Carefull, a fintech platform that aims to help banks protect older customers from fraud, scams and “money mistakes,” today announced that it raised $16.5 million in a Series A round led by Fin Capital with participation from TTV Capital, Bessemer Venture Partners, Commerce Ventures, Montage Ventures and Alloy Labs.

Bringing the company’s total funding to $19.7 million, co-founder and co-CEO Todd Rovak says that the proceeds will be put toward expanding NYC-based Carefull’s network of partners, product development and integrating with additional wealth and banking customers.

“The rise in usage of digital channels has increased the threats to older adults,” Rovak said. “The pandemic, which forced geographically dispersed families to assist with and coordinate money issues digitally, is a catalyst for Carefull’s growth, given the issues and threats behind Carefull’s value proposition.”

Seniors — for a whole host of reasons, some circumstantial, some health and socioeconomic — are more vulnerable to financial fraud and scams. Studies have calculated that older people lose anywhere from $2.9 billion to $36 billion each year from financial exploitation.

There’s no one way to combat money scams targeting older people, especially considering that the vast majority of scams — as high as 72% — are perpetrated by individuals known to the victims, like family members, friends or advisors. But Rovak asserts that his platform, Carefull, can be a useful tool in the broader arsenal of fraud prevention tech.

Rovak co-founded Carefull in 2019 with Max Goldman, an old friend and fellow entrepreneur. The former head of Capgemini’s advisory business in North America, Rovak previously launched the product design and development firm Fahrenheit 212, which was acquired by Capgemini in 2016. Goldman, for his part, co-founded Directr, a video creation platform, and spent several years at Google helping to build out the tech giant’s video ad creation business.

“We recognized that, today, the bulk of financial innovation and investment is directed to solve the patterns and problems of millennials and Gen Z,” Rovak said. “Banks and wealth managers seemed desperate for technology to better protect and connect with their older families.”

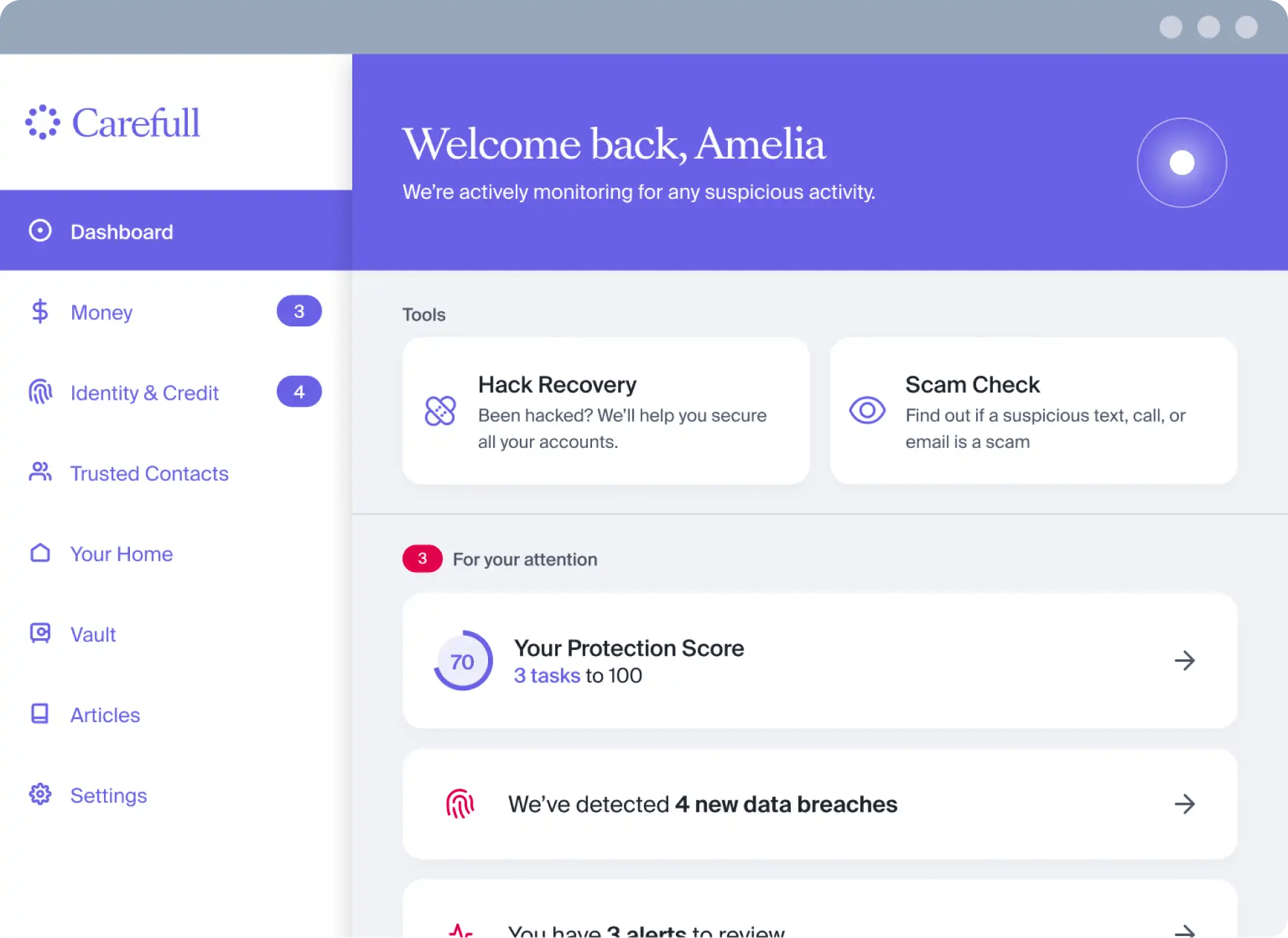

To this end, Carefull’s platform scans customers’ financial accounts for what Rovak describes as “issues unique to aging” — mainly activity that might indicate financial exploitation. Carefull develops models to identify anomalous financial and behavioral patterns, working with partner banks and asset managers to identify threats and trends as well as “geographically local” issues relevant to particular partners (e.g. a mortgage scam in the Northeast).

Plenty of startups — and incumbents, for that matter — offer algorithm-powered tools to fight financial fraud. There’s Fraugster, which uses AI to detect fraudulent payments; Hawk AI, an anti-money laundering and fraud prevention platform for banks; and Oscilar, which recently emerged from stealth to fight transactions fraud with AI.

Moreover, other startups have attempted to address the financial woes of retirees with bespoke product suites. For instance, the neobank Charlie, which launched earlier this year, gives seniors faster access to their social security checks, exclusive discounts and higher earnings on their balances.

Image Credits: Carefull

Goldman argues that Carefull’s differentiated, though, by its focus on “cutting-edge” aging research, including the relationships between cognitive decline and financial transactions. This reporter was skeptical. But, as it turns out, a growing body of research shows that money problems are a possible warning sign of certain neurological disorders.

For example, a study from Johns Hopkins found that missed payments may be an early indicator of dementia. People with Alzheimer’s and related dementias started to develop subprime credit up to six years before a formal diagnosis, according to the coauthors.

“Financial institutions need ways to cultivate relationships with their next generation of customers, and helping caregivers to manage their loved one’s accounts provides value for all parties involved,” Goldman said. “Trust is at the very core of our work.

In addition to algorithmic monitoring, Carefull provides a quarterly review of home titles for signs of fraud and tampering, identity and credit monitoring, help with canceling and negotiating bills and $1 million in identity theft insurance. Individual customers can sign up for $29 per month or $299 per year, and advisors and wealth managers can subscribe to an enterprise plan, Carefull Pro, to offer Carefull to their clients free of charge.

“To date, financial technologies directed at older adults have been either repositioned commodities like credit monitoring or specific point solutions, like accounts for seniors,” Rovak said, making a not-so-subtle dig at rivals like Charlie. “Carefull’s platform approach supports customers aged 55-plus and their caregivers through the decades-long transition from full financial independence to needing assistance with their finances to next-generation wealth transfer.”

Rovak’s proposition to the banks with which it partners is reduced customer attrition, fraud write-downs and resolution expenses. The message is resonating, from the way Rovak tells it. Carefull has over 35 customer institutions and partners so far.

“More and more Americans are supporting the daily money issues of an aging parent,” Goldman said. “This means more password sharing, more impersonating parents to transact from their accounts or look for mistakes, and even commingling money — all contributing to fraud and money mistakes. Carefull is a safer platform for these activities.”

Carefull has 25 employees currently, and Rovak expects to double that number to 50 within the next 12 months.