Investment giant Prosus has written down the valuation of edtech giant Byju’s to below $3 billion, marking a steep drop from the $22 billion valuation the Indian startup hit early last year.

Byju’s is facing many “challenges” and Prosus and other backers are working alongside to aid the Bengaluru-headquartered startup’s recovery, Prosus interim chief executive Ervin Tu said on an earnings call Wednesday after the investment giant reported financial results for the six months to September.

The 86% write-down in Byju’s valuation comes as the Bengaluru-headquartered startup works to restructure operations and cut costs after huge pandemic-era growth left it with surging losses. The news is the latest remarkable turn of fortunes for Byju’s that has raised over $5 billion to date.

The startup — which also counts Peak XV, Lightspeed India Venture Partners, Sofina, BlackRock, UBS and Chan Zuckerberg Initiative among its backers — missed its revenue target for the financial year ending in March last year, the startup disclosed in a much-delayed account this month. It’s also scrambling to resolve a debt of $1.2 billion and is subject to an ongoing investigation by India’s money-laundering agency Enforcement Directorate, which has accused Byju’s of violating the country’s forex law to the tune of $1.12 billion.

Byju’s CFO Ajay Goel left the startup in less than seven months to return to Vedanta in late October, following high-profile and abrupt departures of auditor Deloitte and three of Byju’s key board members in June. Prosus publicly slammed the Bengaluru-headquartered startup in July for not evolving sufficiently and disregarding the investor’s advice and recommendations despite repeated attempts.

Prosus has been proactively adjusting the worth of its holding in Byju’s, in which it owns over 9% stake, for more than a year. Prosus valued Byju’s at $5.1 billion at the end of March.

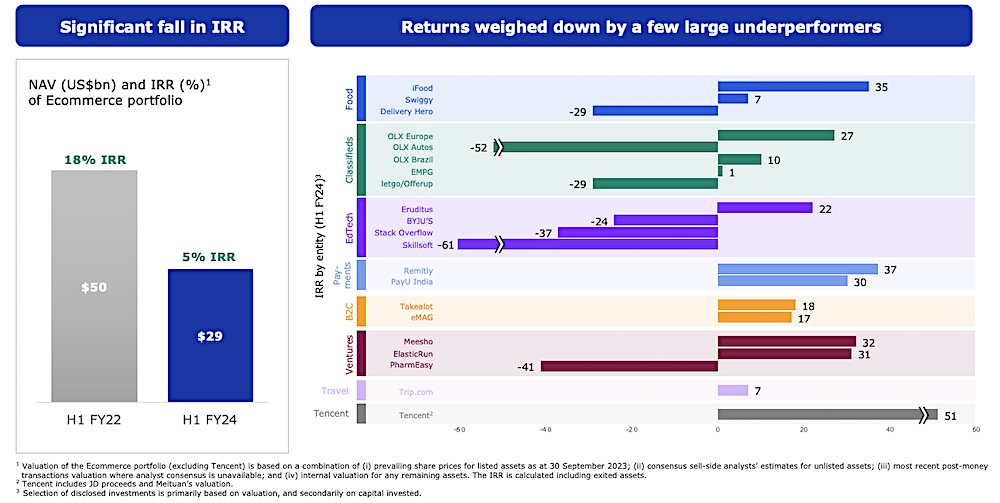

A slide from Prosus’ financial results Wednesday. Image Credits: Prosus

Prosus, one of Europe’s most valuable tech companies, identified Byju’s and Pharmeasy, an Indian online pharmacy startup that this year raised capital at a valuation about 90% below its 2021 highs, among the “large underperformers” for the Amsterdam-listed firm.

The net asset value of Prosus’ holding of its e-commerce portfolio, which features fintech, edtech, food delivery and venture deals, stood at $29 billion at the end of the first half of the financial year 2024, down from $50 billion during the same period two years ago. The IRR fell to 5% in H1 FY24, down from 18% during the same period two years ago, the investment giant said.

Not all is doom in India for Prosus and its vast investments in the country. The firm said Wednesday its payments company PayU is now hopeful for an initial public offering in the second half of 2024 as its operations expand efficiently. Prosus also touted strong growth for leading food delivery startup Swiggy.