that X is not cash-flow positive. In contrast, Snap was operating cash-flow positive through Q3 2023 (cumulative), albeit free cash-flow negative in the first three quarters of the year. Still, Snap did generate cash this year, especially in the first quarter. That again appears a bit stronger than what X can muster.

So what is X worth today now that it has more revenue than we expected and a key comp’s value has soared? That’s a judgment call. If you say that X’s different financial profile makes it worth 4x its trailing top line, that’s much better than what we expected in October. So, Snap’s rise has helped drag X’s valuation up, but only so far. I think that you would have a hard time selling X for $19 billion, given its finances and what we can see elsewhere in the market.

Today, X really needs to improve its financial performance and for Snap to report a strong fourth quarter. If both those things happen, X could seem reasonable with a $19 billion price tag. But that’s a lot of maybes for a single historical pricing estimate to make sense.