We’ve talked about the first to market advantage before, and it certainly applies when it comes to the cloud infrastructure market. While Microsoft made headlines this week for its AI implementation, and Alphabet took a big stock hit for its slight cloud miss, Amazon growth has quietly settled into low double-digits growth.

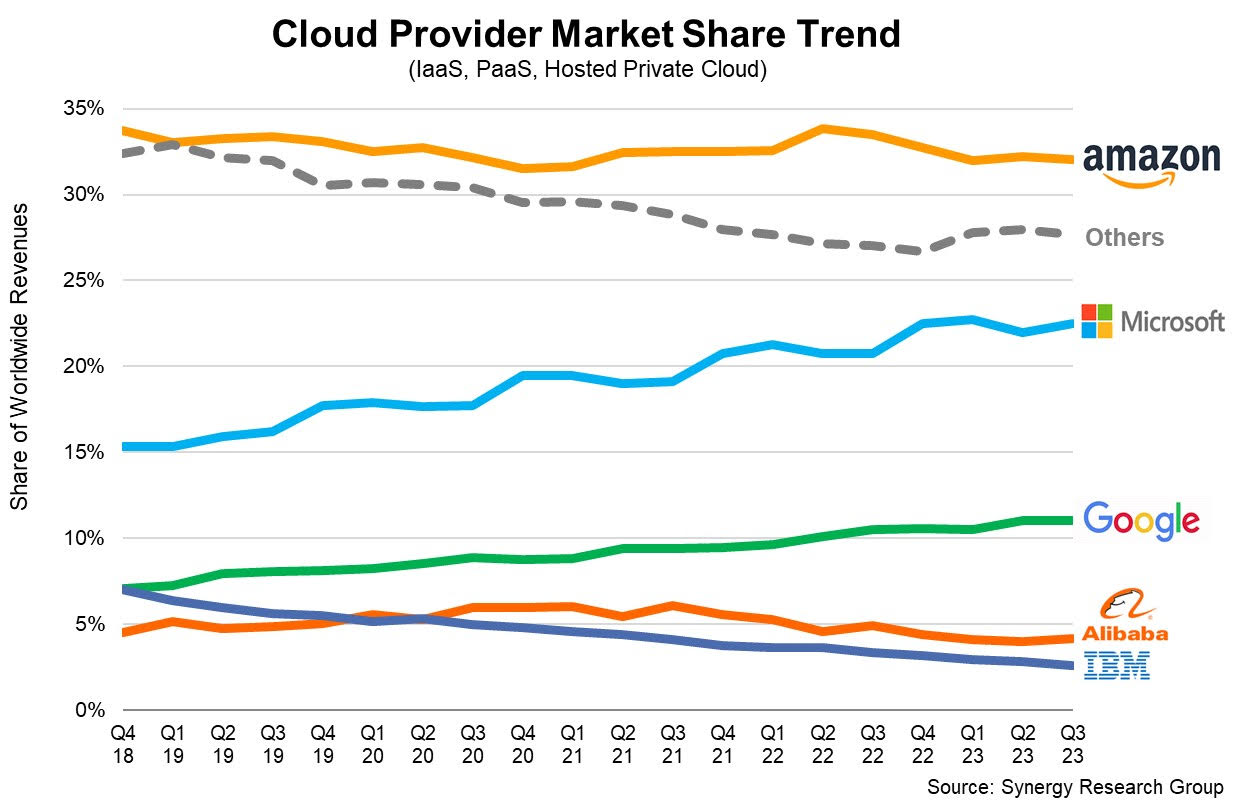

And it still is very much in control of the very large cloud infrastructure market, precisely because it was first, and the others continue to play catch-up all these years later. To give you a sense of just how big Amazon’s lead is, consider this data point from Synergy Research: “The relative scale of their cloud operations now shows Microsoft being twice the size of Google, with Amazon being almost equal to the other two combined.”

This quarter Synergy reports the cloud infrastructure market reached over $68 billion worldwide, up by $10.5 billion or 18% over the prior year. It marked the fifth straight quarter where the cloud market grew by that dollar amount, and it’s good for a run rate of around $257 billion, a humongous market that is continuing to grow.

How did that work out in terms of market share numbers? Well, Microsoft continues to grow its share in impressive fashion gaining another point this past quarter to 23%, while Amazon has pretty much held steady for years at around 33% and Google held steady at 11% over the prior quarter. That works out to approximately $22.4 billion for Amazon, $15.6 billion for Microsoft and $7.4 billion for Google (as you can see, Synergy’s math works).

Image Credits: Synergy Research

Bear in mind, however, that these percentages are for an ever-growing revenue pie, so holding steady still represents substantial growth in a market that has been growing by around $10 billion per quarter over the last five quarters.

In spite of that, cloud growth had begun to decelerate for the first time this year due to economic uncertainty, cost cutting and less experimentation on the part of large enterprise buyers. We’ve seen it take its toll, particularly on Amazon, but this quarter AWS stabilized at around 12% growth, the same as last quarter. While dealing with changing market dynamics, Amazon is also dealing with the law of large numbers where as it grows, it becomes much harder to sustain earlier growth. It defied that law for a long time, but it seems to have caught up with it.

As generative AI begins to take hold this year, it is already beginning to have an impact, and we could start to see an acceleration as the demand grows for cloud services to store, process and manage the large amounts of data required to run large language models, not to mention the pure compute power LLMs consume.

Microsoft seems to be the first to have benefited from that with its multibillion-dollar investments in OpenAI, but it’s still early, and Amazon and Google will also likely gain from that demand in the coming quarters as both also have been adding product and services to address this market change at a rapid rate.

Microsoft reported Azure growth of 29% in the latest quarter, while Google Cloud was up 22% year over year, but had a cloud earnings miss of $8.41 billion versus $8.64 billion the street was expecting. Investors punished Alphabet stock for the miss, in spite of good numbers across other divisions.

Per usual it’s important to note that Google Cloud revenue numbers include its SaaS offerings, and Synergy only counts IaaS, PaaS and hosted private cloud services, which accounts for the difference in Google’s overall publicly reported number, and the number Synergy reported.

While startups might not care about the horse race around cloud market share, it’s worth understanding how other buyers and investors perceive the biggest players and how their orchestrations affect a market that many startups will be using to build their companies.