Clothing retailer Shein’s filing confidentially for a U.S. IPO has brought low-cost retailers from the People’s Republic of China to the forefront of both consumers’ and regulators’ minds. And Temu, another China-based discount retailer that’s often mentioned in the same breath as Shein, is looking particularly interesting today.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Why? The company is expected to report revenue of more than $16 billion this year, according to Reuters — a simply massive figure. What’s more, its parent company, Chinese e-commerce giant Pinduoduo (PDD), recently overtook Alibaba in market value, dethroning a company that has long been considered to be one of China’s leading business lights. Temu is growing quickly and is spurring a reshuffling of the pecking order in Chinese tech along the way.

For a bit of context: Both Shein and Temu are trying to look more like they’re international businesses than Chinese companies. Shein has moved its headquarters to Singapore, and Temu was actually founded in Boston, Massachusetts.

The Shein IPO is the obvious leading story, given its imminence, but Temu is worth a second look at the moment, so we’re going to do just that today. To work!

How did PDD grow to become worth more than Alibaba? It appears its investors liked the fact that it’s been generating more revenue at a rapid clip and increasing its profitability. Alibaba, meanwhile, recently called off the spin-out of its cloud division, which wasn’t good for its share price at all.

The two company’s results are starkly different. In Q3 2023, PDD’s revenue rose 94% to $9.44 billion from a year earlier, and its net income increased 47% to $2.13 billion in the same period. In contrast, Alibaba’s revenue rose 9% to $30.81 billion in Q3 2023, and its non-GAAP net income came to $5.51 billion, up 19% year-over-year.

PDD generates revenues from two broad buckets: Online marketing services and transaction services, the latter of which is scaling far faster than the former. Transaction-related revenues rose 315% in Q3 2023 to $4 billion compared to a year earlier. It’s a little hard to parse just what fraction of PDD’s growth came from Temu, but according to Bloomberg, the subsidiary accounted for 13% of its parent company’s revenue in the third quarter.

All that’s very nice, but it’s not what we think is most interesting in the PDD-Alibaba battle. PDD is now worth more than Alibaba, but the latter is far larger. Does that mean that investors are awarding PDD a far stronger revenue multiple than they are Alibaba? Yep.

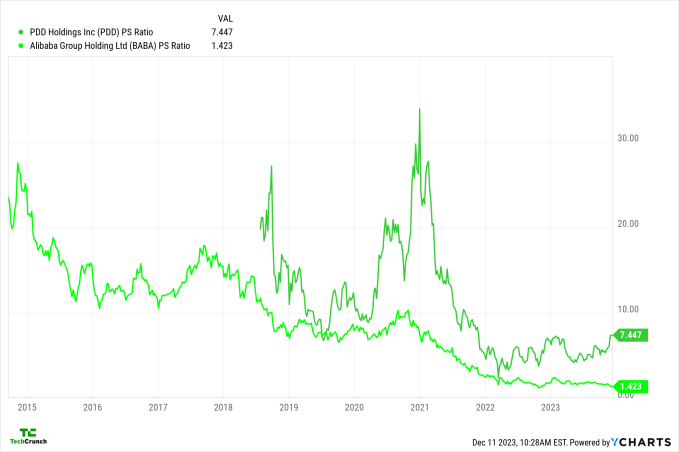

Alibaba is worth less than 2x its trailing revenues, but PDD is worth more than 7x. And the gap is widening:

Image Credits: YCharts

This chart is wild.

It’s pretty clear that PDD’s trailing growth rate is incredibly impressive considering its scale (and that it is very, very profitable), but it’s still hard to parse such a wide divergence in the value of revenue at each of these companies. After all, Alibaba has a cloud computing division and is involved in AI efforts to both support existing foundation models and build its own.

PDD, in contrast, is an e-commerce and payments company. Both of those sectors haven’t fared well in recent years, while AI has pretty much left the solar system.

On one hand, we have an e-commerce company, while on the other, we have a more diversified e-commerce player with a cloud computing division and AI chops. Which would you bet is worth more? Precisely.

Indeed, the market is ascribing such a premium to PDD that I am honestly unsure what I am missing. It must be something apart from just growth, right?

So why do we care?

Well, for several reasons. For one, major tech companies in China have long been critical startup investors, and that role could become even more important in the Chinese tech ecosystem as venture capital investment in the country declines. So, if Alibaba and PDD have lots of value and cash, they could help keep domestic startups afloat if they wanted to.

The other reason is the sheer oddity of the situation. Temu is taking market share from two so-called dollar stores in the U.S. These low-cost, brick-and-mortar businesses trade at around 0.7x to 2x their revenues. That’s more like Alibaba than PDD, ironically.

So, how is Temu’s parent company building a massive business in a market where some players are trading at low revenue multiples? And how is PDD doing it while enjoying a massive valuation premium? It could be that Temu is actually not super profitable and the rest of PDD is driving the profit that has its investors so excited, but I would hazard that Temu’s rise is part of the PDD valuation saga. Hence the odd comparables, and our curiosity.

The year has almost ended, but we have something to look forward to. In 2024, the valuation discrepancy between these two companies, the Shein IPO, and whatever Temu does next will help us better understand not only the future of cross-border discount retailing, but also how Chinese companies are valued moving forward.

Are we entering an era where Temu rules as the undisputed king of e-commerce?