There’s a new unicorn in town, and its name is Enable.

A rebate management platform, Enable today announced that it raised $120 million in a Series D funding round that values the company at $1 billion pre-money. Lightspeed Venture Partners, Menlo Ventures, Norwest Venture Partners, Insight Partners and Sierra Ventures participated, bringing Enable’s total raised to $276 million.

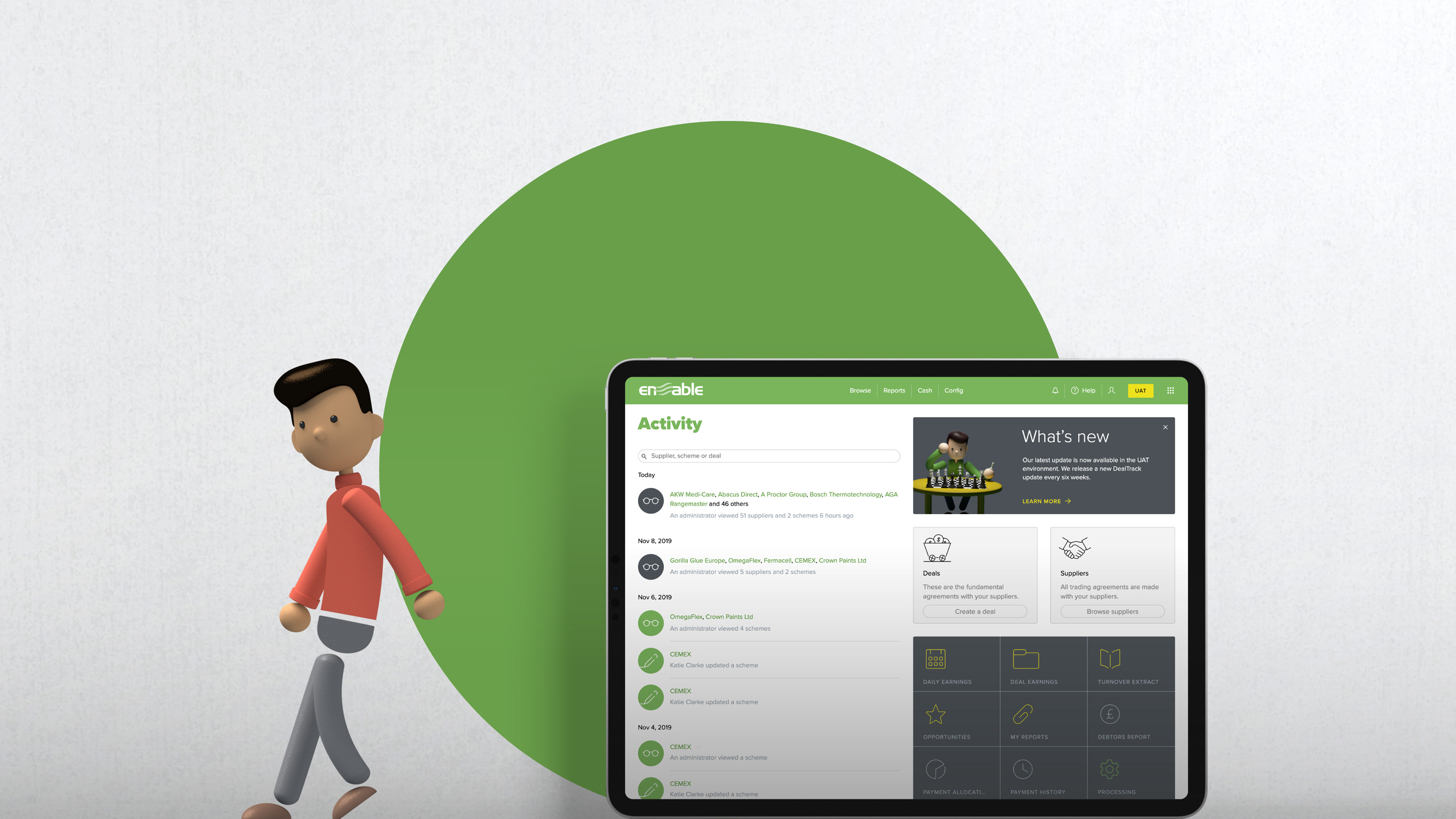

Enable provides a platform that businesses — specifically manufacturers, distributors and retailers — can use to keep track of their business-to-business (B2B) rebates.

Companies often extend B2B rebates to customers when those customers achieve some benchmark, such as reaching a certain total spend, purchasing a product collection or submitting a customer referral. The challenge becomes maintaining records on and designing these benchmarks, as well as a buyer’s progress toward them, ensuring that customers receive all the rebates to which they’re entitled.

Enable, which co-founder and CEO Andrew Butt co-founded in 2016 with Denys Shortt, surfaces B2B rebate deal and incentive data, delivering insights into what’s owed versus collected and the status of customer agreements.

Using Enable, businesses can co-author, propose and execute on rebate-related deals with customers. The platform also hosts automated workflows — including auditing tools — centered around creating and negotiating rebates with both partners and buyers.

“Enable allows trading partners to manage all of their B2B rebate agreements together in a single location,” Butt explained. “We become the system of record for both sides of the trading relationship.”

Butt says that he was inspired to launch Enable by his experiences in the B2B space, including at Enable Informatix, a property management software-as-a-service vendor he co-launched and sold to Sovereign Capital in 2010.

“Enable started in rebate management because of the importance rebates play in the financial outcomes of manufacturers, distributors and retailers; rebates have become the currency of the goods-for-resale supply chain,” Butt told TechCrunch in an email interview. “At the time, the most common way to track the status of rebate programs was in Excel — and that persists today. Typically starting with finance and commercial teams, Enable helps companies better manage rebate complexity with data and insights, forecasting and stronger cross-functional alignment.”

Image Credits: Enable

Butt attributes Enable’s success to date to its “focus on driving revenue and margin growth” for customers — a safe and fairly diplomatic answer to be sure. But judging by the startup’s expansion in recent years, there might be something to it; Butt claims that Enable’s top-line revenue has doubled each year over the past four years across a customer base that recently eclipsed 10,000 brands.

“Even as the supply chain has faced issues in the past few years, our customers continue to drive increased revenue and margin through transparent understanding of deal terms and the ability to collect on their incentives,” Butt said. “By using B2B rebates strategically, [our customers] protect margins, increase revenue, mitigate risk, lower costs and improve customer loyalty.”

So where will Enable look to grow next? Its recent moves offer clues.

Last December, Enable acquired Profectus Group’s rebate deals management platform and team, taking on servicing the group’s existing customers in Australia and extending Profectus’ auditing and compliance technologies to its own clients. (In exchange, Profectus obtained a small stake in Enable.) And in the months leading up to its latest funding tranche, Enable launched support for special pricing agreements (e.g. discounts on a single product from a company) and added inventory rebate accounting, which enables businesses to understand the value of rebates in their inventory of goods.

Arsham Memarzadeh, partner at Lightspeed Venture Partners, had this to say about Enable’s trajectory:

“We first invested in Enable in mid 2022, which was a rocky year for software,” Memarzadeh wrote in an email. “Yet, while everyone else in the market was lowering forecasts, they were upping theirs. Their performance is a result of day one return on investment their product delivers and the immense, unmet need in the market. What impressed us beyond the results was the power of their network. Each new Enable customer enhances the ability for all customers to collaborate on trade agreements across the supply chain. As the network has taken shape over the past year, we were excited to double down and deepen our partnership.”

Butt says that the proceeds from the Series D will enable Enable (heh) to “invest in building collaborative products more quickly” and “scale its team to meet the needs of the market.” A tad more concretely, Enable, which is based in San Francisco, plans to grow its headcount from 550 employees to 600 by the end of the year.