Zeekr, the luxury electric vehicle brand under China’s Geely, is gearing up to list its shares publicly in the U.S., according to a regulatory filing submitted Thursday. The filing shows widening losses between the first halves of 2023 and 2022, and describes the risk of Beijing influencing Zeekr’s business decisions.

The move comes almost a year after Zeekr announced it had confidentially filed for a U.S. initial public offering. If Zeekr’s IPO goes through, it’ll be the first major Chinese listing in the country in nearly two years, following China’s effective ban of foreign IPOs. In August 2022, Washington and Beijing struck a deal that lowers the likelihood of delisting for more than 200 Chinese firms listed on New York exchanges by allowing U.S. officials to review audit documents of Chinese businesses that trade in the U.S.

Still, one of Zeekr’s main risk factors is China’s influence.

“The Chinese government exerts substantial influence over the conduct of our business and may intervene with or influence our operations as the government deems appropriate to further regulatory, political and societal goals,” Zeekr said in its prospectus.

Zeekr still hasn’t shared the total number of shares it will offer, nor the offering price per share or how much the company hopes to raise and at what valuation. Citing sources familiar with the matter, Reuters previously reported that Zeekr, which will be spun out from Geely, aims to raise more than $1 billion through its debut and is seeking a valuation of more than $10 billion.

Morgan Stanley, Goldman Sachs, BofA Securities, CICC and a number of other institutions are listed as underwriters on the filing.

Zeekr, Morgan Stanley and Goldman Sachs have not responded to TechCrunch+’s requests for more information.

The filing does state that although Zeekr will be spun out of Geely, the legacy automaker will remain a controlling shareholder and will hold more than 50% of the voting power for the election of directors, making Zeekr a so-called controlled company.

Image Credits: Zeekr

Zeekr’s products

Zeekr, established under Geely in 2021, makes three mass-produced battery electric vehicle models: the Zeekr 001, Zeekr 009 and Zeekr X.

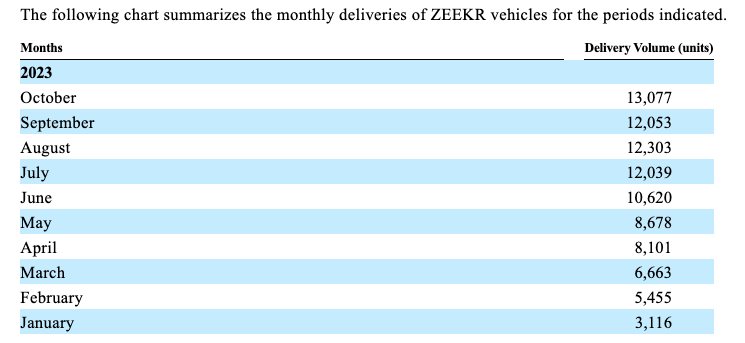

The EV maker said it has cumulatively delivered 170,053 units of Zeekr vehicles. Those deliveries will mainly be for the flagship Zeekr 001 crossover. That and the Zeekr X, the urban SUV that launched in China in April, compete directly with Tesla’s Model Y crossover in an increasingly cutthroat EV market in China. The 001 delivers a range of around 375 miles and costs around $37,000 (RMB 269,000). The X has a range of 348 miles and costs around $27,600 (RMB 190,000).

The Zeekr 009 large minivan debuted in November 2022. Its range starts at 436 miles and its price starts at RMB 499,000 (or around $73,700 at current exchange rates).

Zeekr’s growth in China can be attributed in large part to its direct-to-consumer business model, which the company aims to bring to new markets like Europe, as well. The company has also gained a reputation of producing smart, luxury vehicles at an affordable price range.

Zeekr promised earlier this year to enter the European market by the end of 2023. The company said it will begin selling the 001 and X in Sweden and the Netherlands beginning in the fourth quarter, with plans to expand quickly to other European cities after that.

Zeekr may run into some problems in Europe, where the European Commission is investigating whether to impose punitive tariffs on Chinese EV imports, which the agency says benefits from state subsidies, to protect European Union automakers.

Aside from Europe, Zeekr is also eyeing expansion into Israel and Kazakhstan, among other markets.

Zeekr hasn’t shared plans to sell its EVs in the U.S., which would be tough, considering it couldn’t access any of the incentives from the Biden administration’s Inflation Reduction Act. However, Zeekr has a deal with Waymo to supply the latter’s robotaxis, which are expected to start testing in the U.S. by the end of 2023.

The EV company has also worked with autonomous driving technology company Mobileye to launch the latter’s SuperVision advanced driver assistance system into 110,000 existing Zeekr 001’s via an over-the-air update. The two companies have previously shared plans to build an AV for Chinese consumers.

Zeekr X urban SUV. Image Credits: Zeekr

Breaking down Zeekr’s financials

Per the SEC filing, Zeekr said revenue from vehicle sales amounted to around $1.8 billion in the first half of 2023, compared to $727.3 million in the same period last year, with a gross profit margin of 12.3% and 4.7%, respectively. For comparison, Tesla brought in $41.2 billion in the first half of 2023, with a gross margin of about 18.75%.

Zeekr recorded a net loss of $533.8 million in the first half of this year, up from a net loss of $423.6 million during the same period in 2022. The EV maker closed out the first half of 2023 with $382 million in cash and cash equivalents.

Part of those widening losses could be attributable to a price war started by Tesla in China at the beginning of the year, which is affecting the profitability of EV makers. China has also been experiencing a softening of EV demand as consumers rein in spending.

However, Zeekr can rely on Geely’s manufacturing facilities and cost-saving capabilities, and for the moment is well-funded. In February the company closed a $750 million round at a $13 billion valuation. Investors in the round included Amnon Shashua, the CEO of Mobileye and Chinese battery giant CATL.